Neobanks are the latest entrants in the fintech space. These are low-cost solutions that use technology to improve banking solutions for Indian consumers.

“Banking is necessary, but banks are not,” said Bill Gates way back in 1994. Fast-forward to 2021 & neobanks are changing the financial landscape through their low-cost offering & technology, giving intense competition to traditional banking.

What is Neobank?

The financial services industry is focusing on customer experience and satisfaction; a gap has developed from what the traditional banks offer to what customers expect. And, neobanks are attempting to fill that gap. A neobank is banking on a fingertip through its zero presence on the ground & a complete digital offering.

It offers a fully digital banking solution at a discounted cost due to the considerable savings in operating costs. This is attributed to zero physical branches & no spending on the workforce to man those branches. Some of the services include international payments, money transfers, or lending credit. Some new banks also partner with neobank to offer the services that help them provide both online & offline banking services.

Why Neobank?

India has over 2000 fintech firms in the country. With the government wanting Indians to embrace a completely cashless economy, Fintechs have played a significant role in fulfilling this vision.

Also, with the Covid-19 pandemic, the need for contactless banking was felt by the people more than ever before. People moved away from traditional banking & physical cash with more & more interest in online banking & wallets.

The invention of UPI pushed this adoption, which facilitated transactions irrespective of value size. In 2020, India already has clocked more annual transactions in terms of volume than that of China & the US combined totaling $25.5bn.

Neobank Vs Traditional/Digital Banks

Neobanks are new entrants into the banking industry. They are also known as fintech companies or financial technology companies. A simple example of how they differ from traditional banks is neobanks do not charge any fees for opening an account. Ideally, traditional banks charge a monthly fee for maintaining a budget.

The government regulates traditional banks. On the other hand, neobanks either have no partial or complete banking license regulated by the government.

Digital banks offer a fully digital banking experience, mainly through their e-banking platforms. They are similar to neobanks in some ways, but there are differences too. For example, digital banks charge a monthly fee to maintain an account.

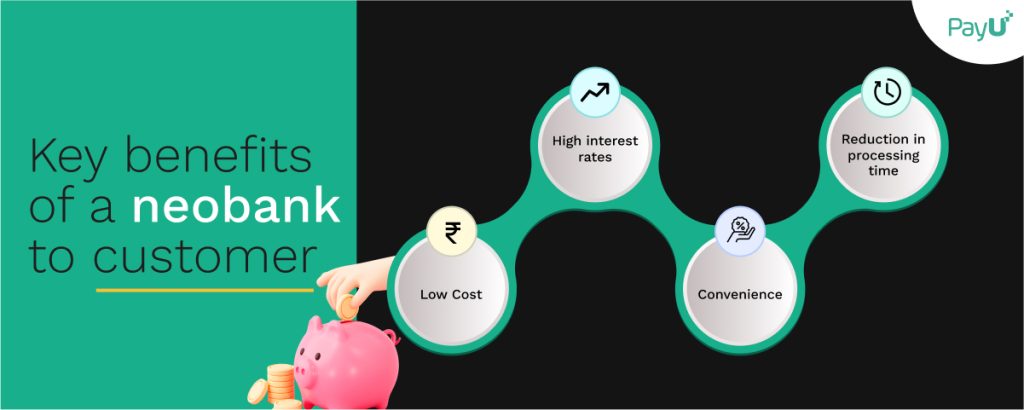

Benefits of a Neobank to Customers?

- Low cost: Products as simple as savings accounts are available at no charge due to the bank’s complete digital presence & low regulatory hurdle.

- Higher interest rate: The low-cost structures of neobanks help offer lucrative fixed deposits at an attractive interest rate as the entire experience is digital.

- Convenience: UI/UX lies at the heart of a neobank, attracting customers to adopt it quickly. Also, due to state of the art IT systems & security features, it is easy to predict any fraudulent activity and stop it at the right time.

- Reduction in processing time: Imagine applying for a loan & it getting processed within minutes & not days. Neobanks bring with it the ability to reduce processing times, which otherwise would take days & manual underwriting by bank personnel.

Tips to Choose a Neobank

Neobanks may offer a great deal of convenience due to its complete digital presence. However, the fact remains that they are partially or fully unregulated in terms of their offerings by RBI currently. Hence, it is essential to choose one based on its management expertise in managing risk related to banking & finance.

Five key points to keep in mind before choosing the right neobank:

- Know your banking needs – The kind of banking partner one needs depends on how complex the individual’s banking need is. Today, most digital banking apps offer the same set of functionalities that a neobank provides, so it is good to know what your bank offers before signing up for a neobank.

- Insurance – Banking is a business of trust & the government, with its regulation, offers to protect the depositors from default through an insurance program. This insurance program ensures that the insurer pays depositors in case the bank defaults on the deposit repayment. The same rules do not govern neobanks. The best way to work with neobanks is to ascertain if they offer a private deposit insurance scheme to protect the depositor.

- You are comfortable with technology – Neobanks work best for tech-savvy folks and want banking at their fingertips. Neobank apps are minimal, with a clean & straightforward UI design.

- You want to get better at money management – In a world that thrives on making you spend more & more money. Neobanks, with their ease of use, can significantly help you design a reward & a goal-based system. Such programs can lead you to invest wisely & track all your unwanted expenses simply because money saved is money earned.

- Account management & reconciliation – If you are a business or an entrepreneur, you may need more than one system to manage your finances. Neobanks can combine all of it into one & offer business insights through its reports that can save time in decision-making.

The Way Forward

Low-cost internet & a tech-savvy young population is creating massive drifts in the way banking is perceived. Some of the notable trends soon with regard to this new-age banking can be seen from

- Focus on national markets by emerging fintech startups that offer unparalleled services in several regions of India & are making an impact by driving financial inclusion for the masses.

- Neobanks gradually transform into full-fledged banking institutions by offering various services, from account opening to travel credit card sales.

- Neobanks are going into messengers; slowly, customers will manage their accounts and cards without installing the bank’s app but from their preferred messaging service. Many popular neobanks partner with social media companies like Facebook & Google to offer world-class customer support through their apps.