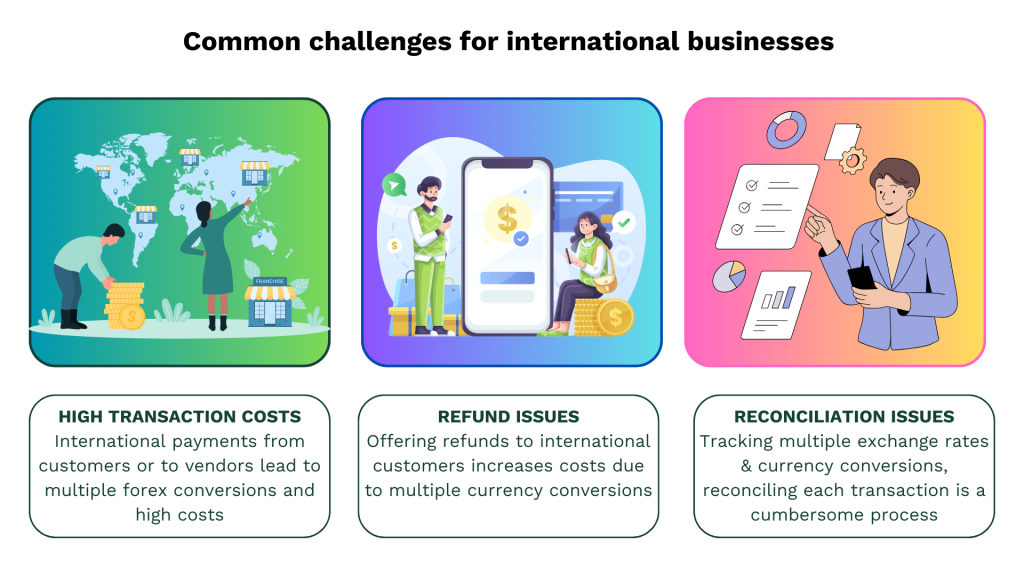

Running a successful online business is not easy, especially when you’re dealing with the complexities of selling internationally.

Picture this: You’ve worked hard to create a global business, expanding revenue streams and earning in foreign currencies. In addition to foreign customers, you also have foreign vendors who need to be paid regularly. However, your earnings from foreign customers are settled after conversion to INR. Your business, thus, multiplies conversion costs when making payments to overseas vendors by again converting these funds to another foreign currency, thereby cutting into your profits.

The solution to all such problems is simple: Opening an EEFC Account

What is an EEFC Account?

Exchange Earners’ Foreign Currency Account (EEFC) is an account maintained in foreign currency with an authorized Dealer Category – I bank i.e. a bank dealing in foreign exchange. It is a facility provided to foreign exchange earners, including exporters to credit 100 percent of their foreign exchange earnings to the account, so that the account holders do not have to convert foreign exchange into INR and vice versa, thereby minimizing the transaction costs.

