Micro Small and Medium Enterprises (MSMEs) comprise over 30% of India’s robust economy. MSMEs are at the heart of India’s flourishing industries, promoting economic growth and employment. On the other hand, the multi-dimensional mix of entrepreneurial spirit, government-backed initiatives and policies, a robust banking ecosystem, and the availability of growth-driving technology solutions in India creates one of the ripest environments for MSMEs to set base and thrive.

But starting and running a business takes immense effort and diligence.

- Setting up a business requires a great deal of paperwork, taking your business to the right social and e-commerce platforms, and putting payments and payouts in place.

- Running a business has many aspects, such as logistics, inventory and order management, and gathering working capital for daily operations.

- Growing your business may entail going to new locations and expanding into new verticals

PayU for MSME growth: Solutions and partnerships that can help you set up and scale

Over the years, PayU has built the right partnerships and expertise that make us the most reliable partner for any business at any stage of its growth journey. While we take care of your digital payment needs, we have a network of industry-leading partners to take care of almost any aspect of your business. Here are PayU solutions and partners that enable MSME growth:

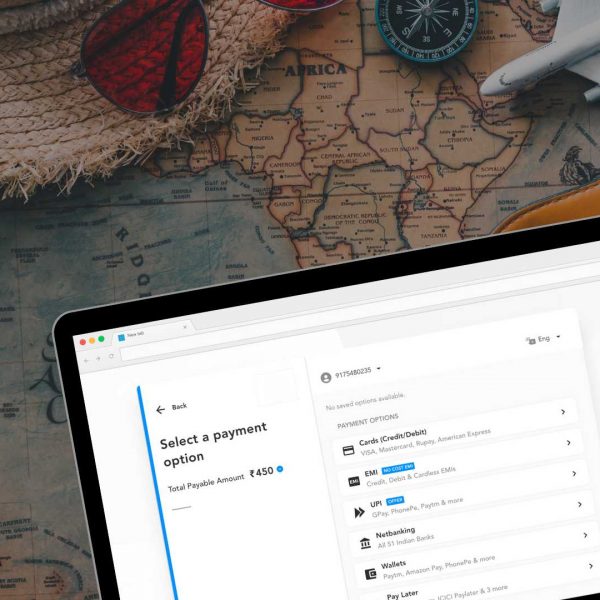

- No online store? No worries. Even before you get a website and online store for your business, you can easily collect payments using payment links generated from the PayU dashboard.

- Deliver your products far and wide with logistics partners like Delhivery and Shiprocket. What’s more? These partners can help you unlock the convenience of converting cash on delivery to digital payments with UPI, QR codes, payment links, etc.

- Your working capital needs will be taken care of with easy access to collateral-free credit within the PayU dashboard

- Seamlessly connect your PayU account with efficient and user-friendly accounting tools like Zoho Books and Tally to sort your accounting books to the T. This way, you can directly add payment links to invoices for easy tracking and reconciliation.

- When you go global, accept international card payments to win customers worldwide.

- Easily integrate with platforms like Haptik and Interkart to set up WhatsApp commerce that can reduce cart abandonment and improve conversion.

In conclusion

Being a business owner may be challenging, but choosing the right partners can take much of the burden off your shoulders. With the right partners, you can leave the daily operations to them so you can focus on taking your business to newer heights.