Unified Payments Interface (UPI) has truly changed the game for digital payments in India. Business Standard even called it “the undisputed king of digital payments” – with a whopping 65 billion transactions and a 56% growth in overall volume compared to last year. And lately, UPI is also becoming a favorite among insurance premium payers. With the advent of UPI, insurers can now streamline premium payments, enhancing customer experience and operational efficiency.

Leveraging UPI for Faster Insurance Payments

Traditionally, insurance premium payments relied on cash, cheques, or RTGS transfers, presenting numerous challenges such as delays and manual errors. UPI’s secure, real-time payment capabilities and user-friendly interface offer unparalleled convenience and efficiency to both insurers and policyholders. The seamless integration of UPI into insurers’ existing payment infrastructure also facilitates faster transaction processing and improved reconciliation processes, leading to enhanced operational efficiency and cost savings.

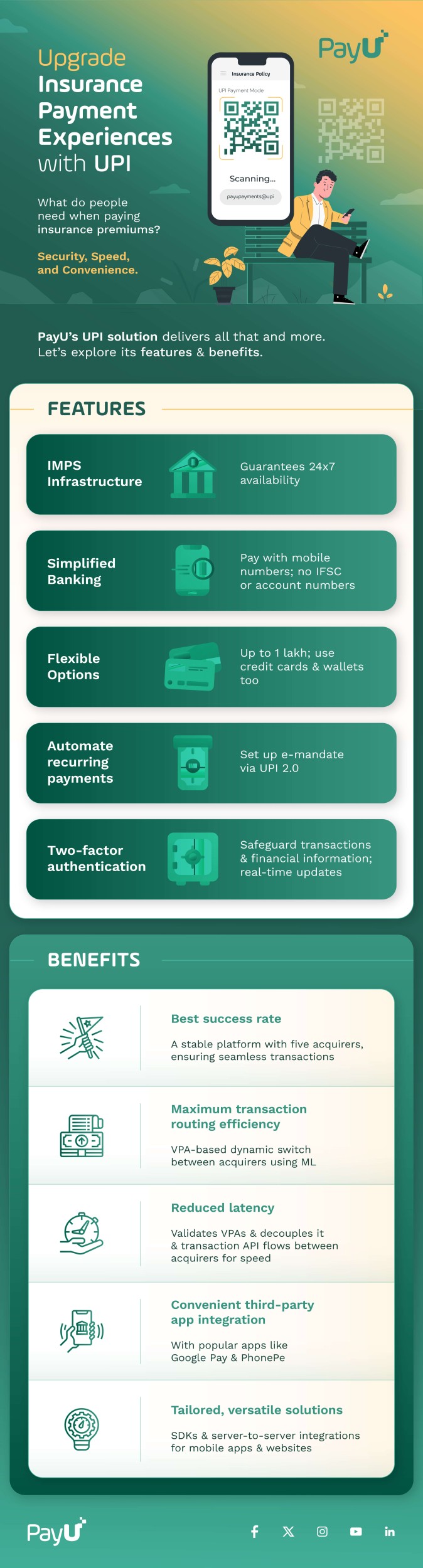

PayU’s UPI integration uses the Immediate Payment Service (IMPS) infrastructure, ensuring round-the-clock availability. PayU’s solution simplifies the banking process, eliminating the need for cumbersome details like IFSC or account numbers. Instead, policyholders can simply enter their mobile numbers to map their accounts, facilitating hassle-free payments.

As insurers continue to harness the power of UPI to streamline insurance premium payments, the future of insurance transactions promises to be characterized by greater speed, security, and simplicity. PayU’s UPI solution offers insurers and policyholders a seamless and efficient method for premium payments.

Click here to learn how to get PayU’s web integration for UPI. To learn about PayU’s other payment solutions for insurance businesses, go here.