Did you know India’s NBFCs are set to grow at 21% annually with earnings jumping 25% each year. But what’s even more remarkable is digital payment growth. 10 years ago, only 1 million merchants accepted digital payments. Today? That number has grown 20-25 times.

But scaling wasn’t easy for Bajaj Finserv when they decided to enter payments. Most NBFCs avoided payments entirely. Customers feared digital fraud. Merchants only accepted cash.

There was no clear way to connect lending with payments. Until Bajaj Finserv came along and decided to bridge this gap. Here’s how they did it.

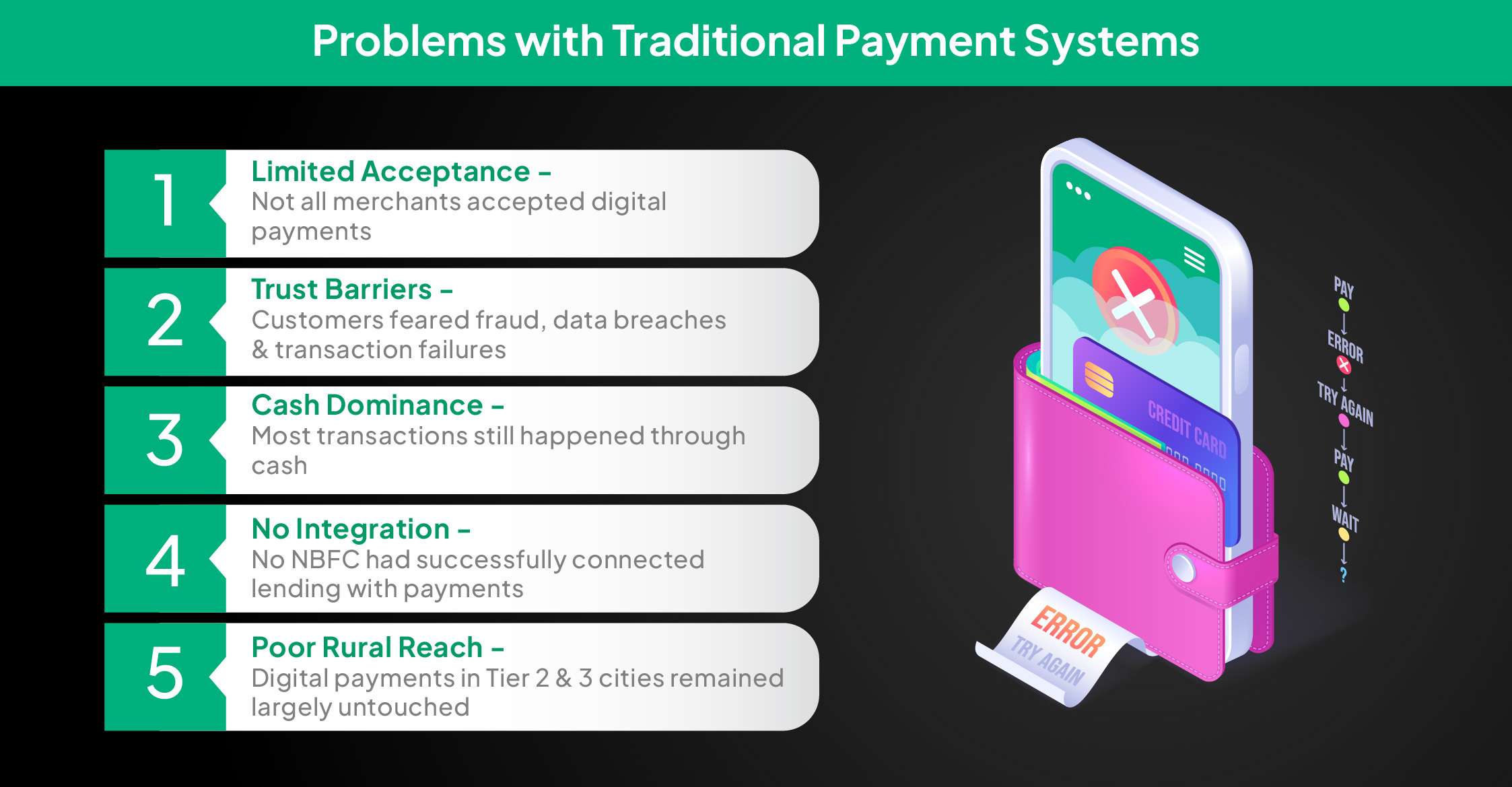

The Broken Reality of Digital Payments

For years, India’s payment landscape was scattered, making it hard for both businesses and customers. This broken system had everyone stuck in old patterns:

Both customers and businesses had no choice but to accept this fragmentation. So, how did Bajaj Finserv solve this?

