POS Machine Charges & Fees Explained

As the Digital India movement gains prominence in India, many Indians are adopting digital payment methods to make their daily purchases. As a result, the businesses are adapting to cater to their customers’ requirements. Today, most retail businesses in India have a POS (point of sale) machine in their establishments to facilitate smooth transactions and provide a better customer experience.

As a business owner, you may already have a POS system in your retail store. But do you know about the POS machine charges?In this guide, we explore the various types of charges associated with a POS machine, enabling you to make informed business decisions.

POS machine charges

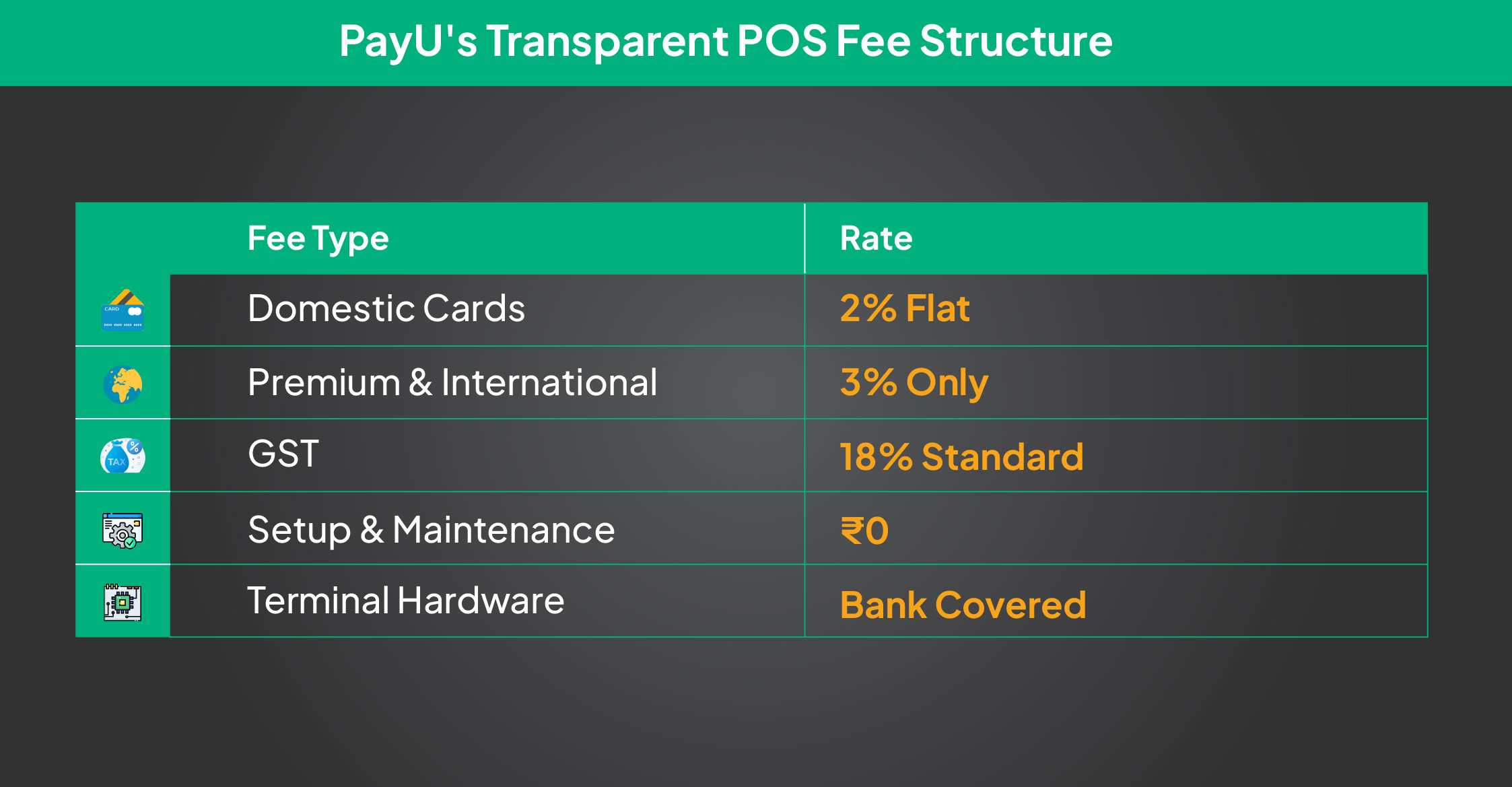

The POS chargesvary among different service providers. PayU takes immense pride in being transparent with their operations and charges, as well as offering a POS machine at a competitive price. There are no hidden fees involved. As a business owner purchasing the POS machine and availing of the services, you can know exactly what you are paying for.

To help you make informed and better business decisions, here is a breakdown of the important PayU POS or card swipe machine charges.

- Transaction fees

PayU POS machines charge a flat 2% transaction fee for all payment modes, including UPI (Unified Payments Interface) digital wallets, credit/debit cards, net banking, and more. This applies only to domestic transactions and VISA and Mastercard cards.

For Diners, American Express, EMI (equated monthly instalments), and international transactions, PayU POS charges a 3% transaction fee.

- GST (Goods and Services Tax)

An 18% GST is applied on all POS transactions, in addition to the 2% transaction fee.

- No setup or maintenance charges

PayU does not charge any fees for setting up the POS system or for annual maintenance of their payment gateway.

- POS terminal cost

The cost of a POS machine is typically borne by the bank, not the merchant or business owner.

Factors that affect POS machine transaction charges

Understanding the various factors that influence POS swipe machine charges can help you make informed business decisions and potentially lower operational costs.

- Type of POS machine

Today, various types of POS machines are available on the market, each with distinct functionalities and features. There are basic POS terminals that have limited functions, and they typically come with a lower transaction fee.

However, other types of POS machines offer advanced features and come with a wide range of functionalities, such as inventory management and customer loyalty programs. And these machines have slightly higher transaction fees.

