What if you could incur minimum customer acquisition costs as a business owner and continue receiving payments for a long time? That would be a dream come true. Such a business model involves accepting recurring payments from customers and can make your business successful. Read on to know more about recurring payments in India and how you can accept payments using PayU India’s Payment Gateway.

We pay for Netflix and music streaming monthly. We also pay regular mobile, electricity and wifi bills. Ever wondered what these types of payments are called? These payments go by recurring payments and provide a constant income source to the business owner.

The revenue model for such businesses entails a recurring payment from the consumer. A recurring payment revenue model means that the business offers certain services or products that require repeated payments from the consumers. Usually, such payments are billed monthly, and in some cases, they could also be year-on-year. Let’s get into the depth of the concept of recurring payments so that you get the maximum out of this article.

Recurring Payments: Explained

The meaning of recurring payments can be best defined as a subscription type of business model that allows the consumer to keep using the service or product seamlessly and without any interruptions.

The cycle continues until the subscription is cancelled or expires. A recurring payment facility enables the user to access the service or product continuously.

How Can Recurring Payments Help Businesses?

Recurring payments are beneficial for business owners as they are assured of a steady income source. Once a customer is onboarded, the business does not have to incur extra costs for customer retention due to the longevity of the customer’s lifetime cycle. Better customer retention benefits the business financially and helps grab market share.

Business owners can also project their business viability, as it becomes relatively straightforward to predict future income. An accurate prediction helps the business to plan for its future operations properly.

How Is A Recurring Payment Facility Beneficial?

Recurring billing allows the merchant to automatically charge the consumer for particular services or products repeatedly over a set period. Until this option is not terminated or expires, the charges will be deducted from the consumer’s chosen mode of payment. It is important to note that the merchant does not need permission for further payment charges once the consumer has agreed to make the recurring payment.

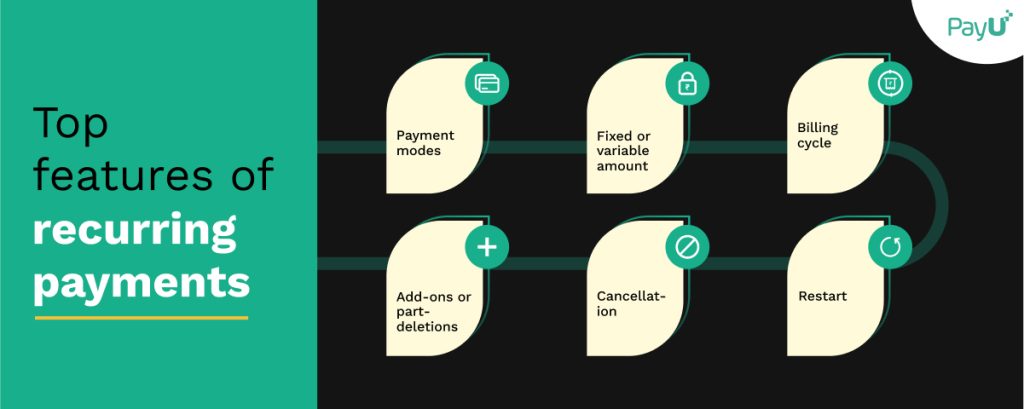

What Are The Features Of Recurring Payments?

The following features characterise recurring payments in India:

1) Payment modes

The customer has various options to select the mode through which the payment would be deducted regularly. Customers can make payments from bank accounts or through debit, credit cards or UPI. For certain high-value transactions, flex-pay options like EMIs are also available.

2) Fixed or variable amounts

Many subscription models involve a fixed amount to be paid over each payment cycle. Some examples of this could be gym membership payments, subscriptions for newspapers or magazines, payments for video streaming services, etc.

Whereas there are certain recurring payments in which the amounts vary for every payment cycle. Examples could be utility bills like electricity, gas or telephone services.

3) Billing cycle

The billing cycle could differ depending upon the service or product used. Most of the subscription models are billed monthly. However, it is not uncommon to see quarterly, half-yearly or even yearly billings.

4) Add-ons or part-deletions

Recurring payments allow the user to add on any part or even delete some part of the subscription, as necessary.

5) Cancellation

An essential feature of recurring payments is to allow cancellation of the subscription when the customer decides.

6) Restart

After the cancellation of service or the expiry of the term, the user may wish to restart the service. This feature is readily provided in the plans for recurring payments.

How Do Users Stand To Benefit From Recurring Payments?

Let’s discuss the benefits for the users:

- Many businesses that offer recurring payment services provide discounts for their regular users. Users can stand to gain financially from the discounts provided.

- With this facility, consumers can continue using the services or goods without interruption and with no worries about missed payments.

- Making recurring payments on debit cards is a handy way of handling financial commitments. It saves time and energy for the consumer. You need to enter the payment information only once, and then the future payments are deducted automatically.

- According to the recurring payments RBI guidelines, a business must notify or remind about the future payments to be deducted. Hence, the consumer is always aware of the charges to be paid.

How Do Merchants Stand To Benefit From Recurring Payments?

Here are some of the benefits for the merchants:

- The merchant is assured of prompt payment. Immediate and prompt payment is a massive advantage for any business.

- The option of recurring payment greatly helps in customer retention for the vendor.

- A huge plus point for the business is streamlining the cash flow through recurring payments.

- Recurring payments help lower the billing and collection costs for the business owner.

- As the future revenue stream is predicted to a large extent, it helps in better planning for operations and growth of a company.

Although recurring payments seem like a win-win situation for both the user and the company, they still have inherent problems. Let us look at some typical issues faced in such a payment system.

1) Payments get declined

There are instances when the payment is declined for myriad reasons. The recurring credit card transaction sometimes declines if the credit limit has already been exhausted.

2) Change in payment mode

Changing the payment mode becomes a tedious task for the user. Resubmitting all the requisite information could consume a lot of time and effort.

3) Errors in billing

It does become a bit challenging to get the errors rectified. Since the payment may have already got released, it takes some follow up to identify and rectify the errors.

4) Continuing with subscription even after the need is exhausted

A user may miss out on cancelling the service once the need has been met. Non-cancellation could lead to unnecessary extra payments, taking a toll on the user’s financial management. PayU India tries to minimise and eliminate the shortcomings of recurring payments. There is no denying that recurring payments can be advantageous to both the customer and the company.

In India, PayU India offers the best service for a business owner who may need to set up or integrate a recurring payment facility for business.

Some of the salient features that PayU India offers are –

- It allows the vendor to create a customised plan.

- It gives the facility for the merchant to combine multiple plans.

- Business owners can accept all modes of payment.

- It offers 24×7 support.

- The best part about PayU India is that it is a completely secure service.

Conclusion

Recurring and regular business can transform your business’ functioning. It could help you meet consistent operating expenses and maintain enough cash flow for contingencies. Your business could soar to new heights with reduced costs and increased cash flows.

But it is vital to have a trusted Payment Gateway for payment acceptance. PayU India, a brand in the Payment Gateway space, has the confidence of its customers. To associate with PayU India would be a good choice. Research and choose the one that suits your needs.

FAQs

A business that runs on a subscription-based model receives recurring or periodic payments from consumers for providing services continuously.

Once the user gives the go-ahead for recurring payments, periodic payments are automatically deducted as per the instructions given. PayU India facilitates these periodic payments.

Recurring payments are beneficial for business owners as they are assured of a continuous income flow, which is crucial for managing business growth in competitive industries.