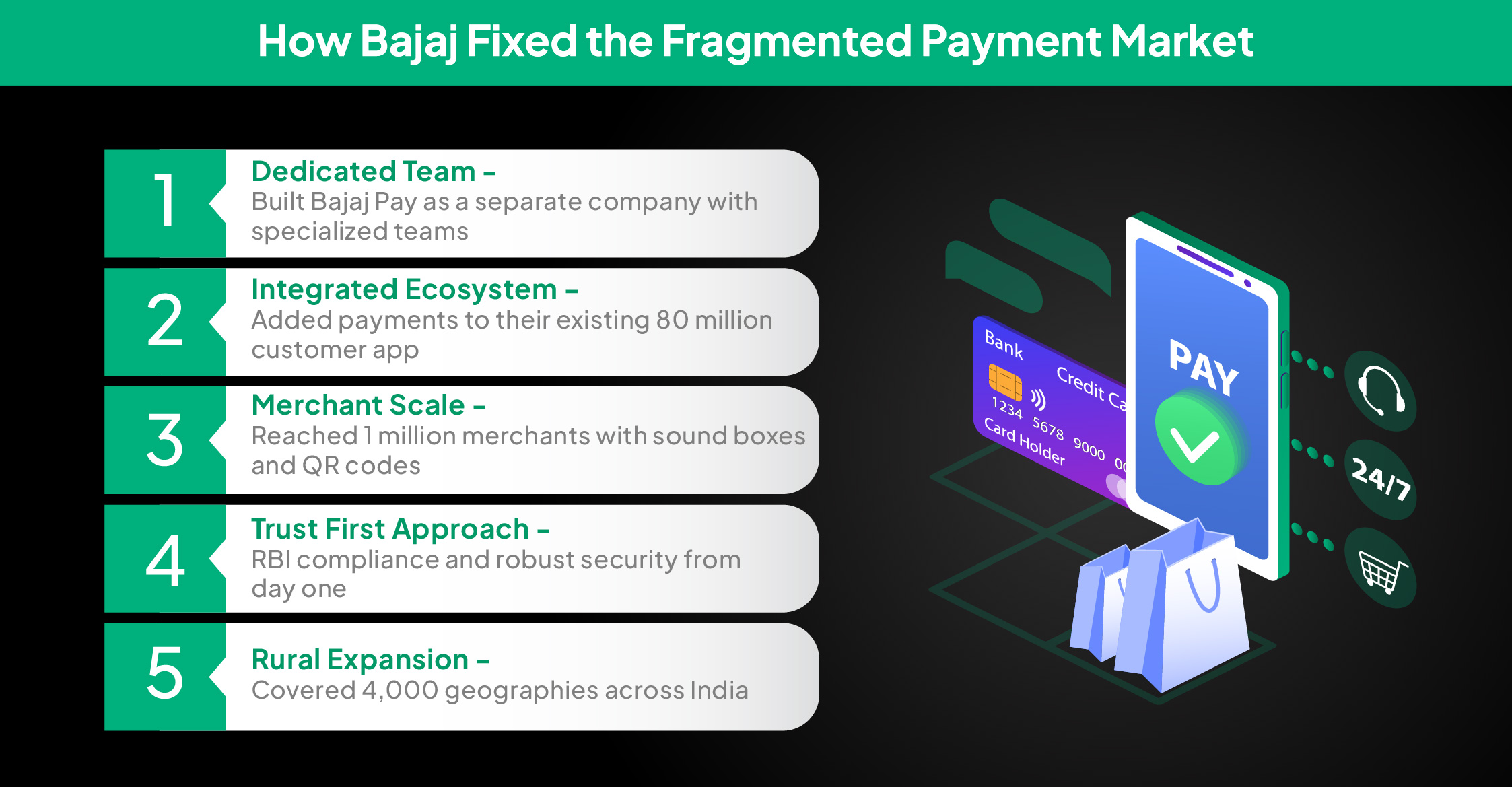

How Bajaj Finserv Bridged the Gap

While others saw payments as too complex, Bajaj Finserv saw a massive opportunity. They realized customers wanted integrated financial services, not separate products.

Bajaj’s solution was revolutionary. They connected customers wanting seamless financial services with merchants needing reliable payment acceptance:

The result? They now serve 40 million payment customers and process 9 crore transactions monthly. They completely changed how NBFCs think about payments. But how did they actually make this happen?

The Bajaj Finserv Scaling Playbook

Bajaj’s journey offers a masterclass in building integrated financial platforms that applies to any business wanting to scale in tough markets:

Be Different – Competing directly with market leaders is extremely difficult. Find your unique advantage and build around it.

Connect Your Businesses – Don’t treat payments as separate. Make it accelerate your core products and drive customer engagement.

Stay Profit-Focused – Never lose sight of profitability, even when scaling rapidly. Build sustainable unit economics from the start.

Embrace Physical + Digital – Work with customer behavior, not against it. Blend human touch with digital convenience.

Build Compliance First – Strong compliance enables innovation at scale while building customer trust and regulatory confidence.

Learn from Your Market – Customers will master technology faster than you expect if it solves their real problems.

Today, Bajaj Finserv has payments contributing to 30-32% of their monthly active users, proving that integrated financial services work. But organizing markets isn’t enough. You need reliable infrastructure to power that growth.

The Infrastructure That Powers Bajaj Pay

