When it comes to startups the main question entrepreneurs juggle with is, “where is the money?”. Apart from investors, Indian banks are also taking a keen interest in facilitating new age entrepreneurs with attractive business loans and various funding schemes. Let’s take a look at what do these banks have in store for startups and how to incur sweet benefits using business loans from banks for growth and sustainability.

Bank Loan for Startups

Today, banks thrive harder to provide monetary security by introducing special business loans which include:

Working Capital Loan

The purpose is to fund company’s every day or short-term operational needs. These needs include wages, rent, inventory costs and so on. Seasonal businesses can opt for a working capital loan as their business activity is reduced or low otherwise. For example, companies manufacturing firecrackers will make maximum sales during Diwali whereas companies producing umbrellas will make most profits from June to September in India.

Term Loan

This type of loan is granted to small businesses in mainly hard cash in order to purchase fixed assets. Fixed assets include tangible goods – laptops, machinery & equipment, furniture, vehicles and intangibles – goodwill, copyrights, patents, to name a few. Term loans are sanctioned to borrowers for a fixed amount and time period. Approximately, the repayment process can extend to 1-25 years.

- Intermediate Term: This type of term loan runs for less than 3 years and is paid in monthly installments. A balloon payment process, wherein a portion of the total amount is paid initially and the rest is paid altogether in the final repayment, is also eligible here.

- Long Term: As the name suggests, it can last up to 3-25 years. The most common type of long-term loan is bonds. Bond sales bring in immediately. The only distinguisher between an intermediate and long-term loan is the time period for which the loan is sanctioned. It also limits other financial support a company may take on such as other debts, dividends, etc.

Secured Loan

In this type, the borrower pledges his property or other valuable assets to the lender, in this case, a bank, in order to secure loans. This pledged property is known as a collateral. Once the collateral is secured by the bank, it has full authority and charge over it. It means, it can be seized, liquidated or sold by the bank at any time in case, the borrower faulters to repay in time. Here the bank evaluates the company’s (borrower’s) present earnings over its credibility.

Mortgages are a classic example of secured loans. For instance, if, you pledge your current home or previous office for your new startup up venture to the bank in opposition to a business loan, then the bank has complete power over your pledged asset or collateral. In case you fail to repay, the bank will take over your collateral completely.

Unsecured Loan

These are the exact opposite of secured loans. No collaterals or seizing is involved here. The banks lend loans to companies solely on the basis of company credibility history. The credit must be really high to be able to get unsecured loans. Unsecured loan has high rate of interest compared to secured loans because it is risky for the banks to lend such big amounts without any security involved as such. Unlike secured loans, where the banks can repossess the collateral if company defaults repayment, in case of defaulting under the unsecured loan, the bank can trigger a collection agency to collect the debt amount or it can drag the company to the court.

Business loans in India are usually granted for an amount ranging from Rs. 50,000 to 75 Lakhs. But this amount may vary as per the terms and conditions laid down by the banks. However, it is always recommended to go through the T&C before finalizing any type.

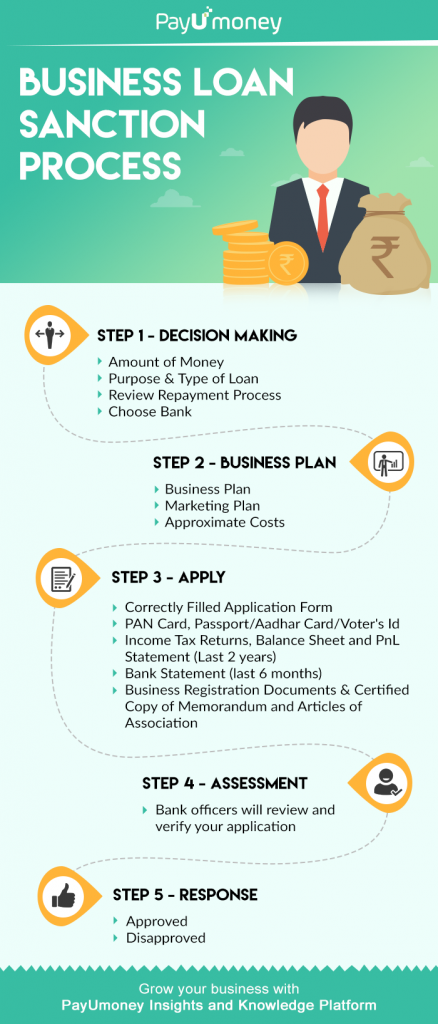

Business Loan Sanction Process

Decide: How much money you actually require? Which bank you want to opt for? How many years the repayment process take? And so on. In this process, you can also take a glance at your own credit history – personal and professional. Banks require clean records to build trust.

