BharatQR allows merchants to receive money from their buyers without any limit. At the same time, the customers get to make purchases without using hard cash, with just a click.

In a move to drive cashless payments, the Government of India launched Bharat QR. A Quick Response(QR) code allows customers to make online payments by scanning a display code using their smartphones. It also helps in enabling digital payments to minimize the use of card swiping machines to make payments.

Well, that’s not enough, this quick payment method allows users to pay their utility bills with Bharat QR-enabled mobile banking apps. The user makes the payment without sharing any user credentials with the businesses. Let’s have a look at it in detail below:

What Is Bharat QR?

The BHIM (Bharat Interface for Money) app, a unified UPI app, was launched with the intention not to create a situation of UPI QR Code vs Bharat QR Code but to make processes even more accessible safer. Bharat QR is known for using unique QR codes to facilitate merchant-to-person (M2P) interactions. After the QR codes are installed in the stores, customers may pay using Bharat QR-enabled mobile banking applications, selecting a payment method without disclosing user details.

A QR (Quick Response) code is a machine-readable information matrix that contains the information needed to receive payments from clients. Name, contact address, business name, destination bank data, and so forth are all stored in the BharatQR code. On top of all of that, payment through this mode is highly safe and secure as well.

How to Use a Bharat QR Code Mechanism?

Bharat QR was created from the bottom up with virtual account transactions at its heart, making it compatible with a wide range of mobile devices and apps.

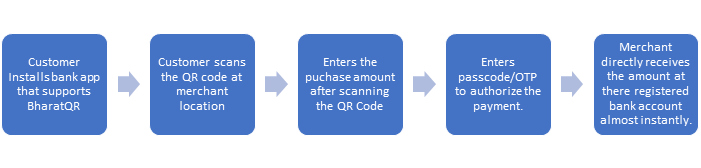

In a QR-based payment scenario, a client scans a QR code placed on the merchant’s shop using a Bharat QR-enabled mobile app. Customers are routed to a checkout page after a successful scan, where they input their card information and complete the payment for the charged amount. Both the merchant and the consumer are advised of the payment status after it is completed. The money is settled in the bank account according to the settlement schedule once successfully authorised and recorded.

Let us now look at a flowchart to understand the working of a Bharat QR:

The supported payment schemes include:

- UPI

- Credit/Debit cards

- Mastercard

- Visa

- RuPay

Will Bharat QR Be Beneficial?

Non-cash expenditure is anticipated to eclipse cash spending, according to industry projections. Infrastructure is one of the most important requirements for enabling electronic transactions. Furthermore, BharatQR virtually removes the need for construction and operational expenditures.

Here’s how this kind of payment may help your company:

Allow Clients Who Do Not have Cards to Make Cashless Transactions

Customers may make cashless purchases without having to use a physical credit or debit card. Payments are made through BharatQR-enabled banking applications on cell phones. For wide acceptability, this payment system accepts Visa, MasterCard, American Express, and Rupay cards, as well as BHIM-UPI. Depending on your needs, you may attach numerous cards to your Bharat QR-enabled bank applications and choose which one you want to use.

Ensure that Clients have a Smooth Payment Experience

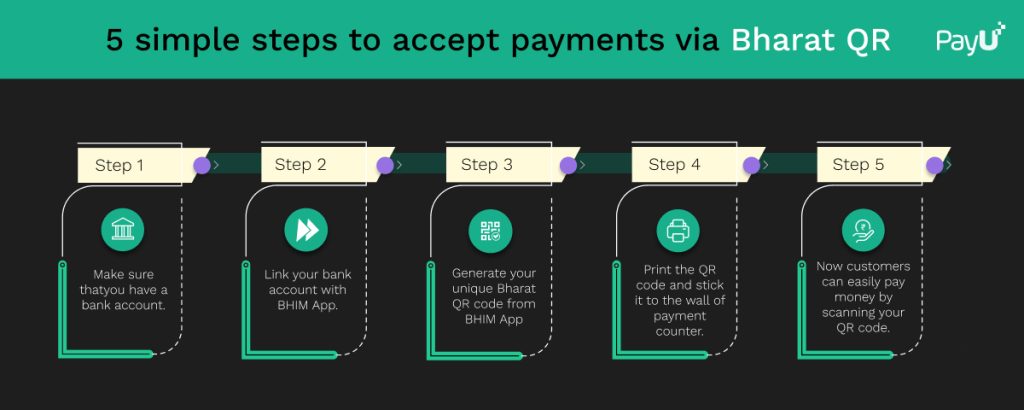

Specific wallet applications are no longer necessary with the BharatQR UPI specifications. Your consumer may now use any app linked to their bank account and is integrated with BHIM (Bharat Interface for Money). You only need the BHIM-UPI app as a merchant to generate a unique BharatQR code. The code may be printed and pasted on your payment counter. Customers may pay money straight to their account by scanning the QR code. There is no need for any further physical or technological involvement.

All of the Big Banks Support Bharat QR

Integration with BharatQR has been enabled by leading banks and service providers such as HDFC Bank, State Bank of India, Amazon Pay, Paytm, PhonePe, and others. As a result, all consumers, regardless of whatever bank or wallet provider they hold money with, may now trade easily.

Limitless Payment

As a merchant, you have no restriction on the amount of money you can receive each month through BharatQR. Also, with Immediate Payment Services, funds are deposited to your account immediately after settlement (IMPS). Cashless payment is quick and easy since there is no intermediate digital interface between your account and the customer’s account, such as PayUMoney or PayBiz.

Extremely Safe and Secure Payments

There is no chance of a customer’s credit card information being leaked to a third party. You need not require to hand over any debit or credit card physically to make payments. Therefore, there is no risk of data theft. You do not need to enter or give your cell phone number or account information to make a payment.

Where Can Bharat QR Be Used?

It is software for Android/ iOS that creates dynamic QR codes printed on power, gas, and other utility bills to pay the correct vendors. Merchants and dealers may now take QR code payments and send money directly into their bank accounts.

How To Get Started With Bharat QR?

Let us follow a simple flow chart to understand the easiest procedure to get started with Bharat QR.

Customers and retailers alike benefit from Bharat QR since it makes transactions easier and more convenient. When clients transact with any business, it removes the need to utilize several QR codes from different payment networks. Similarly, to accept payments with Bharat QR, retailers just need to register with the bank and show a single QR code at the payment counter.

Conclusion

Bharat QR Code is undeniably one of the most significant achievements of the Indian government toward a cashless economy. However, with knowledge about Bharat QR UPI, one also needs a safe payment gateway for carrying out the transactions. PayU India is one such platform that allows Indian businesses to accept online payments from their customers.

PayU provides the customers with 100+ payment options, including the widely preferred Bharat QR code. Despite being new, they ensure safe and speedy transactions to more than 4.5 lakh business owners. So, if you want to focus on your business without worrying about your payments, visit the PayU India website today!