Affordability is what sets businesses apart today

In today’s digital commerce landscape, growth isn’t just about reach—it’s about removing friction at the moment of purchase. Across sectors like edtech, healthcare, insurance, electronics, and travel, high upfront costs remain the #1 reason for cart abandonment.

A Bain & Company study (2024) found that:

- 64% of Indian consumers hesitate to transact online due to lack of flexible payment options.

- Nearly 1 in 2 customers said they would have converted if EMIs or BNPL were offered at checkout.

These aren’t just financial decisions—they’re psychological ones. When buyers are shown flexible prices just when they’re hesitating, it flips the decision. The shopper is no longer thinking:

“Can I afford this?”

They’re thinking:

“I can make this work.”

What helps them decide faster is seeing the right payment options at the right moment.

Why Smart, Timely Affordability Beats Flat Discounts

Flat discounts and generic cashback offer are quickly losing relevance. Today’s consumers—especially Gen Z and younger millennials—don’t just want lower prices. They want smarter, more personalized ways to pay.

What often goes wrong:

- Discounts are shown to people who can’t use them

- EMI or BNPL options are visible only at checkout

- Offers aren’t tailored to the customer’s profile or purchase behavior

PayU’s Affordability Suite solves this by making flexibility visible and relevant through:

- Eligibility-based EMIs shown upfront

- Personalized recommendations with Offer Engine

- BNPL via LazyPay, Simpl and Amazon Pay Later ideal for fast checkouts

- Cardless EMI access for new-to-credit users in Tier 2–3 towns

The result? Customers feel more in control, and businesses see better conversions.

A Deeper Look: Why Indian Buyers Hesitate—and What Actually Works

Meet Aarti, a 28-year-old in Mumbai browsing her favorite lifestyle e-commerce app.

She lands on a product page for the latest iPhone—priced at ₹75,000. She loves it, but the price tag gives her pause.

She adds it to her cart, heads to checkout… then hesitates.

“That’s a lot to pay in one go.”

She drops off. And the opportunity is lost.

This is where PayU’s Affordability Suite changes outcomes.

With PayU Affordability Widget placed directly on the product page, Aarti can instantly see flexible payment options—like:

- No Cost EMI for 6 months on her credit card

- Bank-specific offers or SKU-specific deals based on what she’s buying

- BNPL or Cardless EMI options even if she doesn’t use a credit card

Behind the scenes, the Offer Engine matches her profile to the best-fit plans—so she sees only what she’s eligible for.

Instead of hesitating, Aarti now thinks:

“This is doable. I can break it up and buy it now.”

The Impact for Businesses:

When affordability is shown early, clearly, and in a personalized way:

- New users convert faster – even those who wouldn’t normally afford an iPhone or a ₹40K vacation package

- Larger baskets feel easier to commit to – like a parent buying a full-year edtech subscription, a shopper upgrading to a better laptop, or a customer bundling skincare combos in D2C

It’s not just about offering flexibility—it’s about showing the right payment plan, at the right time, to the right user.

EMI Has Evolved: From Credit Cards to Cardless Confidence

Let’s take Rohit, a 27-year-old teacher in Jaipur. He’s ready to invest in a ₹25,000 laptop for a certification course.

He finds the right product on an edtech site and heads to the checkout.

But there’s a problem—he doesn’t own a credit card.

No EMI options are visible upfront. He assumes there’s no flexible way to pay.

So… he drops off. But you can turn it all around with PayU:

- With Cardless EMI, from issuers such as Lazypay. Homecredit, Axio, Simpl Payin3, HDFC CL, Zest, etc , merchants can show EMI options even to users without a credit card.

Rohit sees an option to pay in 3 interest-free monthly installments, right on the product detail page, via Affordability Widget.

- At checkout, the Offer Engine highlights even more personalized plans based on his profile—often including a No Cost EMI on eligible cards or lenders—making the purchase feel flexible, affordable, and easier to commit to.

The Outcome for Businesses:

When cardless EMI and Pay Later options are clearly visible early in the journey:

