In light of the recent tokenisation guidelines, PayU introduced a solution, PayU Token Hub. This solution will help businesses retain a native payment experience while being a future ready solution for them.

Is your business compliant with the latest tokenization guidelines? If not, become compliant with the guidelines now before it’s too late. Find out everything about the recent guidelines, their impact, and how PayU will help you become compliant with the latest norms here.

What is Tokenization?

The word tokenization means exchanging sensitive data for non-sensitive data in the form of “tokens. The latest tokenization guidelines are based on similar lines.

What are the Latest Tokenisation Guidelines?

Sensitive data is exchanged for non-sensitive data in form of “tokens” which is called tokenization. The latest tokenization guidelines are based on similar lines.

Businesses and payment aggregators are not allowed to store card details of customers (16- digit card number, CVV, etc.) as per the latest guidelines with effect from 1st Oct 2022. Only payment networks (Visa, Mastercard, etc.) and issuers (banks) can store those details. This data is supposed to be shared with business and payment aggregators in a tokenized format.

Businesses Impacted by Latest Guidelines

Every business selling online is affected due to these regulations. We know that repeat transactions are an important pillar for all businesses. As this guideline impacts customer experience, it affects the repeat transactions too.

How is PayU Token Hub the Right Solution for Your Business?

PayU released PayU Token Hub to help you adopt the new guidelines. This solution will ensure compliance with the latest guidelines and visibility for your business. Let’s find out more about PayU Token Hub!

PayU Token Hub is a solution tailor-made for businesses like yours. It has the highest coverage as you can integrate all payment networks and issuers directly. You can manage tokens and your customer’s consent from a single dashboard.

Benefits of PayU Token Hub

PayU Token Hub is the first universally compliant tokenization solution with network & issuer tokens available. This will give you an edge over your competitors. Let’s take a look at its benefits in detail below.

Highest Coverage across payment networks and issuing banks

PayU Token Hub is built by PayU and Wibmo, in partnership with all majority card networks including Visa, Mastercard, Rupay as well as all leading issuing banks. In a recent report by Inc42, it is found that Visa is the biggest market holder in India with a 44% share, followed by Mastercard’s 36% and RuPay and another card’s 20% share. Hence, using PayU Token Hub becomes highly beneficial for your business helping you retain your existing customer base while expanding it. PayU Token Hub will soon be able to offer tokenization for AmEx, Diners, and HDFC card networks too.

Universally compliant

It supports the issuance of both issuer and network tokens under a single hub. Thus, you can choose to issue either a network or an issuer-based token with PayU Token Hub. This enables your business to retain the native payment experience obtained via direct integration with banks, resulting in higher success rates.

Certification & Readiness

PayU is fully certified by Mastercard and Visa as a token requestor and token provider. As a token requestor, PayU now has the ability to request tokens on behalf of businesses. As a token service provider, PayU will be able to issue, manage, and operate payment tokens. This enhances PayU’s capability to ensure an end-to-end frictionless payment journey for the ecosystem.

Ease of integration

PayU Token Hub is a tokenization solution that can be used for websites or apps. You can opt for our zero-code change approach & get started in a day. API customization can also be done to suit your business needs.

Seamless customer experience

With saved payment details and personalized real-time recommendations on the best-performing payment mode, you can continue offering a seamless customer payment experience.

Future-ready solution

PayU Token Hub is one solution for all payment modes. It supports tokenization for all payment modes. You need not deal with different tokenization solutions for every payment mode you use for your business. This future-ready solution will have you covered.

Let’s see the difference in the way your business makes transactions with and without PayU Token Hub.