- Payment processor

The POS transaction fees also vary greatly based on the payment processors with which the POS service provider has partnered. The processors handle the actual transaction authorisation and settlement. These processors generally have different fee structures. As a business owner, you must conduct thorough research on the POS provider you choose and their partner processor to understand their fees and make an informed decision accordingly.

- Transaction volume

The transaction volume and POS machine charges are inversely proportional. This means that businesses that process a higher number of transactions are more valuable to POS providers, and therefore they may offer a lower transaction fee to such businesses.

However, as a business owner, it is advisable to negotiate the transaction fee with the POS service provider and agree on a mutually acceptable fee.

- Contract duration

If you enter into a contract with the POS service provide for a longer period, they can be assured for a good revenue for a longer duration, which may incentive them to offer lower transaction fee as compared to a month-on-month option However, you must assess the pros and cons as well as the potential cost saving against the flexibility of a shorter contract term.

- Transaction type

Another important factor that affects POS machine charges is the type of transactions being processed. Generally, debit card transactions have lower transaction fees than credit card transactions. This is due to the varying levels of risk associated with each payment mode. As a business owner, encouraging your customers to make payments through a card swipe machine can help you reduce your overall card swipe machine charges.

- Card network

Different networks power different credit and debit cards. For example, VISA and MasterCard are the most popular card networks in India, and most banks in India offer VISA or MasterCard-powered credit or debit cards. However, there are other card networks, such as American Express, and transactions with these card networks may incur a slightly higher transaction fee.

Read more – How To Track POS Transactions?

Conclusion

POS machines help business owners stay up-to-date with the latest payment technologies and changing customer preferences for making payments on their purchases. POS machines and service providers, such as PayU, help businesses attract more customers by introducing new payment acceptance modes and offering a better customer experience. Besides, as a business owner, you can use the POS machine to track all transactions, maintain accurate financial records, analyse business trends, and make necessary business decisions accordingly.