GST is finally here with the special midnight session in the central Hall of Parliament. This is one of the landmark tax reforms since independence. From July 1st, the nation is on its way to achieving the goal of One Nation – One Tax with the replacement of bunch of central and state taxes. With Government promoting digital India in full swing, a payment gateway plays a great role in this reform. Here’s a blog demystifying Goods and Services Tax for your business

Tax changes?

Previously, dealers registered under VAT were issued a TIN number & service providers were given a service tax registration number by the Central Board of Excise and Custom (CBEC). From July 1st, a single platform called GSTN has been introduced to provide IT infrastructure for all those under the compliance. Here, the Goods and Services Tax Identification Number (GSTIN) will be used to collect or pay taxes. It is a 15 digit PAN based number with State code & business vertical details as shown below:

At PayUmoney payment gateway, we are helping merchants comply with GST laws & transition to the GSTIN network by completing easy steps shown here with a dummy account:

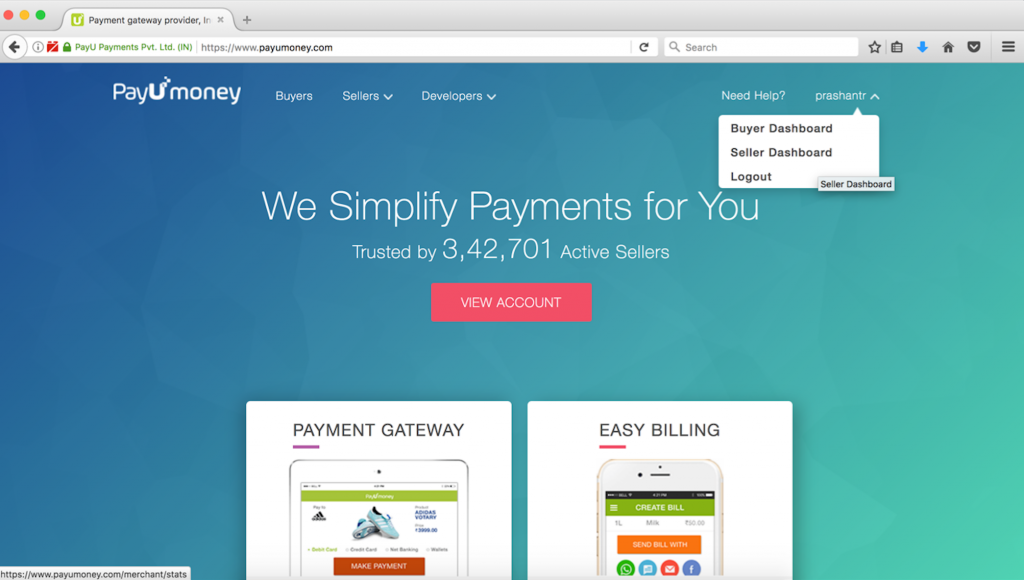

Login to PayUmoney seller Dashboard:

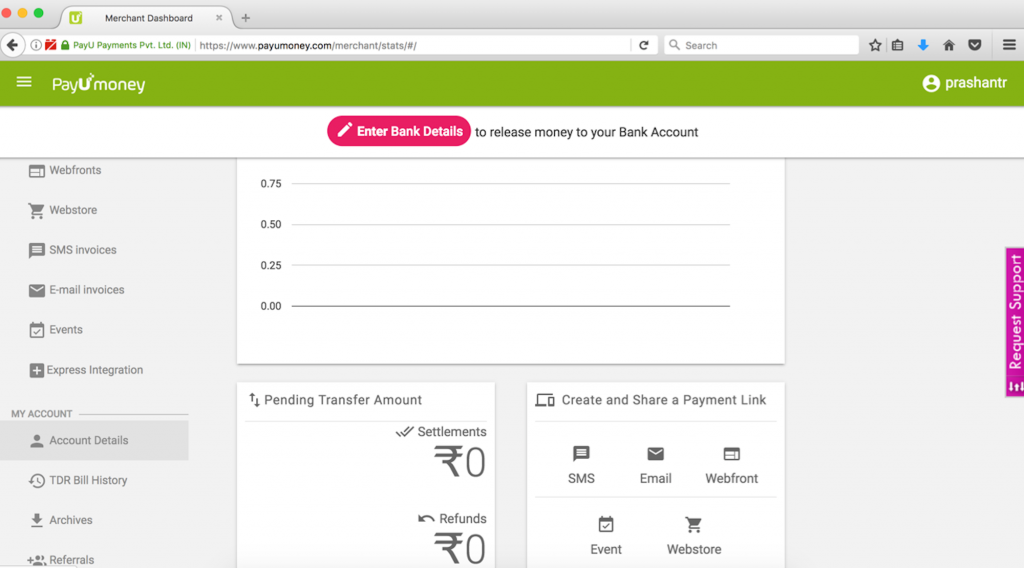

Head over to the ‘Account Details’ section on the left:

