The Indian consumer market has always been a conservative one, with a balance between big-ticket and small-ticket purchases. However, a drastic change has been witnessed in the buying behaviour of Indian consumers in the recent past due to No-Cost EMI being available as a payment mode. One of the main reasons behind this change is the pandemic that began in the subcontinent in early 2020. With the pandemic, India saw an upsurge in pay cuts as well as job cuts. This made many products and services unaffordable to customers. Not only this, the prolonged pandemic almost turned many utilitarian goods into luxurious ones for the consumer, just by virtue of being unaffordable.

Needless to say, this impacted sales across a plethora of brands and industries. For instance, despite the existence of heightened demand for electronic appliances, the consumer durables industry experienced 30% lower sales in 2020 as compared to 2019.

In such a scenario, the need of the hour was to enhance affordability for the masses. It became imperative that consumers are equipped or enabled to purchase big-ticket as well as small-ticket goods based on their needs and not just affordability. This ushered in what has now become a go-to payment option for most buyers in the country: No-Cost EMI.

What is No-Cost EMI?

Simply put, EMI stands for Equated Monthly Installment. As is obvious from the

full form, EMI means a fixed monthly payment provided by a borrower to a creditor on a set day every month.

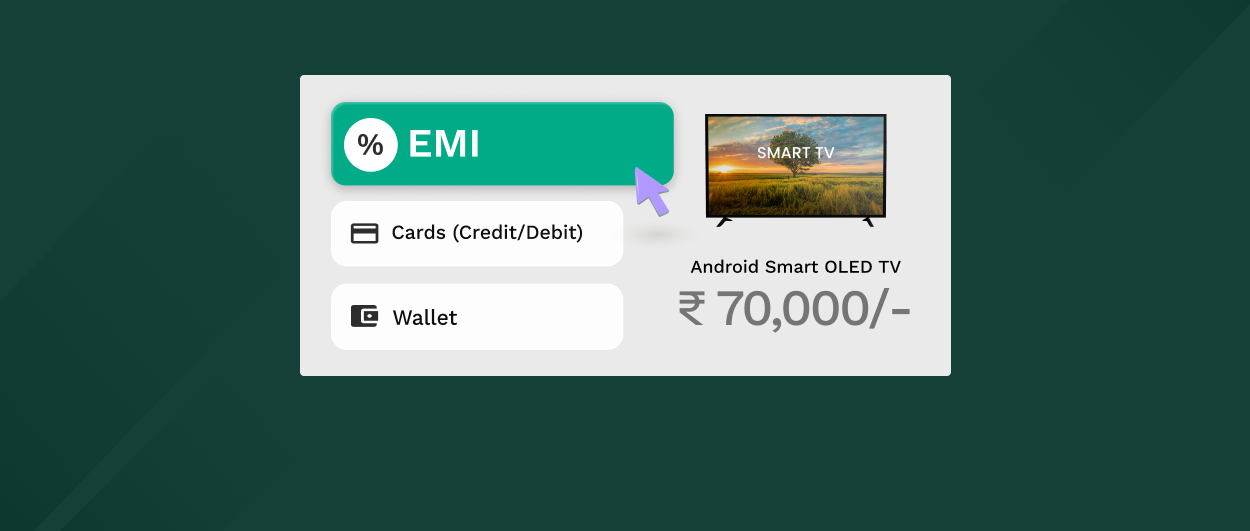

Coming to No-Cost EMI, it is an offer by which you pay your EMI provider only the product price, equally divided over your repayment timeline.

To give an example, if you purchase a smart TV for INR 60,000 but cannot pay the entire amount at the time of purchase, you can resort to splitting the total amount across a fixed number of months and then paying that split amount on a fixed day every month until the total cost of the purchased product has been paid for. However, you are not expected to pay any amount over and above the original price as interest. This is what makes No-Cost EMIs a lucrative payment mode for most buyers!

Growth of No-Cost EMIs in India

With EMI as a payment mode being available on most online commercial platforms, more and more customers are opting for it. In 2020 alone, Ezetap recorded a drastic increase of 220% in the total volume of EMIs processed in 2021.

As the interest charged from customers is completely discounted in No-Cost EMIs, it is the most preferred or chosen option.

Here are some reasons why No-Cost EMIs have become increasingly popular amongst buyers:

- It is easy on the wallet and keeps your liquid money for you to be used throughout the month.

- Customers can choose the tenure over which they would want to pay back the total amount, thereby controlling the amount of money they will pay every month.

- No extra amount needs to be paid by the customer apart from just the product price.

No-Cost EMIs become a Regular

Hence, it is safe to say that while the pandemic ushered in No-Cost EMIs, the Indian buyer is now habitual of this payment mode. What was considered a short-term fix to grow sales amidst economic slowdown and a global health emergency, is now turning into a part and parcel of the quintessential buying behaviour of the Indian shopper. Thus, we can safely conclude that No-Cost EMI payments are not just a passé but are here to stay for a long time to come.

What’s important to note here is that with the growing dependence of the Indian buyer on No-Cost EMIs, businesses also need to tailor their payment modes and enable No-Cost EMIs for their consumers. No-Cost EMIs have now become a key to escalating conversions and consequently garner profits for any and every business out there. So, if you are a business owner looking for measures to push sales, here is one formula you can use immediately.

Frequently Asked Questions

Yes, they can. Know more here.

Yes, you can enable No-Cost EMIs on specific banks such as SBI, ICICI, HDFC, etc.

Banks facilitate its customer with different easy EMI payment mode options. For example, the total amount of purchase can be divided into 24 months, 12 months, 6 months, and 3 months EMI. Hence, the EMI options vary from bank to bank.