With an increase in the adoption of mobile apps and mobile-friendly websites by consumers, merchants are aggressively looking for solutions to provide a seamless payment experience to their users. Today’s customers want to pay securely, quickly and easily. Card payments are globally the most popular way to pay online. To provide improved security for online card transactions, an additional authentication process is needed that requires multiple interactions with users as well as browser redirections before final payment completion.

In General, to complete card payment on any website,

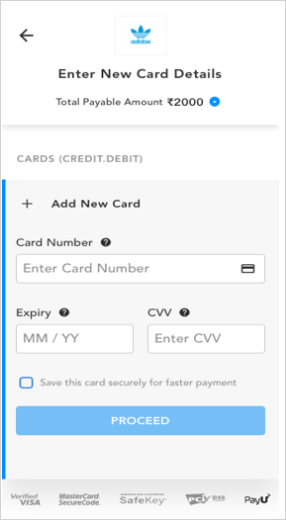

1. The user will either enter the name on the card, card number, CVV and expiry, or will use the ‘store card’ functionality provided by merchants wherein the user’s card along with name and expiry is already saved, and only the CVV needs to be provided each time to initiate card payment.

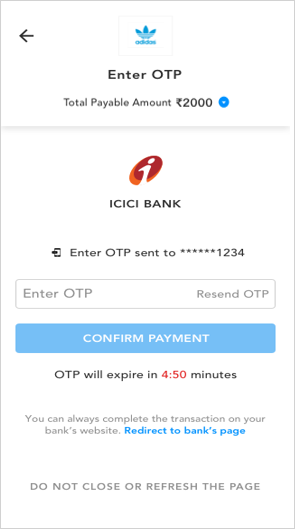

2. User will then be redirected to the bank’s ACS page – also called the 3d secure page – where the user will have to enter the OTP sent by their bank to their registered mobile number.

3. User enters the OTP and clicks Submit. If authentication is successful, following a subsequent authorization call from the backend team the user will be redirected back to the merchant’s website with the final transaction status confirmation.

Problems that customers face while doing card transaction:

1. Due to low internet speeds on mobile, the user may get dropped while redirecting to/from the bank’s pages, resulting in dropping of the transaction either in forward leg or return leg, forcing the user to close the browser/app.

2. In case bank ACS pages are not user-friendly and mobile optimized, the interaction results in a bad user experience and difficulties in user interaction.

3. User has to leave the merchant website/app to complete the transaction, increasing the number of browser hops in overall payment processing and this directly impacts user experience.

In this article, we will discuss a few solutions which merchants can use to optimize the card payment experience for their customers. To Solve all of the above problems for card transactions, PayU has come up with Native OTP flow.

What is Native OTP Flow?

Native OTP flow helps the user to stay on the merchant’s website/app and completes the Card authentication process of entering OTP on the merchant website itself, rather than redirecting the user to a 3d-secure page to complete the transaction cycle. This means that there will be one less point of failure or drop in the checkout process, and faster completion of transactions.

What are the advantages and why should merchants integrate this flow with PayU?

1. Native OTP flow improves Success Rates of card transactions by 3-5% depending upon the source of transactions. It has more positive impact on the transactions initiated from mobile phones, since it reduces drop rates due to user’s internet speed issues.

2. It improves overall user experience since multiple redirections are removed. Also, the customer never leaves the merchant website, which helps in providing a seamless experience.

3. Best-in-class Dynamic Switching functionality at the authentication as well as authorization stages of card payments provides a high-availability network with multiple back-up channels, giving more stability and higher success rates. This is one of PayU’s USPs.

4. PayU works closely with all Issuers and keeps adding support for them for Native OTP flow. Wibmo, a leading ACS service provider for all top banks in India and an entity that is a part of PayU now, has worked with banks to create an ExpressPay flow – a server-to-server API-based authentication solution – that helps PayU provide seamless integration and direct connectivity with the bank’s authentication system.

5. PayU supports all major banks – 15+ banks including HDFC, AXIS, ICICI, SBI, KOTAK, RBL etc. – on this flow.

What other features are provided along with API based authentication and their impact?

| Features Supported | Description and Impact |

| Upfront authentication selection – (OTP) | 3-5% increase in Conversion with native OTP |

| Fallback support | Ensures customer can complete transactions in cases where OTP is not received, or users are not comfortable in entering OTP on the merchant’s page due to lack of flow awareness |

| Resend OTP | Cases where customer didn’t receive the OTP the first time. ~1-2% increase in authentication success rate |

| Retry OTP | Option to re-enter OTP in case the wrong OTP is entered by the customer. ~1-2% increase in authentication success rate |

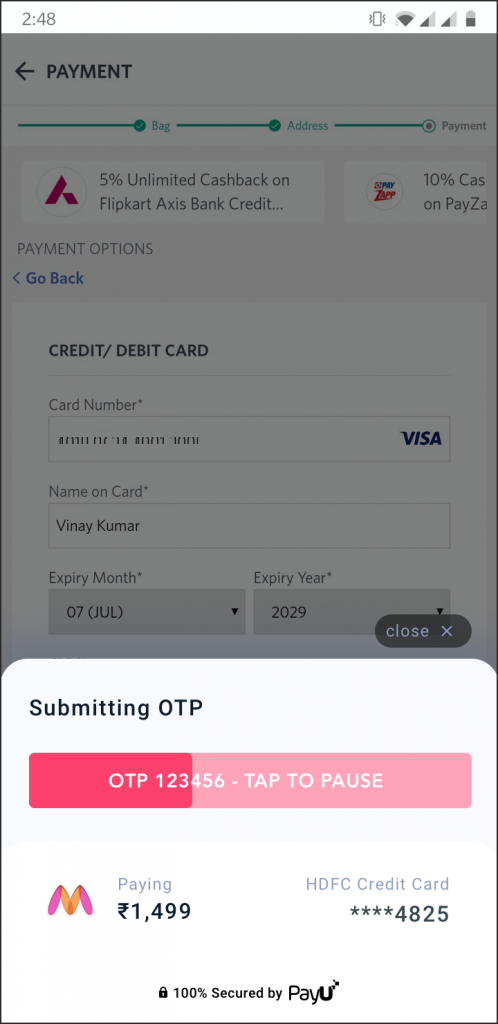

| OTP Auto Read (through mobile SDK) and Auto Submit | Lesser OTP validation failures and a seamless user experience |

Native OTP – Transaction flow

1. User navigates to the merchant’s website and proceeds to the checkout step.

2. User enter card details on the merchant website or selects a stored card.

3. Merchant initiates PayU’s Native OTP API on Proceed button over server-to-server call, which will act as an OTP generate request.

4. Merchant shows OTP entry page at Checkout wherein user enters OTP received against registered mobile number.

5. On entering OTP, merchant initiates Validate OTP call to PayU, which validates the OTP with the bank followed by a server-to-server authorization call in case of successful authentication, and gives the final transaction status back to the merchant in a validate OTP API response.

Need modular SDK Solution?

In case a merchant wants to use PayU’s native OTP feature via SDK, We have our modular OTP assist SDK which will help provide native OTP functionality along with features like auto OTP Read and Submit feature for a more seamless experience.

All leading merchants in the market providing online services are currently using PayU to provide this seamless experience to their users including Flipkart, Phonepe, Freecharge, Swiggy, Zomato, Airtel, VI, MakeMyTrip, Yatra, FirstCry, OLA, Grofers and many more.

This feature has now become a de facto in the market, with a lot of exciting ongoing development happening around it to take it to the next level of frictionless payments.

Feel free to contact us to know more about this feature.