Current account is a deposit account created request of the applicant and made often or instantaneously accessible. An individual who routinely engages in an incredibly high rate of banking activities should maintain a current account, which are connected to liquid deposits, provide a variety of personalized solutions to assist with financial activities.

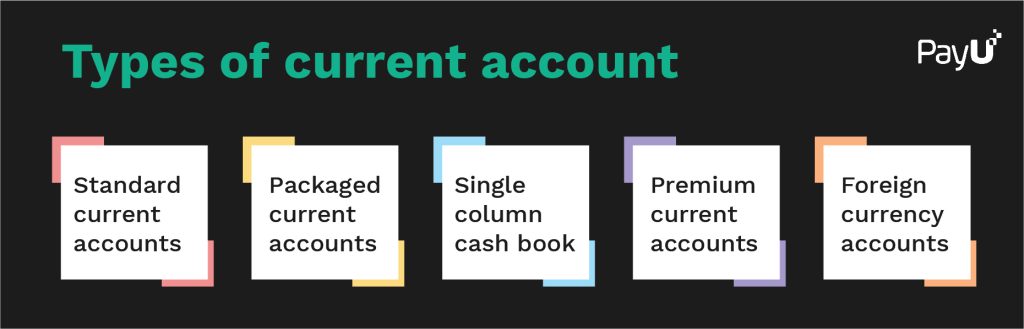

Types of current account

While opening a current account, you should be thoroughly familiar with your needs. The types of current account include:

Standard current accounts

This is a non-interest account with minimum balance needs and a predefined monthly average balance. Other benefits could include free RTGS and NEFT transactions, SMS banking, internet banking, etc. Chequebooks, debit cards, an overdraft facility, etc., are all provided.

Packaged current accounts

The packaged accounts provide accountholders with a variety of benefits. It also includes other services like roadside help, medical care, and travel insurance.

Single column cash book

As the name suggests, it is a cashbook that keeps track of daily transactions in distinct columns for debit and credit. It is appropriate for businesses that don’t maintain bank accounts. Daily transactions are permitted by these accounts, although they lack features like an overdraft facility.

Premium current accounts

For account holders, premium offers special discounts and perks. The account offers a wide range of personalized options and is typically appropriate for people who conduct significant financial activities.

Foreign currency accounts

A foreign currency account is the best choice for people or businesses who frequently need to conduct transactions in foreign currencies.

What is the difference between a current and savings account?

An essential condition for starting a business is having an active bank account. To meet the varied demands of businesses, banks now provide a multitude of alluring offers and incentives on current accounts. The following are some of the fundamental characteristics of a current bank account contrasted with a savings account:

- Allows countless transactions

- Requires a higher minimum balance

- Eases frequent transactions such as money transfers, cash withdrawals, and check deposits.

- Operated by individuals, private and public companies, trusts, associations, etc.

- Unlimited number of transactions per day

- Penalty fees may apply if the minimum balance is not maintained.

- The same KYC rules apply to savings accounts also apply to current accounts.

- There cannot be multiple current accounts for a single firm.

Documents required for current account

Usually, you may need documents such as:

- PAN card

- Address proof

- Partnership agreements for partnership firms

- ID and address proof of all the partners

- Passport size photo of the applicant

- Cheque from an existing savings account

But again, these documents may vary from bank to bank.

Note: Verify that your KYC documents are still valid on the submission date.

Conclusion

A current account is beneficial when you need quick transactions, unlimited withdrawals, deposits, overdraft facilities, etc. It is a must for business accounts now. Additionally, current accounts allow you to pay debtors using the check feature of the bank. current accounts often don’t pay interest and have greater minimum balance requirements in contrast to savings accounts. Nevertheless, the greatest benefit of a current bank account is the simplicity with which account users can use up to a certain amount of overdraft.

FAQs

Generally, the minimum account balance starts from 10,000 INR, but it may vary.

Usually, current account interest rates are zero for most such accounts. However, some do offer some interest rates.

Top banks like ICICI, HDFC, SBI, Axis Bank, and Bank of Baroda can offer lucrative deals for current accounts.

A current account can be opened both offline or online. You can complete the application process by going to the bank’s official website.

The cash depositing methods include:

Digital transfer

Cheques

Wire transfer

Depositing at the bank branch