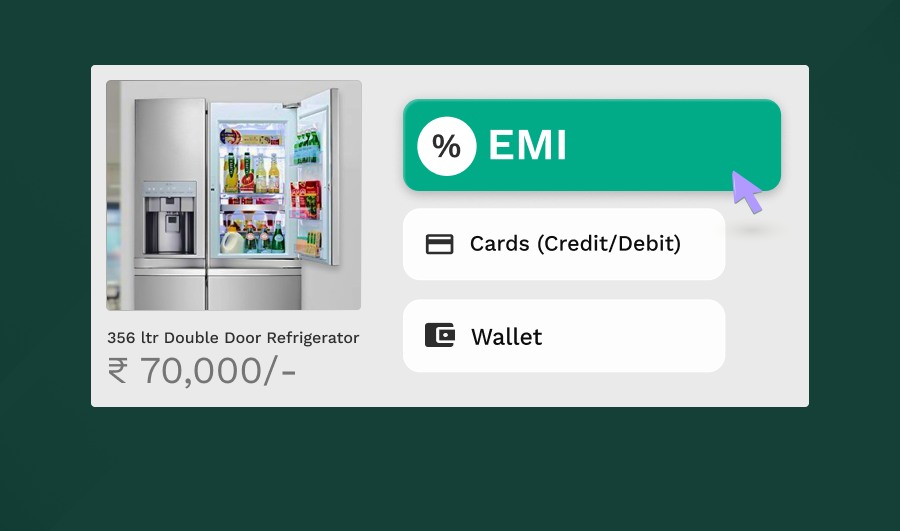

Step 1: The payment checkout screen

Customers need not enter their payment details as they are already saved. They also get recommendations on the payment mode working best in real-time using PayU Token Hub.

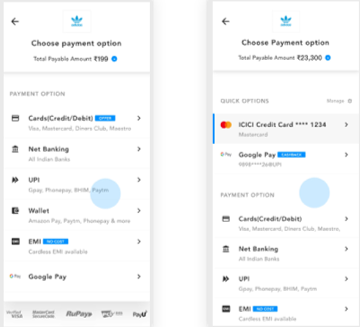

Step 2: Difference in entering details

Your customer has to make the effort of adding payment details if you do not use PayU Token Hub. If you use PayU Token Hub, your customer sees a few saved payment modes, all they have to do is authenticate.

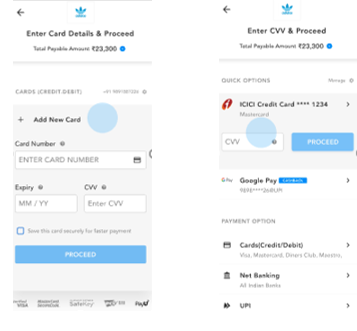

Step 3: Possibility of errors due to a customer inputting incorrect card payment detail

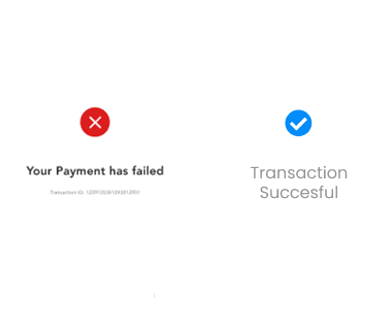

Using PayU Token Hub will increase success rates of transactions along with an improved customer experience.

Know more about becoming compliant with the latest tokenization guidelines from our product team here:

Final Thoughts

These new norms may influence your business in the short term, but they’ll increase consumer control and data safety in the long run. These guidelines will pave the road for an improved and secure payment ecosystem.

Frequently Asked Questions

All businesses have to migrate to a compliant solution by 30th Sep 2022, and not store this data from 1st Oct 2022 onwards. Only data obtained after Additional Factor Authentication (AFA) can be kept with a compliant partner from 1st Oct 2022 onwards.

Yes, PayU Token Hub is a decoupled solution from the PayU Payment Gateway. So, any businesses currently using other Payment Gateway can use PayU Token Hub.

Yes, a business would have to delete card details if a customer doesn’t give consent by 30th Sep 2022.

Both payment networks and issuing banks are permitted to tokenize cards going forward. For example, if a customer has an HDFC Visa credit card, either Visa or HDFC can the card- both are permitted to do so. However, Visa cannot tokenize a MasterCard and HDFC cannot tokenize cards issued by other banks.