Did you know NBFCs lose over ₹5000 crore annually to failed payment mandates and bounce-related delays? Lending is growing but collections? Not so much.

According to BCG reports, bounce rates are hitting 26-38%. Every missed EMI leads to manual recovery efforts, increased costs, and delayed cash flow.

Traditional repayment methods are outdated and blocking your growth. Manual follow-ups are no longer viable. NBFCs must switch to automated collections to grow.

Here’s how PayU helps NBFCs like yours transform reactive recovery to proactive, predictable cash flow with PayU’s collection stack.

From Chasing Payments to Predictable Cash Flow

Meet Rahul. He runs a growing NBFC, operating across 5 states with 8,000 active loans. Six months ago, he was struggling with missed EMIs, endless manual follow-ups, rising recovery costs and unpredictable cash flow.

Today? His money comes in automatically, and the heavy lifting is gone.

Here’s how Rahul tackled key bottlenecks and how you can too:

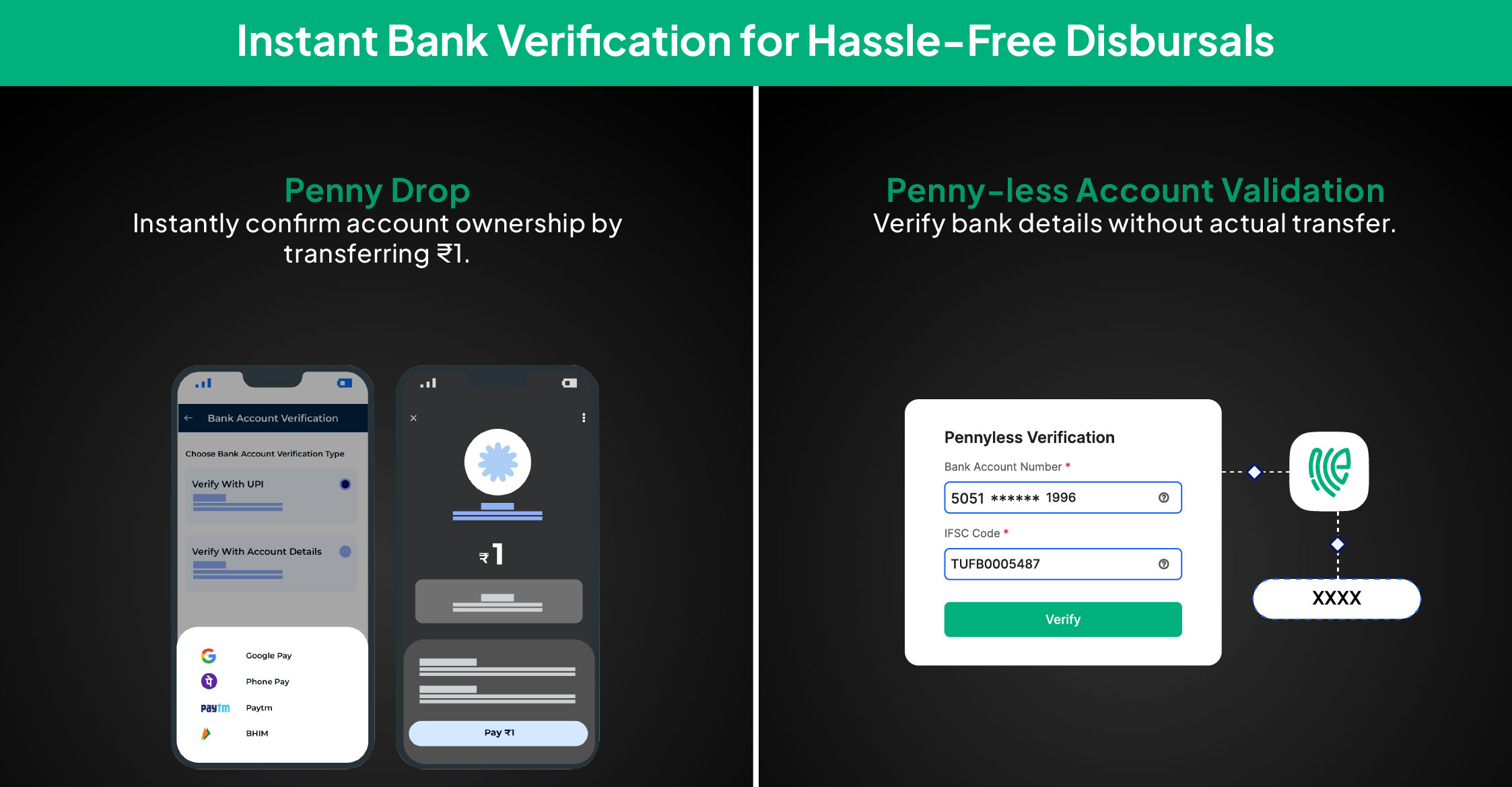

Step 1: Validate before disbursing

Rahul struggled with a high bounce rate because customers submitted incorrect bank account details. So, Rahul used the following PayU tools:

With these tools, Rahul validated customer accounts and avoided bounces right from the start. No more follow-up delays and costs.

