Fintech with crypto is revolutionising the financial services and banking industry. Further, with the advent of Web 3.0 and blockchain technology, Fintech blockchain companies are in search of ways in which blockchain tech can be used to provide enhanced user experience with more security and more efficiency. Further, it is not new for companies (especially in the international landscape) to accept payments through cryptos. A great example would be Elon Musk, who not only embraced Bitcoins but also has given his thumbs-up to payments through Dogecoins.

Ever heard about DeFi? Also known as Decentralised Finance, DeFi is the emerging financial technology based on blockchain that is expected to revolutionise the financial industry to its core. The current financial industry is highly centralised, with financial institutions and the government at its centre. However, with the emergence of Fintechs with DeFi, things will change sooner or later. Let’s understand how blockchain, particularly decentralisation, addresses the shortcomings of the current financial landscape.

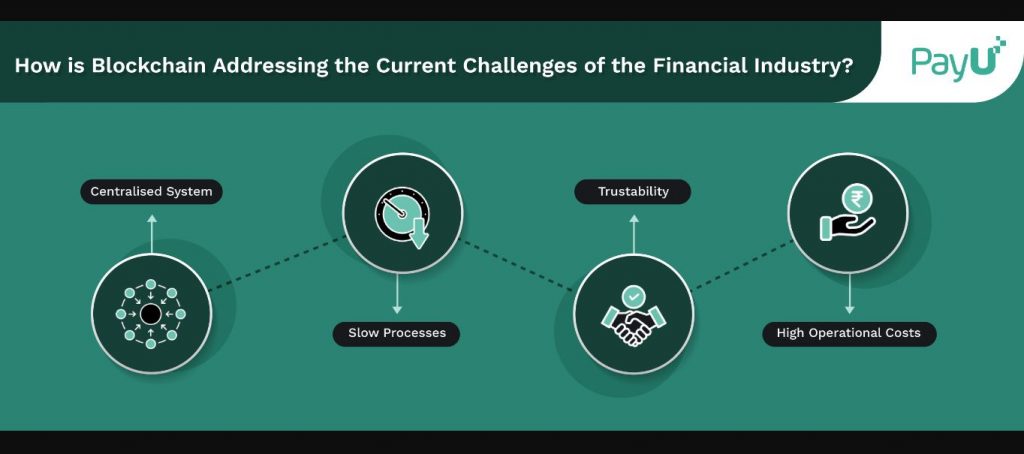

How is Blockchain Addressing the Current Challenges of the Financial Industry?

Following are some of the significant challenges that the financial industry is currently facing:

- Centralised System: As discussed earlier, the financial industry in India is currently centralised, with the government and financial institutions at their heart. As the core idea behind blockchain business is decentralisation, introducing it in finance will address this shortcoming from the root.

- Slow Processes: The current financial systems are still lagging. Even though the technology is developing rapidly, the process is often delayed. This leads to a lower satisfaction rate amongst the users and customers.

- Trustability: When it comes to money, trust is the most crucial factor. While Fintechs are emerging, they are struggling to win people’s trust. People are growing more and more conscious regarding finances and their data. Therefore, imparting trust and transparency are core to the Fintech business, without which they cannot survive.

- High Operational Costs: Fintechs are currently burdened with high operational costs. If you see recent Fintech service providers, they spend a lot on customer acquisition and retention. This only adds to the cost of operations. If they make the process public and cut out dependency on multiple people, they can reduce their operational costs to a great extent.

In a Nutshell

The above problems can be tackled if the finance industry shifts from centralisation to decentralisation. Conventional brick-and-mortar banks are burdened with their existing customers and services, so conducting this shift is difficult. All eyes are on Fintech businesses that can bring revolution by integrating decentralised finance with the current landscape.

However, until the time transition is made from existing systems to DeFi, you can focus on selecting the best financial systems and gateways for your business. PayU is a leading payment gateway that provides 150+ payment modes and allows you to accept payments in international currencies. So, let your business flourish with happy customers using PayU!

FAQs

Major financial institutions are considering using digital currencies because it provides tangible benefits in terms of faster transactions, lower transaction costs etc. This can further solve the inefficiencies of the current payment systems.

Yes. Current share market transactions go through stages, from brokerages to exchange, clearing and settlement. It usually takes T+2 settlement days for the transaction to complete, and the process can extend to weekends. Further, the parties involved must maintain their databases and regularly cross-check against other parties to ensure accuracy. All these inefficiencies can be eliminated using Fintechs and blockchain finance technology.

Crypto lending is a process whereby the borrowers can borrow by providing crypto assets as collateral against a predetermined interest rate. Such borrowers usually borrow stable coins or fiat currencies. However, the reverse can also be done where borrowers can provide stable coins or fiat currencies as collateral to borrow the crypto assets.