Any business today will agree that besides quality products and services, timely delivery, and great customer experience, it is crucial to adopt digital payments. But return and refund are major concerns for big e-commerce businesses, D2C companies, and consumer goods brands. The challenge is reducing the cost of return to order (RTO) due to many issues a customer may face.

While you focus on resolving such situations, PayU can help you streamline refunds and provide a hassle-free experience to your customers. Refunds need to be quick and flow back into their source accounts. PayU processes over 4 lakh refund requests daily with a success rate of over 99%. Over 90% of these refunds are successfully processed within 30 seconds of initiation.

Here is how PayU can help businesses ramp up their refund cycle during peak sale season and improve stickiness by offering customers quick money back.

Channels offered by PayU for refund initiation

- Refund initiation via merchant dashboard: Refunds can be initiated for any transaction by clicking on the ‘send refund’ button next to the transaction on the merchant dashboard.

- Refund initiation in bulk through files: Businesses can issue refunds in bulk using a .xlsx, .xls or .csvfile. Once the file is uploaded, the details are picked up within 60 minutes for refund processing.

- Refund initiation via APIs: Businesses can integrate with PayU’s refund APIs to initiate refunds for any transaction processed via PayU.

- Payment methods supported: Refunds are supported on all payment methods powered by PayU. Refunds are issued back to the source, which means the money is credited to the customer’s source account used for making the payment. For instance, if a transaction is performed using a credit card, the refund will be pushed to the same credit card.

Refunds can be full or partial

- Full refund: 100% of the amount paid is returned to the customer.

- Partial refund: Depending on the customer’s request, refunds can also be initiated for amounts less than the total transaction amounts. Multiple partial refunds can be made until the full amount has been refunded.

Refund processing

Once a refund is initiated, it is queued in PayU’s system for processing. After passing internal validations, the refund request is raised to the banking partners for processing. Each bank has its own process for making refunds.

Once the refund is processed successfully, money is credited to the customer’s account, and the refund status is communicated to the business via APIs, the dashboard, or webhooks.

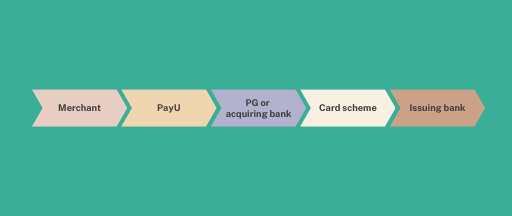

A typical flow for card refunds looks like this:

If a refund fails at a banking partner’s end, PayU can internally retry processing it with the banking partner. This is to ensure high success rates for refunds. This retry functionality is configurable at a merchant level and is enabled for all merchants by default.

How long does it take to process a refund?

When a business initiates a refund request with PayU, it is instantly moved forward to the banking partner for processing. Depending on the bank’s processing time, it can take up to five to seven business days for the refund to reflect in the customer’s source account.

How to track refunds

Once a refund is initiated, it can be in either of these stages:

SUCCESS: This indicates that the refund has been processed successfully.

FAILURE: This indicates that the refund processing failed. No funds are deducted from the merchant’s settlement for such refunds.

IN PROGRESS: This indicates that the refund has been raised to the bank for processing.

REQUESTED: This indicates that the refund is sent to the bank for offline processing. In such cases, it takes up to five to seven business days for the credit to reflect in the customer’s account.

Businesses can track the refund status and details via the dashboard and APIs.

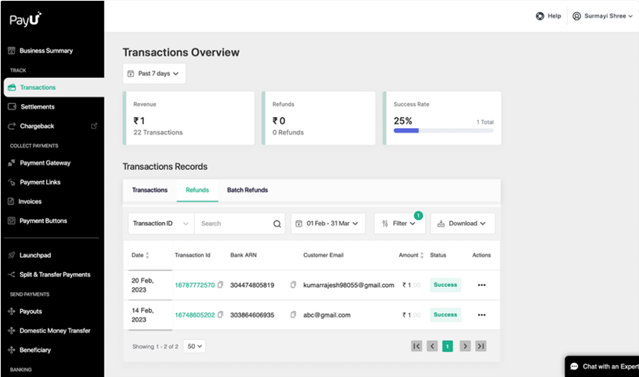

Here’s how refunds appear to businesses

· Through the PayU dashboard

Businesses can see the refund requests created, their status, and other details under the ‘Refunds’ tab on the dashboard. Refunds can be filtered based on their date of initiation and refund status. You can also search for refunds with transaction IDs and download refund reports.

