TDS or tax deducted at source, was introduced in the Indian taxation system as a part of income tax in India for fast and efficient tax collection during income generation and also to minimise tax evasion.

Any individual earning a taxable income in India has to go for an income tax filing. TDS is a direct taxation system handled by the tax authorities. TDS is levied on different incomes like salaries, rent, fixed deposits, etc. TDS full form is tax-deducted at the source. It means the tax is deducted from the very source where an income originates. TDS was introduced as a part of income tax in India for fast and efficient tax collection during income generation and also to minimise tax evasion. This article will discuss TDS and how to make TDS payments online as it is a vital taxation mechanism relevant to all taxpayers in the country.

How is Tax Deducted at Source?

TDS is deducted at the source of a person’s income. Incom could be in the form of professional fees, salary, commission, interests and even rent. According to the Income Tax Department, “a person (deductor) who is liable to make payment of specified nature to any other person (deductee) shall deduct tax at source(…).”

The recipient is paid the net amount after deducting TDS. The deductor then remits the TDS to the central government’s account.

The recipient will adjust the TDS against their final tax liability. The recipient can claim credit for the TDS based on Form 26AS or the TDS certificate (Form 16/Form 16A). If the income tax liability comes down after the income tax calculation, the taxpayer receives an income tax refund for their TDS payment.

What are TDS rates, and how’re they applicable?

There are varying rates of TDS applicable for varying levels and types of income. Taxes are deducted at the rates specified per the relevant Income Tax Act provisions or the Finance Act’s First Schedule.

For instance, for non-resident individuals, income tax rules also consider tax rates set under double taxation avoidance agreements. The TDS rate chart will help taxpayers assess the rates for fixed payments. The TDS payment must be made to the government account within the due dates by the deductor.

Read more – How to File Your TDS Online In A Few Simple Steps?

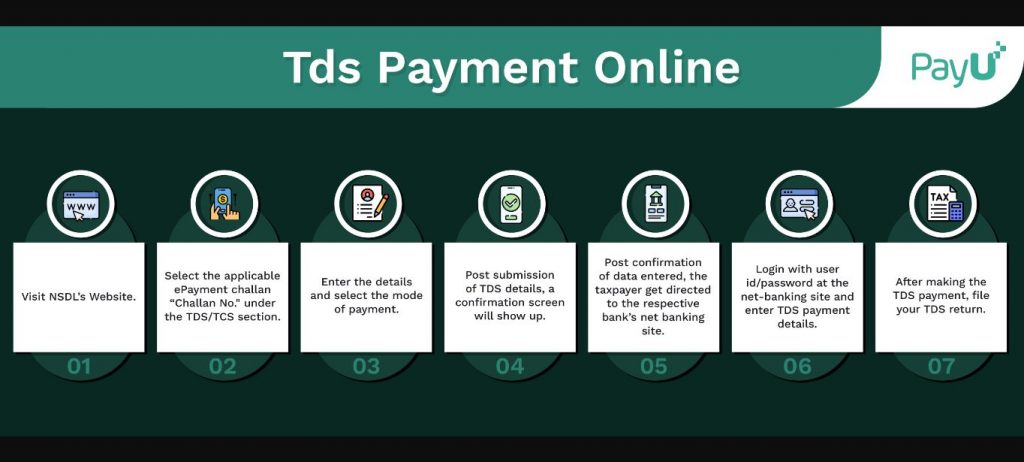

Online Procedure for TDS Payment

You can make an ePayment of tax by following the below steps.

- Visit NSDL’s Website.

- Select “Services” > “e-payment: Pay Taxes Online” or select the “e-pay taxes” tab.

- You should provide a valid e-payment link to make a tax payment online.

- Select the applicable ePayment challan “Challan No.” under the TDS/TCS section. You will be directed to the e-payment page where you can make your tds payment online.