Do you ever wonder when you will receive the payments your customers made? Read on to know the answer and learn how you can speed up the process.

What is Settlement?

Settlement is a simple process by which any business can collect payments via a payment gateway. The settlement process is completed when the payment made by a customer reaches your bank account.

Payment Gateway Settlement Cycle

Here’s how the money movement happens.

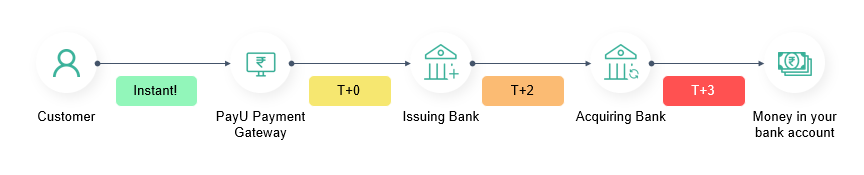

There are three main stakeholders in a payment gateway settlement cycle:

- Issuing bank is the customer’s bank

- Payment gateway

- Acquiring bank is your bank

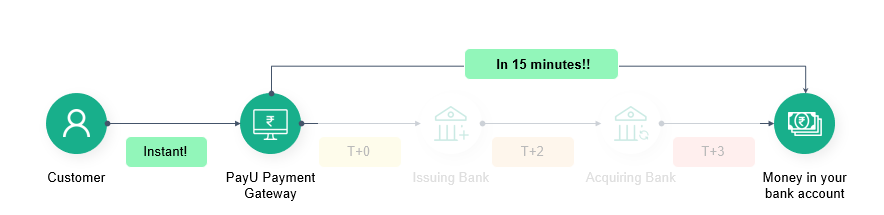

Once a customer pays you, the money is deducted from their account instantly. Money moves from your customer’s bank to your bank via the payment gateway. This money movement takes T + 2 days. After deducting payment gateway charges, the remaining amount is then transferred to your account after T+3 days. This is what a generic payment gateway settlement cycle looks like:

In the case of card payments, the card networks connect the issuing bank & acquiring bank to enable online payment. The entire payment gateway settlement cycle remains the same.

This table will help you understand how much time each payment mode needs to settle:

| Payment modes | Time taken to settle payments |

| UPI, Wallets | Instant |

| Debit Card, Credit Card | T+2 days |

| Net Banking | T+2 days |

| EMI | T+2 days |

Payment modes & time taken for settlement

As you can see, the money movement is not immediate and depends on bank processes. So now you know why you don’t receive your online collections instantly.

Can We Fast-Track These Settlements?

Yes, there’s a way fast-track these settlements!

With PayU Priority Settlements, you can get your customer payments any time of the day in just 15 minutes. It works 24×7, supports all payment modes, and lets you choose your settlement cycle.