Following the June Policy meeting, RBI governor Shaktikanta Das made some significant announcements on 8th June. As mentioned by Das, the globalization of inflation has led to accentuation in existing supply chain disruption. In the face of such uncertainty, it is not surprising that central banks are reorienting their monetary policies.

While India is on the path to recovery, here is a glimpse of how the latest monetary policy will impact the payments industry and its consumers:

Limit On Subscription Transactions Increased

To boost and simplify recurring payment transactions, the limit for e-mandates on cards (credit & debit) and UPI has been lifted from INR 5,000 to INR 15,000. This leads to a simpler and faster recurring payment experience for customers. Not just this, increasing the limit on such transactions will also give a boost to subscription-based businesses. It will also automate recurring payments for a higher value and be used for more businesses, viz-a-viz insurance companies, edtech companies, etc. This allows subscription businesses to experiment and build on their existing subscription plans and ensure maximized revenue.

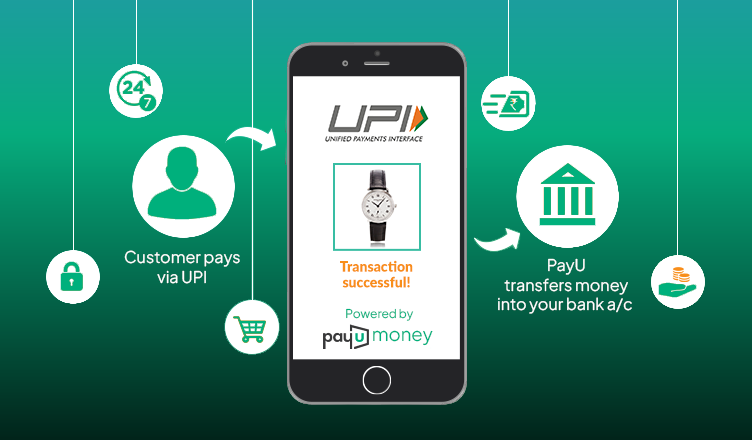

UPI Payments Via Rupay Credit Cards Will Be Allowed

With UPI becoming increasingly inclusive and one of the most preferred payment methods in India, RBI has announced that UPI payments will be allowed via Rupay credit cards. All you need to do is add your Rupay credit card to the UPI app you use and start paying directly from credit cards on your UPI apps. With this, the system of credit becomes more fluid for consumers. On the one hand, UPI is one of the most commonly used payment modes; on the other hand, credit cards are also becoming indispensable. For the payments industry, this means more merchants being open to accepting credit cards which will enhance the usage of cards and boost UPI and card infrastructure in India. Also, this reduces costs for merchants as they don’t need POS machines to accept payments via RuPay credit cards. Additionally, this ensures all benefits of credit cards without any setup cost except standard MDR, which is chargeable.

This is the latest RBI policy announced by Das in June, which impacts the payments industry and its consumers significantly. What comes next is the only time, and the following policy meeting will tell. Till then, stay tuned!

Frequently Asked Questions

The governor of RBI is Shaktikanta Das since December, 2018.

The Monetary Policy Committee of RBI has raised the repo rate by 50 basis points to 4.9%.

Some RBI banks or banks controlled by RBI in India are Bank of Baroda, Bank of India, Bank of Maharashtra, and Canara Bank.

In April 2022 RBI announced that debit cards will be issued only to those having savings or current accounts.