Picture this:

It’s 9:30 AM. The markets have just opened. Thousands of investors are funding their accounts, eager to grab the first trade of the day.

But here’s what’s happening behind the scenes at most WealthTech platforms:

UPI payments crash during peak volumes, settlements arrive the next day delaying trades, and finance teams drown in reconciliation chaos. Meanwhile, customer support fields endless investor queries about failed SIPs and delayed redemptions.

By the time the money reflects, investors have already lost their chance. Their trust in your platform? Gone.

Payments in WealthTech whether for mutual funds, stock brokers, or multi-asset platforms, are broken at the very core. And the cracks show up every single day: failed SIPs, delayed settlements, compliance headaches, and lost investors.

Let’s unpack why.

The Real Challenges in WealthTech Payments

If you’re a WealthTech business, chances are your teams (and even investors) are constantly search for:

- “Why do SIP payments fail?”

- “How to manage SEBI compliance in fund settlements?”

- “Best payment gateway for stock brokers in India”

- “How to reduce reconciliation errors in mutual funds”

The truth? Today’s payment systems were never designed for the high-stakes, high-volume, highly-regulated world of investments. And that’s why cracks show up everywhere.

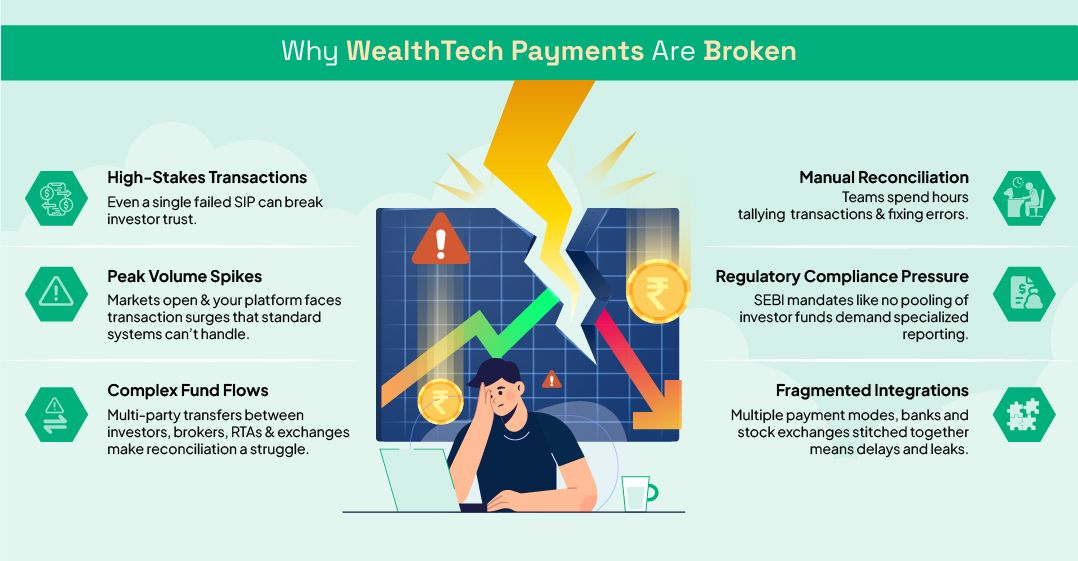

Here’s what’s broken:

- High-Stakes Transactions: In WealthTech, even a single failed SIP or delayed redemption is not just a “technical glitch” it directly erodes investor trust. Unlike e-commerce, where a failed payment means an abandoned cart, here it means a lost investor relationship.

- Peak Volume Spikes: Market opening or SIP collection dates create 10x transaction spikes within minutes. Standard payment gateways can’t handle these surges, causing failures right when investors need them most.

- Complex Fund Flows: Money moves between investors, brokers, exchanges, RTAs, and AMCs. Unlike simple merchant payments, these multi-party transfers create reconciliation nightmares when any link fails.

- Manual Reconciliation: Finance teams spend nights matching data across payment gateways, bank statements, and exchange reports. Finding discrepancies in thousands of daily transactions becomes a manual treasure hunt.

- Regulatory Compliance Pressure: SEBI mandates no fund pooling, direct settlements, and detailed reporting. Generic providers don’t understand these requirements, forcing platforms to build compliance layers manually.

- Fragmented Integrations: Separate integrations for UPI, banking, NACH, exchanges, and RTAs mean different APIs and formats. When one integration breaks, the entire payment flow collapses.