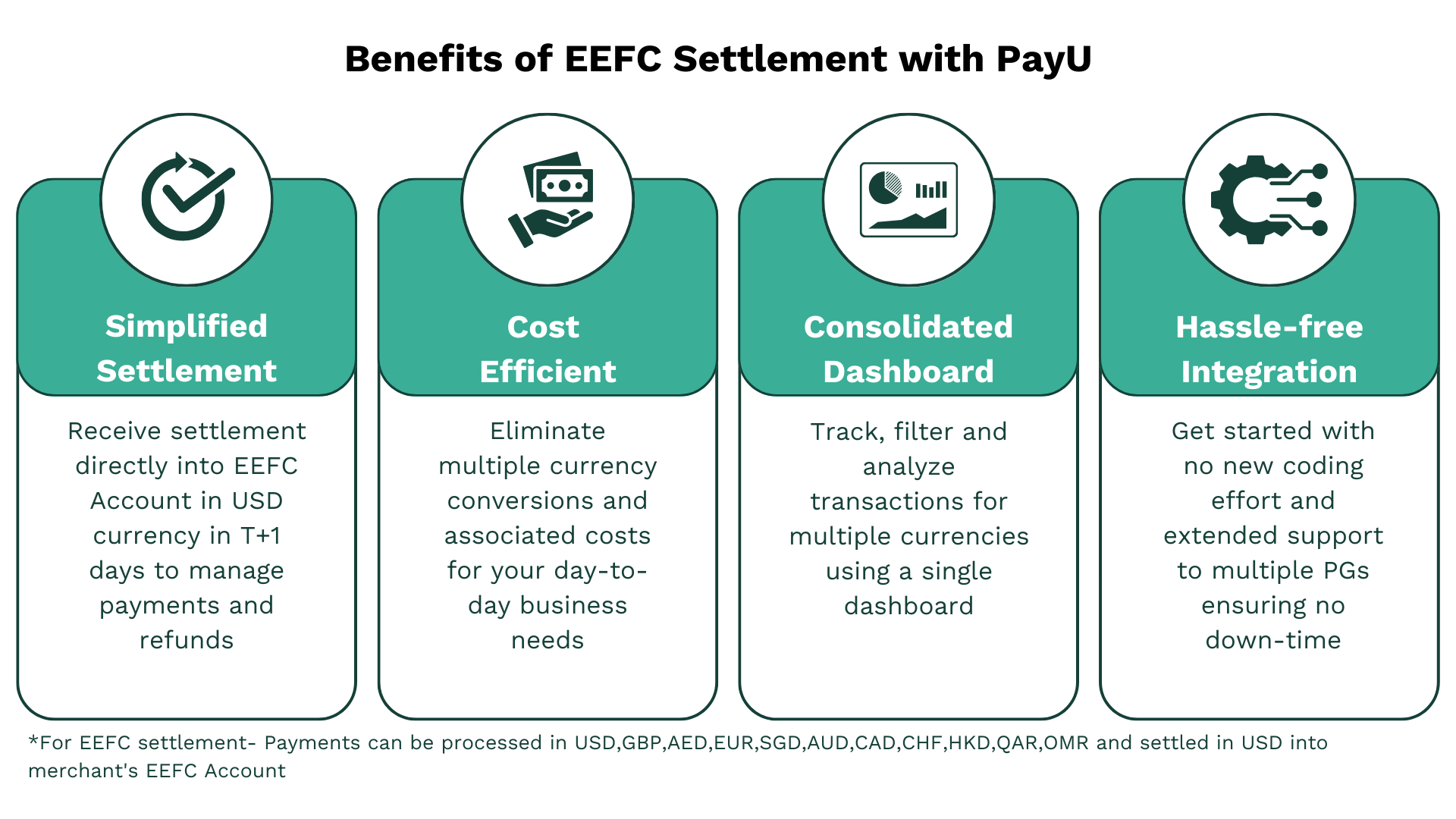

EEFC Settlement with PayU

With PayU EEFC Settlement, say goodbye to currency conversion woes and manage foreign currency transactions with ease. Enjoy hassle-free onboarding along with additional features that ensure the best success rates and make managing multiple currency earnings easy.

So, what are you waiting for? Say goodbye to the hassles of currency conversion and hello to a brighter, more profitable future for your online business, all thanks to PayU EEFC Settlement.

FAQs

Q: What currencies are supported for transaction processing?

A: Payments can be processed in USD, GBP, AED, EUR, SGD, AUD, CAD, CHF, HKD, QAR, OMR.

Q: How will refunds be managed?

A: Refunds can be initiated through PayU and settlement for these refunds will be directly managed by the banking partner

Q: How will chargeback be managed?

A: Chargeback will be managed directly by the banking partner, streamlining their dispute resolution processes.

Q: EEFC settlement is supported in which currencies?

A: Settlement into EEFC account will happen in USD.