An individual can get into various professions for extra sources of income. However, the individual is also liable to pay the government. A significant bearing on taxpayers is observed, and tax deduction is made essential. This is termed Tax Deduction at Source (TDS).

As per Indian law, the Indian tax system has incorporated a scheme that collects income tax, and it is deducted automatically from the deductee’s bank account. Income tax is the direct tax which every earning individual is liable to pay to the government. Every individual earning an income has experienced this tax deduction in various formats.

A tax deduction system is wherein the amount of tax is deducted by the employer or deductor. This amount is deposited into the income tax department. The amount of tax deduction varies based on the age bracket and the income of the individual. The tax deduction is usually made by deducting a certain amount like rent, commission, salary, professional fees, etc., so it ends up reducing the big chunk of our salary.

According to the Income Tax Act, any company or a person can deduct tax at the source. The person who receives payment is also liable to pay tax.

How Does TDS Work?

Tax deduction applies to all the taxable incomes. But it is deducted at a fixed rate. The rate depends on the type of income rather than the amount of the income, except in the case of salary. In the case of salary, the employer can evaluate the total expected income of the employee.

Income Tax TDS Payment happens at the applicable slab rate, and it may change in the middle of the year based on appraisals and investments made. Therefore, it becomes essential for employed taxpayers to pay taxes at the beginning of the financial year to avoid losses at the last moment.

Example of Tax Deducted At Source

Under the income tax act, the TDS rate on rent payments applies to resident individuals and HUFs (Hindu Undivided Family). When the rent is more than 50,000/- month, the TDS rate is 5%. Thus, if the rent of a house is 70,000/- month, the TDS will be Rs 3500 per month. The tenant, therefore, will have to pay Rs 66,500 to the owner and deposit Rs 10,500 every quarter to the CBDT. Similarly, for a salaried employee, a firm may deduct TDS at 10%.

How To File Your TDS Online?

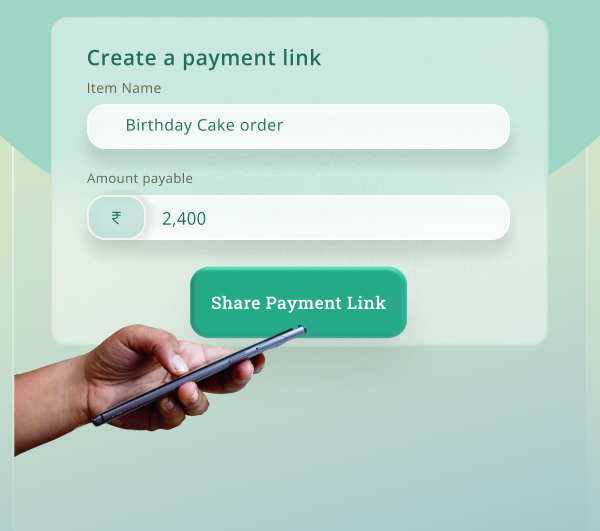

Online TDS payment, also known as Income Tax efiling, online is simple and can be completed in a couple of minutes. The step-by-step process for e-TDS payment by filing TDS Challan 281. Just follow the steps mentioned below:

- Visit the NSDL website and complete the process to E-Pay Income Tax.

- Click on ‘CHALLAN NO./ITNS 281’ under TDS/TCS section. After proceeding, the page will be directed to the e-payment page.

- You will have to fill in the following details which include the nature of payment, mode of payment and other information:

- Under ‘Tax Applicable’ select ‘Company Deductees’ if the TDS deducted by you is while making a payment to a company. If not, select ‘Non-Company Deductees’.

- TAN is mandatory. Therefore, enter TAN along with the Assessment Year for which the TDS is made.

- Enter the Pin Code of your location and select the State from the drop-down.

- Select between the two options: the payment made for TDS deducted and payable by you or TDS on regular assessment.

- Select the ‘Nature of Payment’ and ‘Mode of Payment’ from the drop-down.

- Click on the ‘Submit’ button.

- After submission, a confirmation screen will be displayed. If TAN is valid and confirmed, the full name of the taxpayer as per the data stored will be displayed on the confirmation screen.

- On confirmation of the details given, the net banking site as per the bank details given will be opened.

- Login with the User ID to the banking site and make the payment.

- After completion of the payment, a TDS challan online counterfoil will be produced that will contain the CIN, payment details and name. The TDS Paid Challan download file will be a proof of completion of payment.

- After payment of TDS, move on to file your TDS return. There is a simple process for Tax Return eFiling.

Conclusion

TDS is an imperative obligation as it is levied at the source itself. Everyone who is earning an income must ensure that there is no tax evasion. Every individual must pay close attention to tax-paying because the late filing will lead to penalties and fines.

At the same time, proper documentation of all the online e-pay tax challans must be done. A proper check on updates in TDS provisions must also be paid attention to. An employer should ensure that the right amount of tax is deducted from salary income.

If you need a payments partner for your business, use PayU India

FAQs

Yes, it is mandatory as per the Income Tax Act 1961. The income tax department allows the TAN.

Yes, income that is generated by income on securities is liable to pay TDS.

It must be deposited on the 7th of the subsequent month. In cases like rent and property purchase, the due date is extended.

The delay causes 1% of interest until the tax is deducted.

As per the salary, the TDS amount is calculated. Any investments by the employers are also considered.