Small & medium enterprises face accounting challenges that large businesses face. However, unlike large enterprises, SMEs lack the financial resources to outsource professional services. Hence operations such as bookkeeping and accounting are managed in-house at SMEs. As a result, small business owners face many challenges while managing their accounting process.

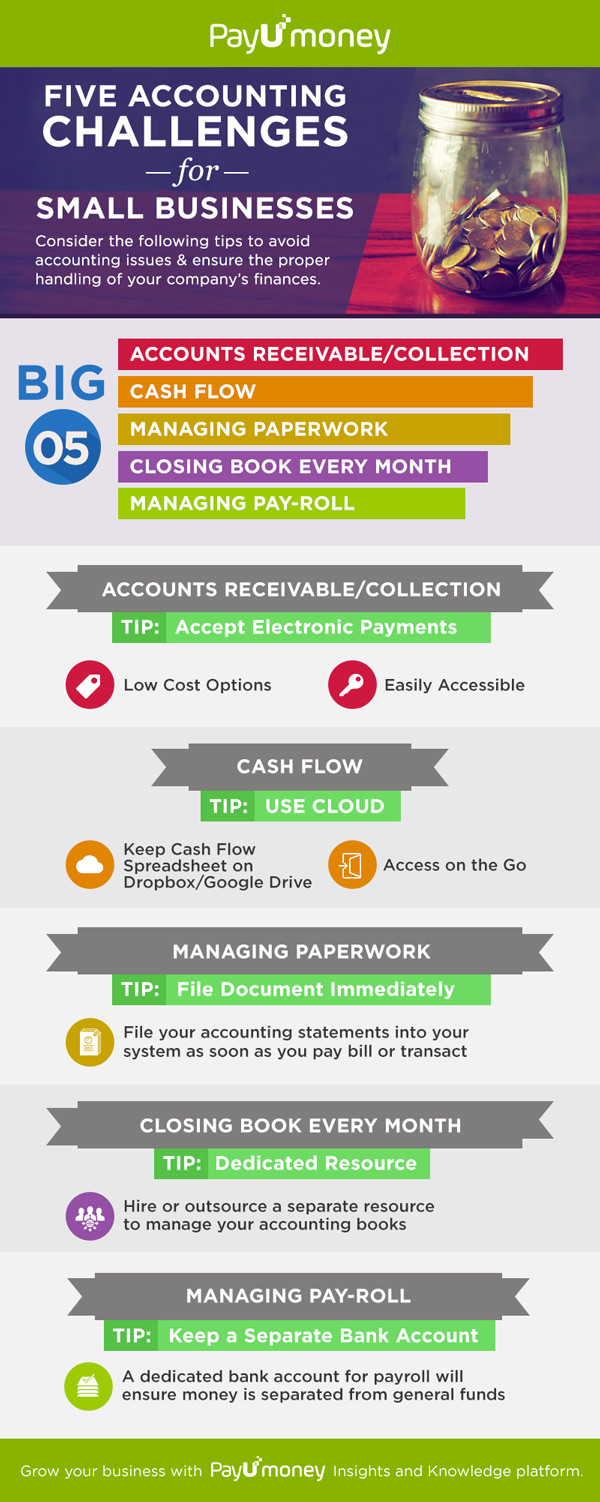

We have underlined top business accounting issues faced by small businesses. Consider the following tips and ensure proper accounting of your company’s finances.

Accounts Receivable/Collection

Maintaining process for the receivable or collection remains top business accounting issue for small/medium enterprises. However, by accepting electronic payments, you can overcome this challenge. Electronic payments are easily accessible, low cost options, in order to accelerate the receipt of cash.

Cash Flow

SMEs must balance their cash flow in order to deal with the upfront expenses. It is recommended that you consider an alternate source of capital to manage large purchases. By spreading the mode of expenses, you can build cash reserves. Keep cash flow spreadsheet in the Cloud by using systems such as Dropbox or Google Drive so you can access them on the go.

Managing Paperwork

From the moment you have paid a bill or taken action on a piece of paper, file the document immediately into your system. It will help you streamline the accounting process.

Closing Book Every Month

Small business owners who find it difficult to manage accounting book or handle tax issues are recommended to hire professional tax consultant or accountant. Failing to properly close accounting book can result in heavy cash deficit, a situation that can quickly sink any business.

Managing Pay-Roll

Keep a second account that is meant only for employee’s payroll. This will ensure money for payroll is separated from the general business fund.

Also read To-Do List for Setting up Your Online Business. Stay tuned with PayU Knowledge platform for more insights and case studies.

Leave a Comment