Head over to the ‘Account Details’ section on the left:

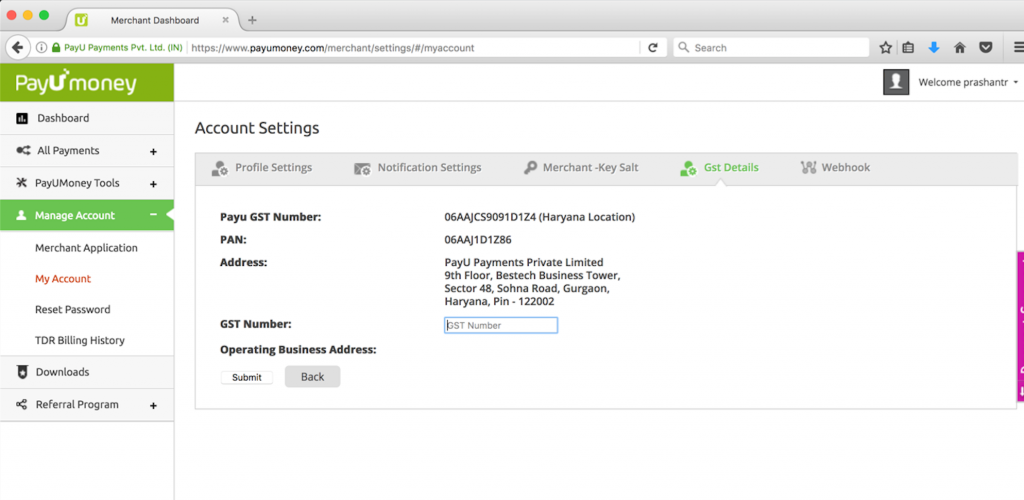

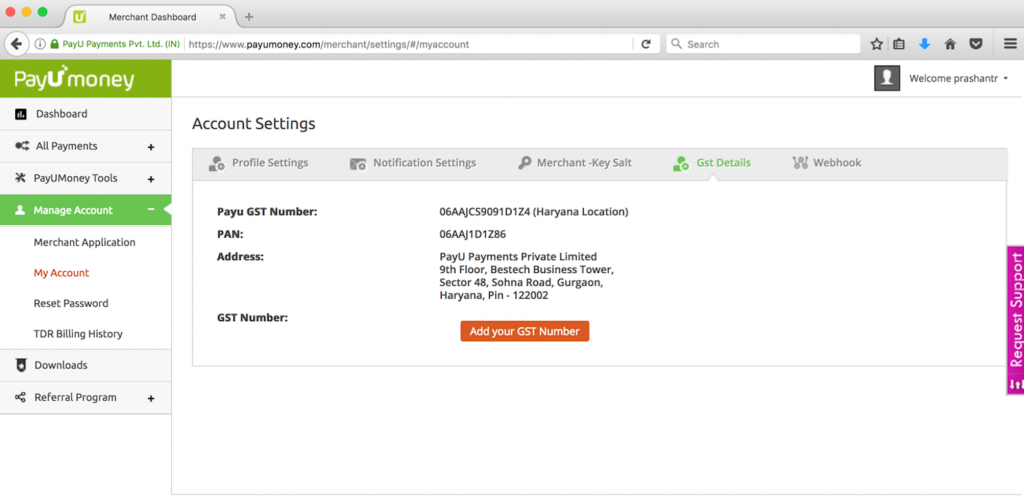

Move to ‘GST Details’ section:

Click on ‘Add your GST Number’:

Enter Correct 15 digit GSTIN & Operating Address details and Click on Submit.

Enter Correct 15 digit GSTIN & Operating Address details and Click on Submit.

Service Tax changes?

In the era from July 1st 00.00.00 Hours, the Service Tax will be levied at 18% instead of the 15% on all transactions. This is in accordance with the guidelines issued by the Government of India and the GST council.

To comply with the GST laws, it is imperative that you update your GSTIN on our dashboard asap. Login to our payment gateway dashboard now!

Read this blog to know more about the impact of GST on your online business

Leave a Comment