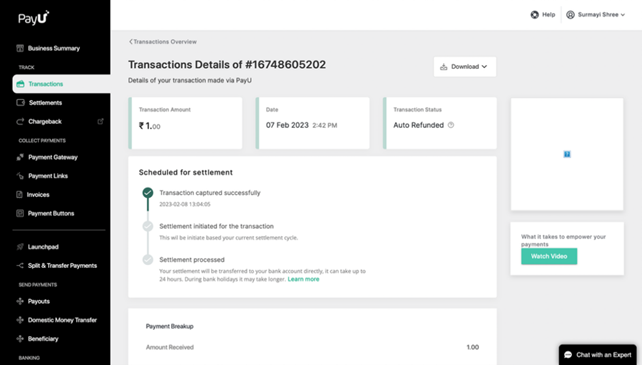

When you click on the transaction ID, you can see the ‘transaction details’ page, which contains payment, refund, and settlement details for that transaction.

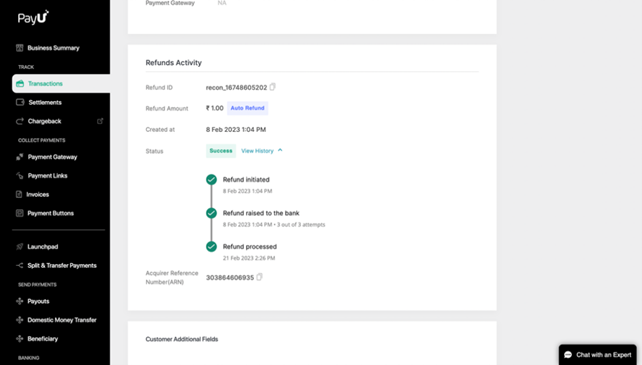

You can find the refund details under the ‘Refund Activity’ section. You can view the refund history by clicking on the ‘view history’ button. This shows a timeline view for each refund, highlighting various stages in the refund processing lifecycle.

· Through APIs

Merchants can also enquire about any refund status and details by integrating with refund enquiry APIs.

· Refund communication

PayU supports webhooks or callbacks for the following events:

- Refund status updates: Callbacks for refund status updates can be sent on a URL configured by the business. These callbacks can be configured for refund successes, failures, and all status updates.

- ARN generation: An Acquirer Reference Number (ARN) is a unique number generated by banks for online transactions. This ARN is generated within 24-72 business hours of a successful refund. A callback for successfully uploading ARN can be made to the URL configured by the business.

How to fund your refunds

PayU does not charge any processing fees for refunds. However, transaction fees PayU charges on successful transactions are not reversed into the business’s account.

Refunds can be sourced from:

- Daily settlements: The refund amount can be deducted from the business’s daily sales till the amount is exhausted. By default, all refunds are deducted from the business’s daily sales.

- Overdraft account: If a business does not wish refunds to be deducted from its daily sales, PayU supports an overdraft functionality that allows the business to park additional funds for refunds with PayU. In such cases, the business needs to pre-fund its overdraft account for refund processing.

- Combination of business’s daily settlements and an overdraft account: In cases where the business’s daily sale is insufficient, additional funds parked by the merchant in the overdraft account can be used to process refunds.

How do chargebacks differ from refunds?

A chargeback is raised by the customer to the issuing bank for many reasons, like a fraudulent transaction or unsatisfactory product or service delivery. On the other hand, refunds are initiated by the business at its customer’s request.

Initiating and processing refunds is extremely easy and fast with PayU. To learn more, read this dev guide.