- Buyers like Rohit convert without needing a credit card

- Drop-offs among first-time or new-to-credit users reduce

- Purchases that seemed out of reach become doable

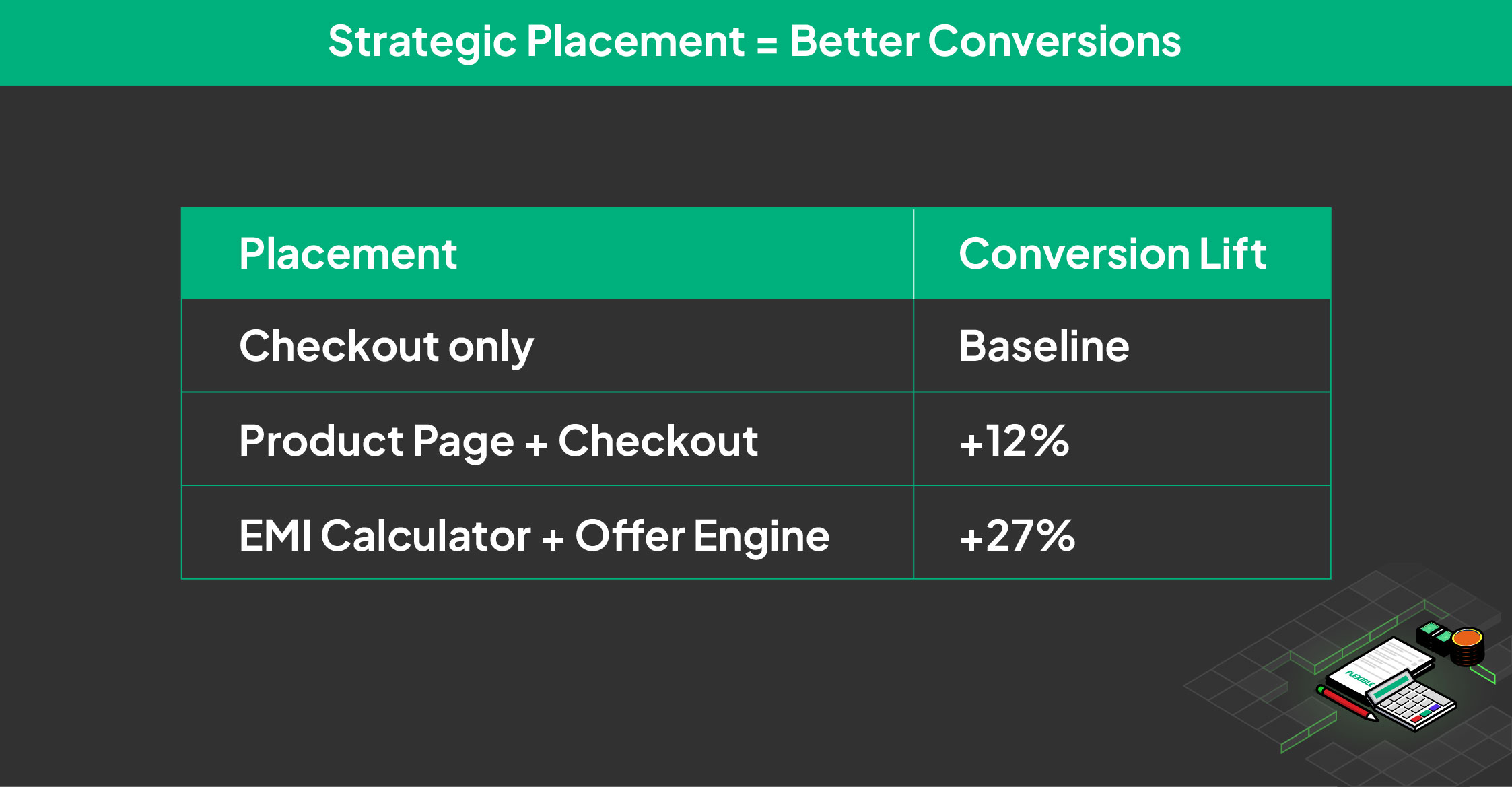

Visibility = Conversions: The Science of Showing Affordability Early or at the Right Time

PayU’s internal A/B tests show that when and where you show affordability options has a direct impact on both conversions and cart drop-offs.

- Showing EMI/BNPL options only at checkout leads to high friction and second-guessing.

- When affordability is visible earlier—on the product page or via a calculator—users feel more confident and in control, and fewer of them abandon their cart.

The result?

✔️ Higher conversions

✔️ 40-45% reduction in drop-offs

✔️ Better buyer experience overall

How Affordability Helps You Grow Across Industries

PayU’s Affordability Suite drives real impact across categories by turning price hesitation into payment flexibility. Here’s how:

1. Travel

Challenge: High-value bookings drop off at checkout

Solution: EMI with down payment options at checkout + agent-assisted journeys for No Cost EMI discovery

What Changed: Flexible plans and real-time assistance → Higher conversions, fewer drop-offs for premium travel bookings