When processing 9 crore transactions monthly across diverse geographies, payment reliability becomes critical for maintaining customer trust. At PayU, we power businesses like Bajaj Finserv accelerate disbursals, automate repayments, and improve collection efficiency with:

Collections Stack:

• eNACH – Automate recurring EMI mandates seamlessly

• UPI AutoPay – Enable quick, mobile-first loan repayments

• Pay by Link – Collect EMIs through WhatsApp, SMS, or email

• Dynamic QR – Accept repayments in person or during field collections

Verification & Onboarding:

• Penny Drop – Verify borrower bank accounts instantly

• TPV (Third Party Validation) – Real-time account authentication and compliance checks

Reconciliation & Analytics:

• ReconX – Simplify loan-level reconciliation with automated dashboards

“PayU brings expertise as a payment processor, bill payment capabilities, and registered payment aggregator status. We bring expertise to reach consumers, deliver front-end technology, and distribute.” – Nitish Astana, President of Payments, Bajaj Finserv

When customers trust your payment experience completely, they use more of your financial products and become advocates for your brand.

Make Payments Your Growth Engine with PayU

Bajaj’s story shows that when you’re scaling tough markets, payments can’t be an afterthought. They need to be the bridge that connects all your business lines.

Strategic payment partnerships help businesses scale faster. Customers trust more, operations become efficient, and new revenue streams emerge to create long-term growth.

PayU makes sure every payment flows seamlessly so you can focus on growing your business.

Ready to scale faster?

Partner with PayU to Make Every Transaction Seamless & Drive Growth.