MSMEs are the growth accelerators of the Indian economy and considered as an engine of economic growth and for promoting equitable development”. Here are the detailed guidelines for registration as MSME

Micro, small, and medium enterprises (MSMEs) may not have massive turnovers, but they drive the Indian economy by the sheer strength of their numbers. MSMEs are classified in terms of their investments and annual turnovers (refer to the table below). The government of India has made MSME registration mandatory to bring more businesses into the formal sector.

| Investment | Annual turnover | Classification |

| < Rs. 1 crore | Up to Rs. 5 crores | Micro enterprises |

| < Rs. 10 crores | Up to Rs. 50 crores | Small enterprises |

| < Rs. 20 crores | Up to Rs. 100 crores | Medium enterprises |

Benefits of MSME registration

Registering your business can fetch numerous benefits. Some of these are:

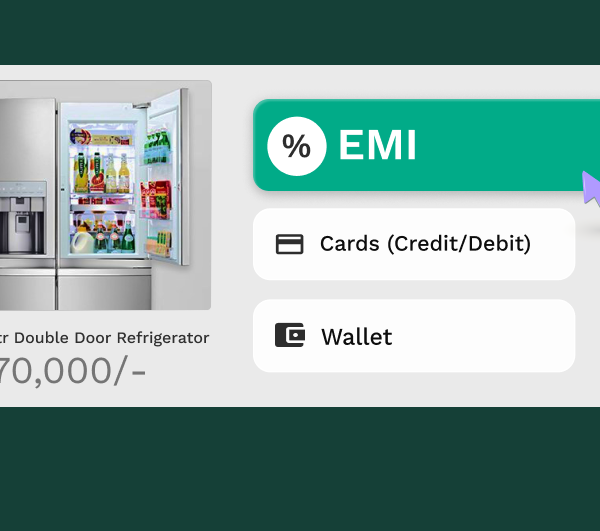

- Get bank loans at the lowest interest rates (around 1-1.5% lower) with ease

- Avail of tax benefits by taking credit for MAT (minimum alternate tax) for up to 15 years

- Concessions & rebates on setting up an industry or getting patents

- Reimburse ISO Certification fees

- Registered MSMEs get preference for government tenders

- State governments support MSMEs

- Leverage government schemes like Credit Linked Capital Subsidy Schemes, Credit Guarantee Schemes, etc.

- Get priority sector loans from banks

- Avail of bar code registration subsidy

- Concession on MSME electricity bill

- Special consideration for International Trade fairs

How to register your MSME online

• MSME online registration process for new businesses or those with EM-II

You can register your MSME on the Udyog Aadhaar Memorandum (UAM) portal. Here’s how to apply for MSME Udyam registration online:

- Visit the MSME Udyam registration web portal.

- For new or unregistered businesses, click on the first link – “For new entrepreneurs who are not registered yet as MSME or those with EM-II”.

- Submit your Aadhaar Number and name.

- Then tick the consent button and click on the ‘Validate & Generate OTP’ button.

- On the next page, submit details of your PAN and organization type. If you don’t have PAN, select the ‘No’ option.

- Fill in the rest of the fields on the form.

- Enter the OTP received on your phone number and verification code to submit the form.

- On successful registration, a “Thank You” message will appear with your registration number.

It may take 2-3 days to get approval for your MSME’s registration. On approval, you will receive a registration certificate via email.

• MSME online registration process for businesses with UAM

- Visit the govt portal (UAM portal).

- For UAM-registered businesses, click on the respective link to access the migration form.

- On the next page, enter your Udyog Aadhaar number, select an OTP option and click on the ‘Validate & Generate OTP’ button.

- Enter the OTP received on your registered mobile number or email ID.

- Fill in the MSME Udyam registration form and submit it.

It may take 2-3 days to get approval for your MSME’s registration migration. On approval, you will receive a registration certificate via email.

MSME registration fees and documents

The MSME registration process does not require extensive documentation. All you need is your Aadhaar number. Details related to your PAN- and GST- linked investments and turnover will be automatically sourced from government databases. You also do not need to pay any fees to get your MSME registered through the Udyam portal.

How to download the MSME registration certificate

Once your MSME is successfully registered, you will receive a permanent registration number and an e-certificate. The MSME registration certificate requires no renewals as it has lifetime validity unless you get it canceled. It features a dynamic QR code linked to the Udyam portal, where you can access details regarding your enterprise.

Check your inbox and spam folder to see if you have received the certificate. But if at any point you need to download the certificate, follow these steps:

- Go to the Udyam Registration portal.

- Go to the “Print/Verify” drop-down button on the top menu bar.

- Click on “Print Udyam Certificate”. This will take you to a login page if you aren’t already logged in.

- Here, enter your Udyam registration and registered mobile numbers.

- Choose the preferred option in the third field and press “Validate & Generate OTP”.

- Enter the OPT you received in the next field and press “Validate OTP and Login”.

- You will see your Udyam Certificate on the next page. Download or print it from here.

Register your MSME to accelerate its growth

MSMEs contribute enormously to our country’s socioeconomic development. This sector plays an important role in generating a huge number of employment opportunities at low costs. It also helps reduce regional economic imbalances by industrializing and generating more income from rural areas. Register your MSME to enjoy the many benefits that can help you take your business to new heights.