The Plan: Draft a detailed and crisp business plan, because your preferred banks, will want to know why, where and how much they investing or lending? This plan is crucial not only for the bank’s clarity beam but also for your own clarity. At times, we do ask for more when in reality we don’t need that much at that moment.

Application: Once all the above answers are in place, proceed towards gathering and compiling all your documents. The basic documentation required is:

- For Id & Address Proofs –

- Aadhaar Card

- Driving License

- PAN Card

- Passport

- Voter’s Id

- Financial Proofs –

- Bank Statements (last 6 months)

- Latest ITR with computed income

- CA Certified/Audited Balance sheet & PnL account (last 2 years)

- Proof of Continuation (Establishment/ Sales Tax Certificate/ ITR)

- Legal Proofs –

- Sole Proprietor Declaration or Certified Copy of Partnership Deed

- Certified true copy of Memorandum & Articles of Association

Assessment: After you have submitted your application form with all the required documents (mentioned above), the bank assessment and verification process commencement. The assessment mainly takes place on the basis of the type of loan you have opted for and hence credibility.

Response: Depending on the assessment, your application will be approved or disapproved.

*The entire business loan sanction process may take up to a minimum of 60-90 days to get completed.

Eligibility Criteria

Who can apply or avail a business loan in India?

- Self Employed Professionals & Non – Professionals

- Architects

- Chartered Accountant (CA) & Company Secretary (CS)

- Entities (traders & manufacturers) – Partnerships, Limited Liabilities Partnerships, Private Limited Partnerships, Limited Companies.

What factors decide the eligibility?

This completely depends on the preferred bank, as each bank as different criteria to be fulfilled by the applicant.

Reasons to Choose Business Loans over Liquidating Your Savings

Business loans should be the first preference for your hard earned savings because:

-

- While you are paying interest on your business loan, you are earning returns on your savings. This chain of in and out will keep your money rolling, increasing your savings and thus maintaining healthy cash flow in your startup.

-

- It is not a wise choice to make by pumping in your savings when alternatives are available.

-

- Make use of your savings for the hard times instead of exhausting them in the very beginning.

- Use your savings to invest in the betterment of your business.

Benefits of Business Loans

Easily available: You can kickstart your startup without worrying much about initial funds. Due to the Indian government and banks convenient loan plans for startups and small businesses, it is easily available to all aspirants.

Highly Flexibility: Every business idea or startup has different monetary requirements. Depending on your needs you can opt for it. The duration of repayment is also quite flexible (it depends on the financer).

Multiple Repayment Options: You can choose how you want to repay – monthly installments, bullet payments and so on.

Healthy Cashflow & Growth: Cashflow and workflow are maintained in an orderly manner, as the funds successfully meet the operational needs of the business.

Reasons for Business Loan Rejection

Incomplete Documents: If you haven’t submitted all the required documents your loan is likely to get rejected in the assessment stage mentioned above.

Bad Credibility History: If you have a backlog of repayments. A credit score is necessary to reflect your worthiness and how prompt you are with the repayment cycle.

Inadequate Collaterals: In terms of secured loans, the bank asks for collaterals in exchange. If you have less or no collaterals as against the exchange then the chances of it being rejected are high.

Poor Cashflow: If you are unable to maintain a good cash flow or money rolling in your company(previous).

Other Factors: These could be political or economic imbalances in the country. It could also be some technical changes.

Business Loans for Women

In the era of rising and aspiring women entrepreneurs, the Indian Government has introduced and facilitated country’s urban and rural women with multiple loans along with financial schemes and support. These business schemes are introduced for women with a view to supporting Indian women to rise up, stand tall and earn on her own. This can be done by exploring the types of loans available for women entrepreneurs.

Dare to dream big and kickstart your startup carefree! Read PayUmoney blogs to explore more about online business and marketing.

Leave a Comment