But validation alone wasn’t enough. Rahul still faced the challenge of collecting repayments from valid accounts.

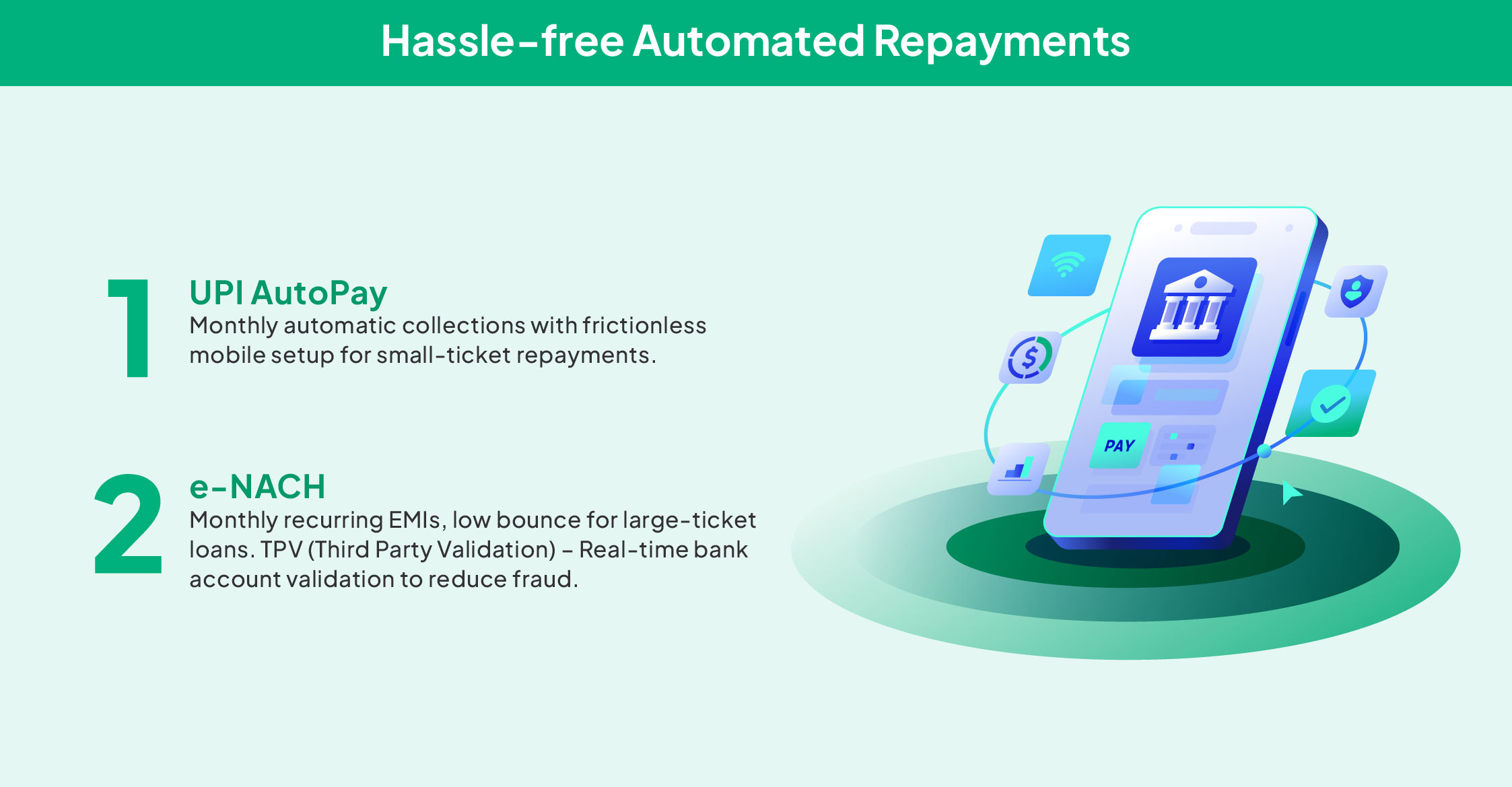

Step 2: Automate Repayments at Scale

Customers wanted to pay but forgot to pay on time. Manual reminders wasted a lot of Rahul’s team’s time and increased costs and delays. With PayU’s Automation Tools, EMI collections became frictionless and automatic:

Rahul’s team makes 80% fewer calls saving costs and effort. EMIs now get collected automatically. This lets him focus on growing his business instead of chasing repayments.

However, even automated systems aren’t perfect. Occasional failures can still happen.

