The number of people opting for UPI payments is increasing every day. Offering a UPI Payment Gateway can attract more customers to your business or freelance services.

Unified Payments Interface (UPI) is a real-time payment system that enables instant transfer of money through the use of a stable internet connection on a mobile device. It was developed by the National Payments Corporation of India (NPCI), an organization facilitating inter-bank transactions. UPI is fast replacing the time-consuming, traditional modes of monetary transaction. Similarly, UPI payment gateway is a third-party service that acts as a medium for a business to send and receive money.

Transfer through UPI is very simple. You can initiate a transaction either through the QR code of the recipient or UPI VPA. UPI VPA, also known as UPI Virtual Payment Address, is the address through which UPI transactions can be done. UPI VPA is unique for each person, but it is also customizable. It can be described as an email ID for your UPI payments, for instance, your Google Pay ID.

What Is UPI Payment Gateway?

UPI is fast becoming a primary mode for monetary transactions, especially for small and medium-scale businesses. A UPI payment gateway is a third-party service provider that works as a medium for one to send and receive money. UPI payment gateways can be integrated with UPI online payment apps like Google Pay, PhonePe, etc., to both accept and send payments.

An Ideal Payment Gateway – PayU

The PayU Payment Gateway is helping businesses to grow and conveniently accept payments from customers with unique payment solutions. Further, accepting international payments couldn’t have been easier! With the PayU payment gateway, you can accept payments in 100+ foreign currencies. Following are the key benefits that PayU offers to its users:

- No Transaction Limit: There is no limit on transactions undertaken through UPI.

- Transaction Alert: Get notified of each transaction through email as well as SMS instantly.

- Mobile App UPI Integration: It provides a faster checkout experience for users using mobile applications or mobile web. Users just need to enter the UPI VPA, select the UPI app and make the payment.

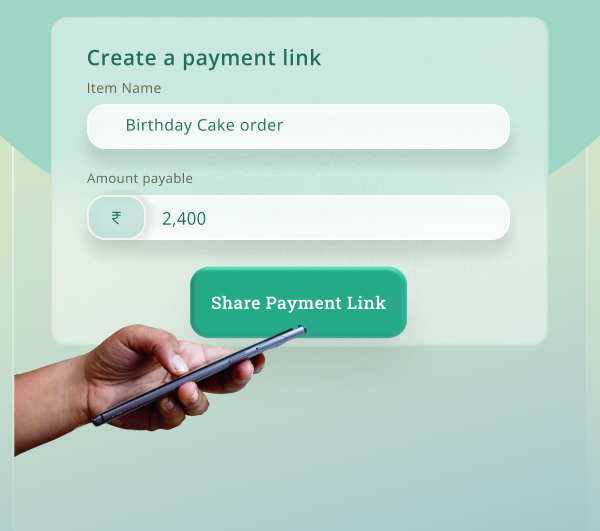

- UPI Payment Link: Businesses can easily generate a UPI payment link to share with their customers. After the customer clicks on the link, payments can be made. A pop-up window will appear showing all the UPI online payment apps installed on the phone in India. Just select the app and make the transaction. Receiving payments has never been easier before.

- UPI AutoPay: Specially designed for businesses with subscription-based plans, the customers can now enable e-mandates using any UPI application. The payments will automatically get debited weekly, monthly, or yearly through UPI apps. The business can create a plan and start a subscription by adding a user. A one-time authorization link can be shared with the user to confirm the e-mandate.

- Reconciliations with Virtual UPI Addresses: Reconciling the UPI payments can be a tedious task. This is primarily in the case of loan repayments, school fees payments, etc., where the payee shares the UPI IDs with the payers. However, it can be made easier by generating a unique virtual ID for each payer or invoice. While the user can make the payment through any UPI app, each payment can be matched with the payer or invoice, thus automating the manual reconciliation process.

- Dynamic Universal QR Code: While UPI IDs are convenient, they are not the only modes for payment. UPI Dynamic Universal QR Codes can be used by the users whereby they just have to scan the QR code through any of the UPI payment apps and make the payment. The amount is auto-filled and the customer just needs to execute the payment.

What About Disbursals?

While collecting payments has become easier, so has the disbursal. UPI simplifies disbursals with the following features:

- UPI ID Verification: If you want to verify the validity of a UPI ID, you can do so by transferring a small amount. This will help you verify that the UPI ID is valid and of the person to whom you want to transfer the amount. However, with PayU, you can know that the UPI ID is valid and in the registered name of the payee by just entering the UPI ID.

- Automating UPI Payment Disbursals: Bulk transfer to other individuals and businesses is now easier on a real-time basis. With API or excel file uploads, you can make instant payouts to multiple people at once.

Conclusion

The PayU payment gateway has been enabling businesses to accept and disburse payments, including international payments, in the most convenient manner. With world-class security through deep encryption protocols, payments are not only convenient but secure as well. Integrate the PayU payment gateway on different platforms and start collecting payments instantly.

Sign up for the PayU UPI Payment Gateway Now to revolutionize your payments system!

FAQs

Q: What is the UPI 2.0?

A: UPI 2.0 is the upgraded version of the UPI rolled out in 2018. It supports multiple new features like invoice approval mechanism, linking of UPI account with the customer’s OD account, and payment blocking options.

Q: How can I make a payment if I don’t know the UPI ID?

A: You can make the payment even if you don’t know the free UPI ID. You just need to generate a link and send it to the recipient. The recipient can enter their bank details, UPI details or card details. Once done, the recipient will receive the payment.

Q: What is the limit for fund transfers through UPI?

A: Currently, the upper limit for fund transfers through UPI is Rs. 2 lakhs per transaction.

Q: What are the integration modes available for merchants?

A: Merchants can easily integrate their UPI through QR, Applications, Intent and UPI Collect modes.