In the past few years, we have witnessed tremendous growth of small businesses. What started as a policy of Liberalization, Privatization and Globalization in 1991; took a major leap with the onset of the pandemic in 2020. The pandemic gave a much-needed boost, especially to the small businesses in India. The contribution from small businesses toward India’s Gross Domestic Product (GDP) is estimated at 30% today. (Source: NDTV)

Another area that has seen enormous growth is online transactions. Fueled by demonetization as well as the pandemic, the volume of online transactions has escalated to 45.6% in tier 2 cities and 54.3% in tier 3 cities. (Source: Economic Times)

Businesses, as well as consumers, prefer online transactions as it ensures greater safety and is an easy process importantly, it eliminates the hassle of withdrawing cash or coming in close contact with anyone.

With the growth of both small businesses and online transactions, it is very easy to put 2 and 2 together and conclude that online transactions form an essential part of small businesses as well. For instance, consider the owner of a cloud kitchen who collects and delivers orders offline and doesn’t have a website or an app. Or a freelancer who gets paid by his/her clients on a weekly basis. Or an online tutor who has to do online fee collection. How do they go about getting paid?

It is in such situations that small businesses feel the need to have a payment solution that can help them receive payments with minimum hassle. This is where PayU Payment Links comes to the rescue of such businesses!

What Are Payment Links?

The PayU payment link is a simple URL to collect payments. Links are the easiest way to collect payments from customers or clients. All you need to do is create and share the link with the person from whom you are expecting payment.

What adds to your convenience while using payment links is that once you have created a payment link, you can share it with your customers via any social platform that suits you viz a viz, WhatsApp, Facebook and Instagram.

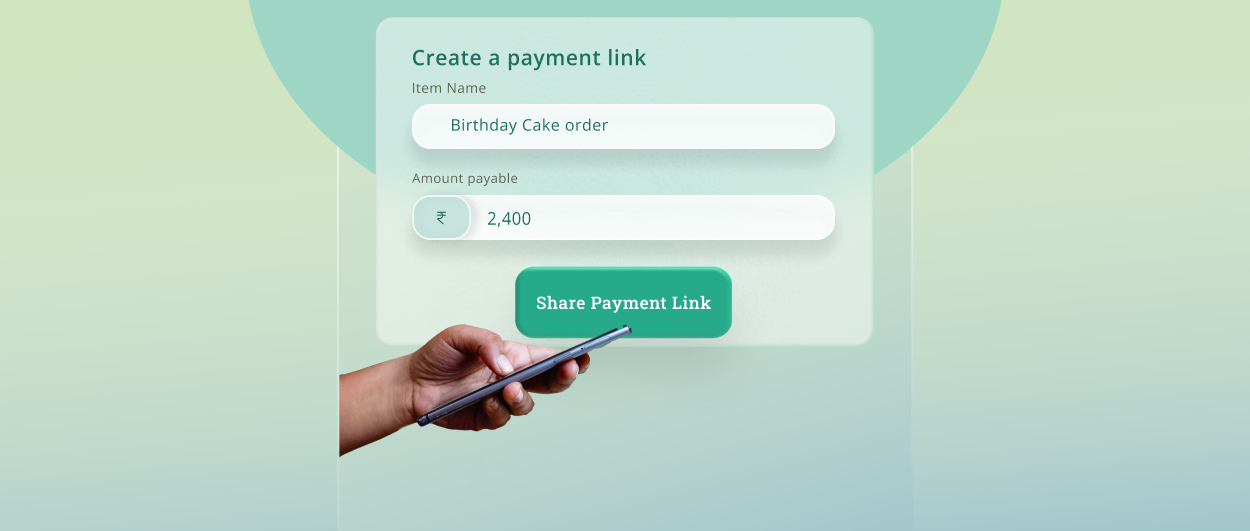

What Is The Process of Creating PayU Payment Link?

As far as creating a payment link is concerned, it’s a simple 2-step process wherein you create and share the link or link payment with your customer. On receiving the link, your customer has to click on it and then fill in their basic details and proceed towards payment checkout where they can select from the available online payment methods and complete the payment.

How Do PayU Payment Links Benefit Your Customers & You?

Here are some ways in which payment links can be helpful for your customers as well as your business:

- Create links individually or in bulk via dashboard or API

- Track your payments in real-time

- Accept partial or full payments on the link, as per requirement

- Give access to a sub-user to create a link/only view

- Share payment links via any social platform or SMS or email with your customers

Which Businesses Are Ideal For PayU Payment Links?

- Businesses without a website or an app: If you are a business without a website or an app, then payment links are the best way for you to collect payments from your customers

- Businesses selling in-person: With more and more customers preferring to pay online if you are a business that operates in-person, payment links are the most impeccable tool to ascertain smooth payment collection.

- Businesses selling via multiple digital channels: Off late, there has been a drastic increase in sales via multiple digital channels such as Facebook, Instagram, WhatsApp, etc. In such cases again, collecting payments via payment links makes you look more professional. At the same time, your customers have the flexibility to pay via any mode they want.

Conclusion

To cut the story short, PayU payment links give you complete control over your business’s finances. Be it a single link creation or bulk, the process is a cakewalk. With links being an absolute no-code solution, you can comfortably use the product without requiring the intervention of any developer. Be it card payments or any other mode, the payment link will take only a few seconds. Hence, PayU payment links are the ideal solution to augment your business!

FAQs

Sign in to your PayU dashboard. Click on “payment links” on the main menu on the left. Then, click on “Create New Payment Link”.

Payment links can be shared via WhatsApp/SMS/email to customers and clients.

PayU payment links support all online payment methods I.e. UPI, wallet, debit & credit cards and net banking.

Yes, payment links can be created in bulk for multiple clients/customers on PayU.

The customer has to enter their name and email id on the payment checkout page

Click on the payment links on Main Menu. Click on “Bulk Create” in the top right corner. Download a sample file to understand the format in which details need to be uploaded and then upload all customers’/clients’ information at once and click “Upload”.

Yes, links can be deactivated by clicking on “Details” on the main dashboard where all links are listed. After that, click on “Deactivate” next to Status.

Click on “Details” on the main dashboard against the link for which the expiry date needs to be changed. Click on “Change” next to Expires On.

Links can be shared via WhatsApp, Facebook, SMS and email. Also, the link can be simply copied and pasted as required.

Following information about the links will be provided on the dashboard: date of creation, payment link, the purpose of payment, amount, status, actions (share the link, copy link, disable link) and other details (expiry date, transaction ID, etc.)

Yes, a detailed report of all links can be downloaded by clicking on “Download” on the dashboard next to Filter, after clicking on payment links.

Yes, you will get a preview of the link while creating it on the right-hand side of the screen.

Yes, partial payments can be collected from customers by requesting some additional details from customers.

Yes, multiple payments can be accepted using a single link.

For further information, please visit: https://devguide.payu.in/payment-links/payment-links-dashboard/