Step 3: Streamline Repayments and Improve Collection Success

Customers wanted to pay but still some repayments failed due to low balance or technical issues. Here’s how Rahul made it easier with PayU’s tools:

Rahul made repayments easy and convenient with just a tap, keeping customers happy and cash flow regular. It’s a win-win!

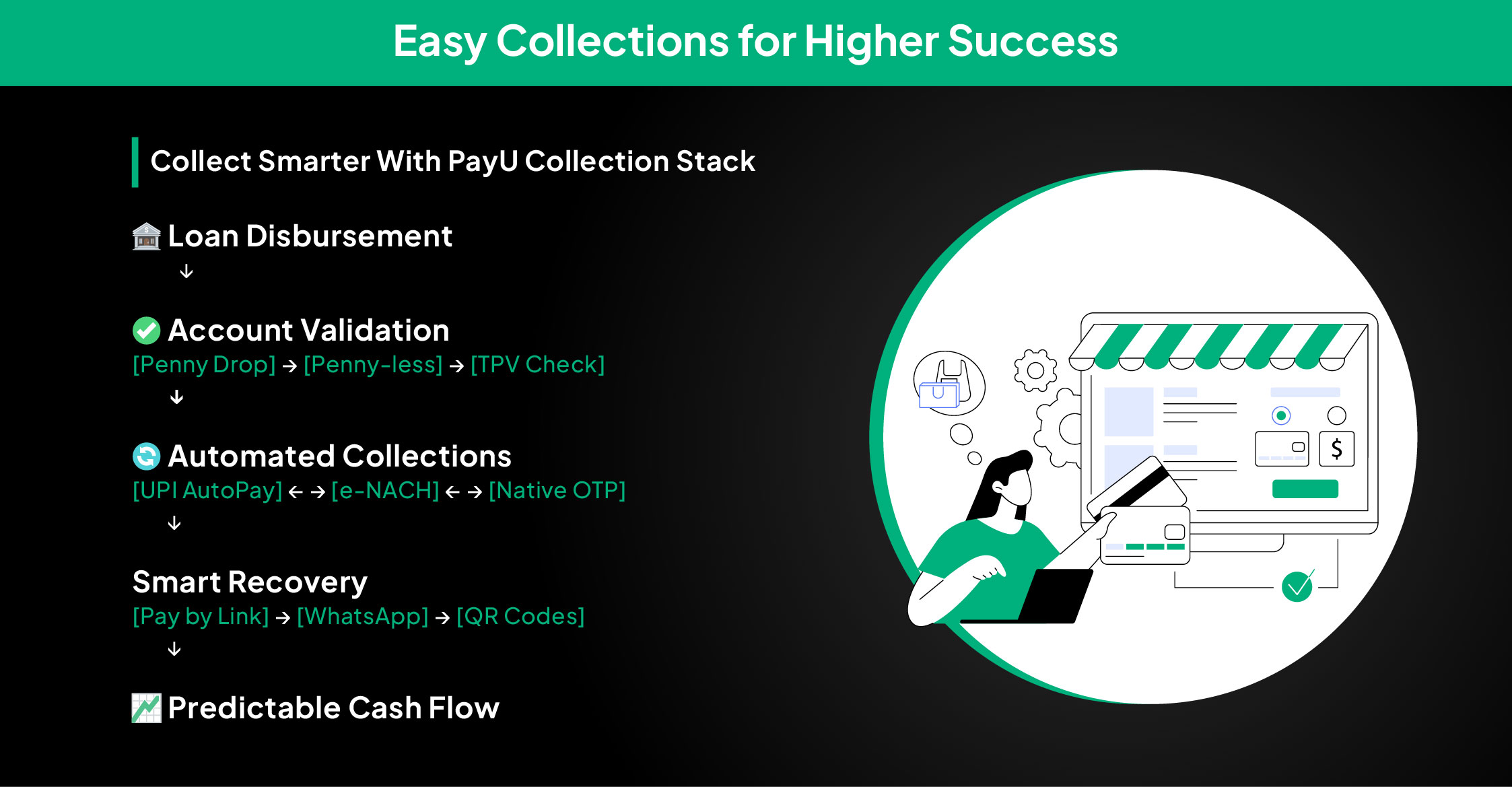

The Complete Collections Flow

Here’s how all three steps work together to create a seamless collections system:

With PayU Collection Stack, enjoy:

• 50% fewer bounces

• 40% better repayments

• 35% lower operational costs

That’s more time for growth and less time worrying about collections.

Ready to Transform Your Collections?

Stop chasing payments—start collecting automatically.

- Simplify your recovery process

- Cut bounce rates

- Boost cash flow

Your customers expect quick, convenient and digital payment experience. With PayU, you make collections on autopilot, your entire business transforms.

Don’t let unpredictable collections hold back your growth. Let us handle collections while you focus on scaling your business.