We are extremely happy to share that we are the proud launch partners of NPCI’s UPI AutoPay for recurring payments. This means PayU merchants will now be able to give their customers an option to set up or automate recurring payments via UPI as well, with a one-time mandate from the users.

UPI AutoPay by NPCI was launched at the Global Fintech Fest recently. At PayU, our endeavour is always to support growing businesses and further boost the fintech ecosystem. Continuing this tradition, we partnered with NPCI for the launch of UPI AutoPay. Our team will be adding support for this under the same integration, requiring no change from our merchant’s end.

To be the first one to get access to this feature,

Growth of UPI and Recurring Payments

The growth story of UPI is quite impressive. Since its inception in India in 2016, it has achieved various milestones and has become the most preferred mode of payments among Indians. For FY20, UPI processed 12,519 million transactions worth Rs 2 1,31,730 crore, a 132% jump in volume, and a 143% surge in value as compared to FY19.

On the other hand, with advancements in fintech, consumers are more open to businesses auto-debiting charges for their services or products. According to a report, the subscription growth rate has accelerated for 22.5% of companies.

Making payments via subscriptions is easier for customers, especially during this global pandemic COVID-19. Also, offering subscriptions to your customers will keep your business running in these times.Offering recurring payments to your customers saves them time and effort required to buy the same things, again; they become more loyal to your brand.

UPI AutoPay on PayU Subscriptions

The convenience of UPIAutoPay combined with the power of PayU Subscriptions will be a game changer for businesses such as OTTs, insurance, rentals and much more to collect recurring payments. You can read more about how different businesses can use PayU Subscriptions here.

Businesses can now take advantage of all modes of recurring payments credit card/debit card, NACH and UPI via a single integration of PayU Subscriptions.

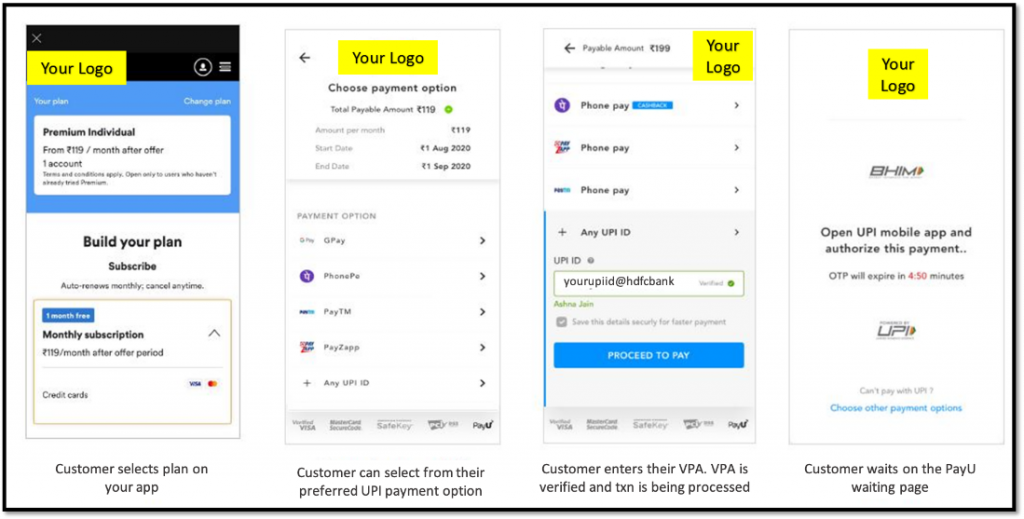

Here’s how UPI Recurring Payments will offer a seamless and virtually frictionless experience to your customers. Take a look!

Benefits of Using UPIAutoPay on PayU Subscriptions for Businesses

- Automate billing via our Subscription APIs

- Improve cash-flow for your business

- Seamless customer experience

- Offer better pricing to your customers

Benefits of Using UPIAutoPay for Consumers

- Control of authorizing requested payment and cancel it any time they want

- Also, the 24-hour pre-notification feature of UPI AutoPay ensures that customer is well aware of the charges to be levied in advance making it completely safe and secure.

Conclusion

Now all businesses can simply offer subscriptions to anybody that has UPI and start collecting recurring payments easily. Offering Subscriptions means better reach and locking customers to your platform. So, get started with UPI AutoPay on PayU Subscriptions today,

Leave a Comment