2. EdTech

Challenge: Parents and students hesitate at full upfront fees

Solution: Cardless EMI + No Cost EMI on course pages

What Changed: More enrollments from salaried and new-to-credit users

3. Commerce (D2C, Electronics, Lifestyle)

Challenge: Big-ticket purchases stall without visible affordability

Solution: LazyPay Pay Later + EMI Calculator on PDP

What Changed: Higher average order value, better sales during promotions

4. Insurance

Challenge: Monthly premium renewals delayed or dropped

Solution: LazyPay BNPL + EMI Widget for clear payment visibility

What Changed: More consistent collections and better customer experience

5. Quick Commerce

Challenge: Impulse purchases drop due to payment hesitation

Solution: LazyPay Pay Later for single-click checkout

What Changed: Faster transactions and better conversion during rush hours

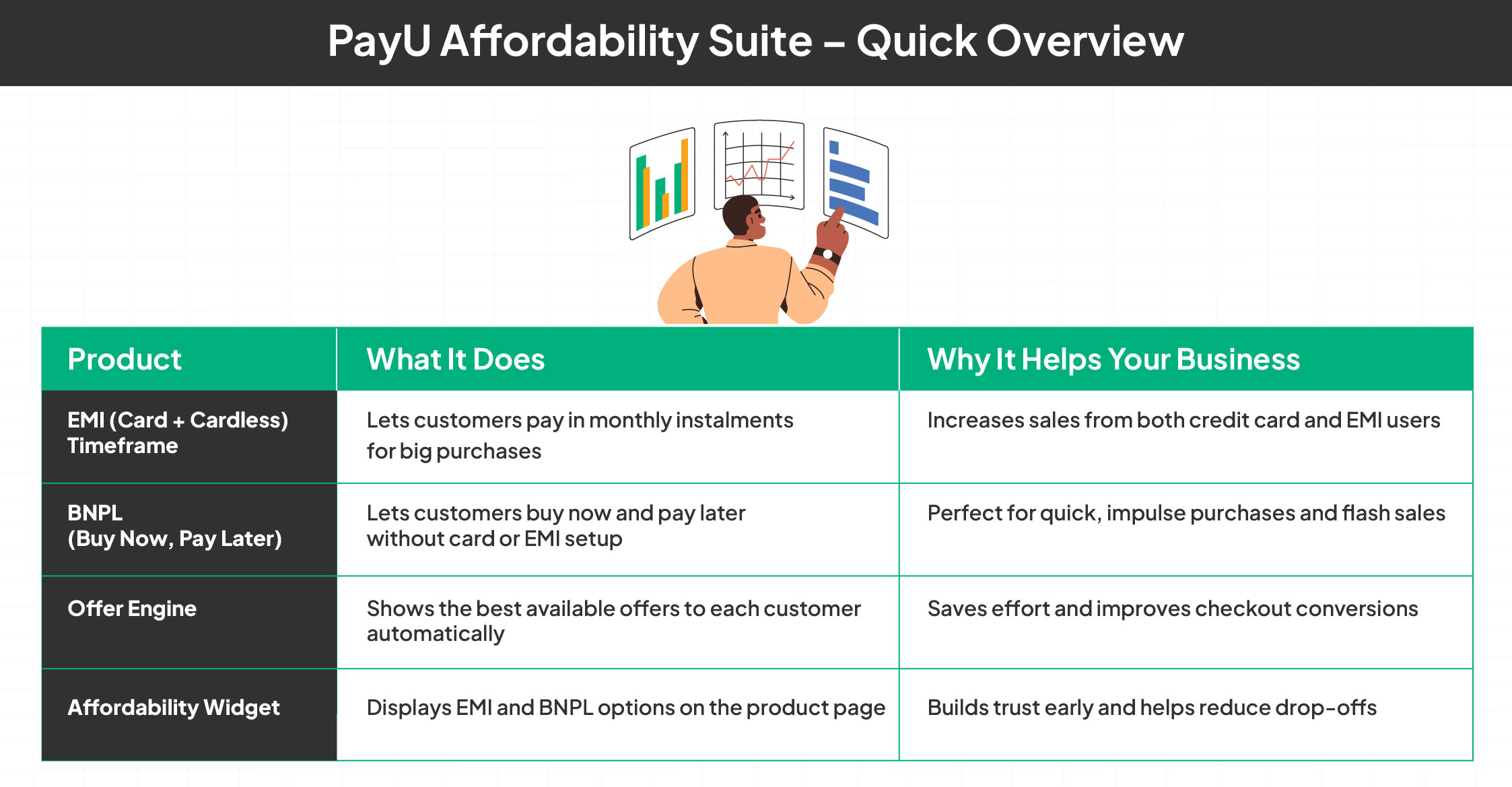

What’s in PayU’s Affordability Suite?

Getting started with PayU’s Affordability Suite is simple.

You get access to powerful tools that help turn price hesitation into more sales.

Here’s what’s included:

In today’s ecommerce world, the biggest blocker isn’t reach—it’s high upfront costs at checkout.

Final Word: Affordability Isn’t a Feature. It’s Your Growth Strategy.

Buyers hesitate when they don’t see payment flexibility early. That’s where PayU’s Affordability Suite steps in.

By combining Affordability Widget, Offer Engine, BNPL, and both card + cardless EMI, merchants can turn drop-offs into conversions—across every industry and buyer type.

Because when customers feel like they’re in control of how they pay, they’re far more likely to say yes.

Ready to reduce drop-offs and grow AOV with smarter payment flexibility? Let’s talk.