Today, credit cards are indispensable in our lives. Credit card uses range from the ease of buying anything offline or online to airport lounge access to improving your credit score. Credit cards are a multi-purpose financial asset that makes your life much easier. They also carry multiple rewards and incentives. But with effortless economic power at your disposal also comes great responsibility not to misuse your credit cards. You may be a reckless borrower who overspends on his credit card, does not make payments on time, or has too many credit cards, all of which might ultimately cost you.

Should I Get a Credit Card? How Many Credit Cards Should I Have?

Getting a credit card or not is determined by your financial needs. The answer to the second question depends on your level of finances, expenditure, your knowledge of the terms and conditions, and the many offers by credit card companies available to you. Credit cards have reward points associated with them; some of you may want to maximise the reward points available or use different credit cards for other purposes due to more advantageous terms. According to a survey by Experian, millennials have 2-3 cards, and baby boomers have 3-5 cards. You also have the option not to use a credit card at all. The following factor determines how many credit cards you can have. Along with the owing of the credit card comes the responsibility of tracking and making timely payments for your credit card expenses. Decide responsibly when you decide how many credit cards I can have.

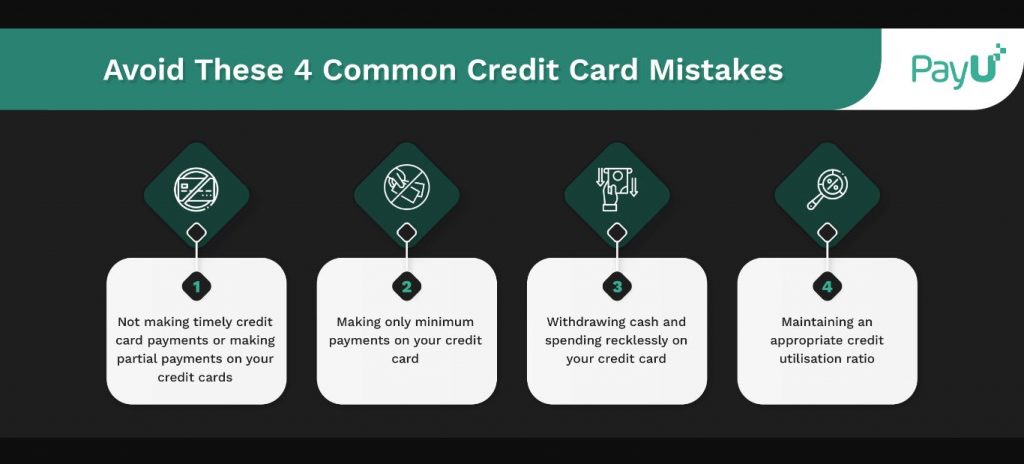

The Most Common Credit Card Mistakes

- Not making timely credit card payments or making partial payments on your credit cards: Credit cards indicate minimum amounts to be made on your card; they offer EMI options for purchases. These delayed payments add the burden of additional interest payments, which means you will enter into a debt trap. Interest payments are also high, ranging from 2% to 3.5% per month, which is levied daily. Interest is also charged on the outstanding amount of the debt for the number of unpaid days. Partial payments only offset this significant amount to the extent of such partial payments. Late payment charges are also levied.

- Making only minimum payments on your credit card: Making minimum payments only means unnecessarily prolonging the amount of your debt. You are postponing the cost to the next payment cycle. All the above problems of increasing outstanding balances and levying penal interest charges apply. If you spend more on a credit card, all these new payments will also attract interest.

- Withdrawing cash and spending recklessly on your credit card: Some measure of caution and prudence has to be exercised on your credit card spending. Withdrawing large amounts of cash because your credit card policy allows you to do the same is a reckless policy. All cash advances attract a hefty transaction fee. For example, the cash advance fee on the HDFC credit card is a big 2.5% of the transaction amount. If repayments are not made in time, an additional penal interest levy will compound your debt.

- Maintaining an appropriate credit utilisation ratio: Experts recommend keeping this ratio at 30% or below. At any point, at least keep 20% of your entire credit limit free. This method is optimal use of the credit card. This helps preserve your credit rating, and you can have the necessary limit available during emergencies. Lower spending will also facilitate easy repayments.

How Long Does it Take to Get a Credit Card?

You can immediately get approved for a credit card if you satisfy the lender’s credit policies. However you apply, whether in person, on the phone, or by mail, the credit card company must approve or reject your application within thirty days of receiving your application. Factors like credit score, credit history, income levels, and credit report will be assessed before making a decision.

Key Takeaways

You should carefully assess the above factors and decide if I should get a credit card. Avoid multiple credit cards from different providers as spending on them may unnecessarily increase your debt burden and tracking and monitoring repayments also become problematic. Analyse all your credit card payments and avoid unnecessary EMIs or partial refunds, as this will benefit you in the long run. Use your credit card responsibly. Make your payments on time and avoid assuming excess debt.

FAQs

Some typical card mistakes people make are:

a) Missing payments

b) Making only partial payments

c) Neglecting to review your billing statement

The top two mistakes affecting your credit rating are missing payments and paying late.

a) Incurring heavy debt and high-interest charges

b) Using too much of your credit card limit

c) Applying for too many credit cards at once.

a) Character

b) Capacity

c) Capital

d) Collateral

e) Conditions

If you want help accessing proper technology, obtaining an on-demand settlement of customer payments, and making refunds for your eCommerce store, visit PayU.