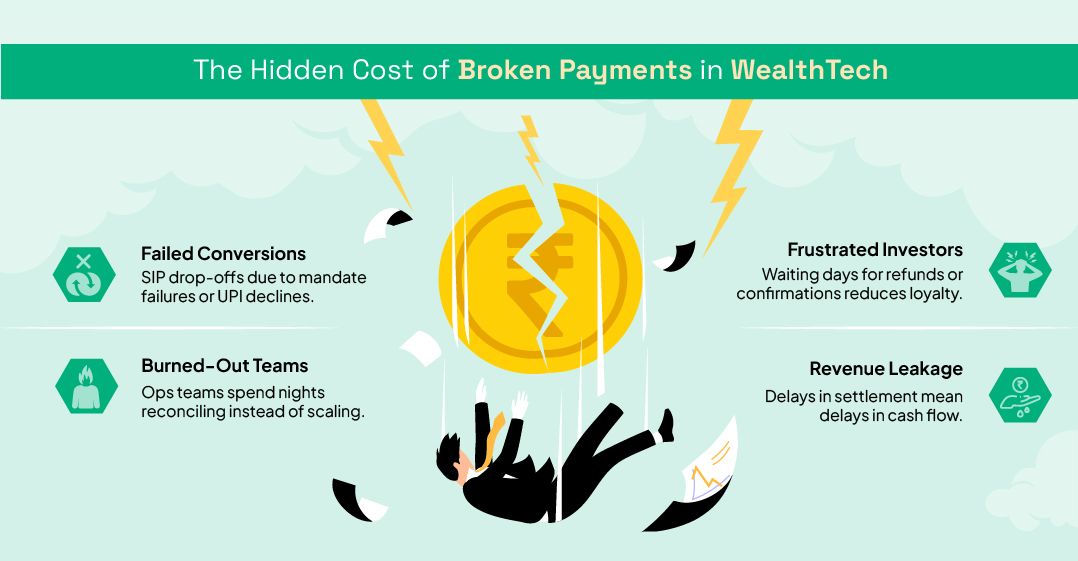

What This Chaos Costs WealthTech Platforms

This isn’t just about missed payments. It’s about lost growth opportunities.

A top equity broker shared:

“During peak trading hours, our payment failures shot up. We lost investor confidence, and my team spent hours fixing reconciliation instead of onboarding new clients.”

When payments fail, everything fails. Your investors lose trust. Your operations team burns out. Your growth gets stuck.

Why Current Banking Systems Don’t Work

Here’s the catch: Your entire business depends on seamless payments. Whether it’s a ₹500 SIP or a ₹5 lakh equity trade, every transaction matters.

But the tools available weren’t built for WealthTech. They were designed for e-commerce, not high-stakes financial transactions.

Most WealthTech platforms are stuck with:

• Generic payment gateways that don’t understand fund flows

• Multiple vendor integrations for different payment modes

• Manual processes for compliance reporting

• Delayed settlements that hurt cash flow

• No TPV (Third Party Verification) support for source account validation

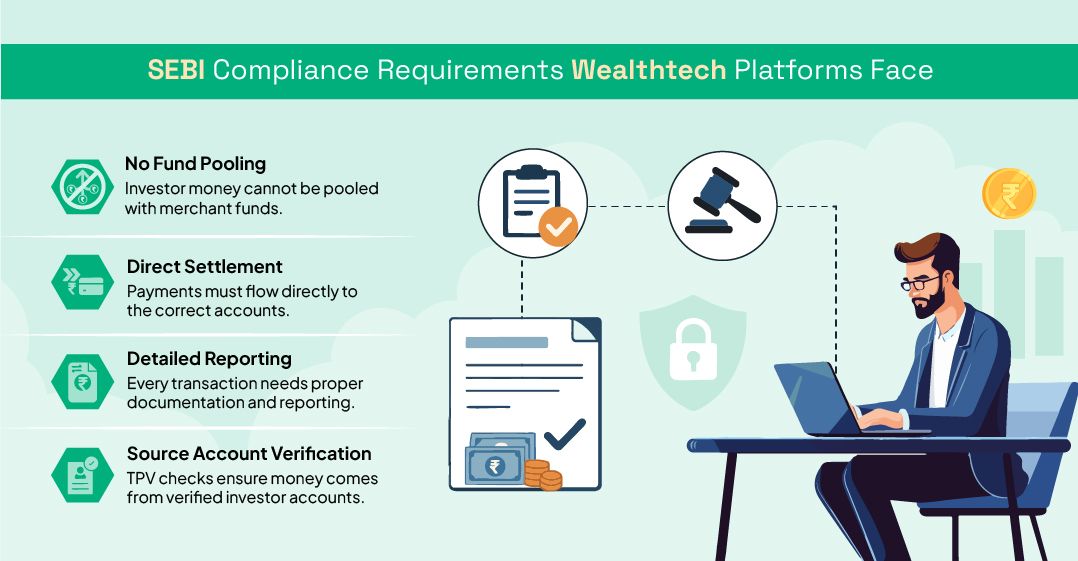

The Hidden Challenge: Regulatory Compliance

Here’s what most WealthTech founders don’t realize until it’s too late: SEBI guidelines are strict about fund pooling and settlement flows.

For mutual fund platforms, you can’t just collect money and settle later. Direct settlement to merchants is mandatory. Your payment partner needs to understand this, not just process transactions.

Most payment providers don’t even know these requirements exist. So, what’s the fix?

What If Payments Actually Worked for WealthTech?

Imagine this instead:

Your SIP collections run smoothly every month, even during peak volumes. Your equity trades settle in real-time. Your compliance reports generate automatically. Your investors never face payment failures.

What if you had:

• A payment system built specifically for WealthTech

• TPV support across all payment modes

• Direct settlement that keeps you SEBI compliant

• Real-time reconciliation that saves hours of manual work

• 99.98% uptime even during market volatility

The solution exists. You just haven’t discovered it yet.

The Change is Coming

The WealthTech industry deserves payment infrastructure that understands its unique needs. Not generic solutions forced to fit complex financial flows.

In our next blog, we’ll reveal exactly how leading WealthTech platforms like Groww and 5Paisa solved these payment challenges and achieved 3-4% improvement in settlement rates during peak volumes.

For now, remember: The WealthTech industry is evolving rapidly, and payment infrastructure is finally catching up. Purpose-built solutions designed specifically for investment platforms are transforming how leading brokers and mutual fund companies operate.

Your investors deserve seamless transactions. Your business deserves to scale without payment bottlenecks.

It’s time to fix WealthTech payments once and for all.

Stay tuned for the solution you’ve been waiting for.