Payment methods are essentially the different ways in which you can make payments to merchants or transfer funds for the goods or services you purchase and avail yourself of. Traditionally, cash was the most popular and preferred mode of payment before the advent of credit/debit cards, net banking and other digital payment systems.

The payment methods or payment gateway serve as the bridge between consumers and businesses, facilitating payments and fund transfers between the two parties. Today, as more people prefer digital payment systems, there are various types of payment methods to choose from for making payments. Each of these methods comes with a host of features and security measures tailored to suit the different preferences of individuals.

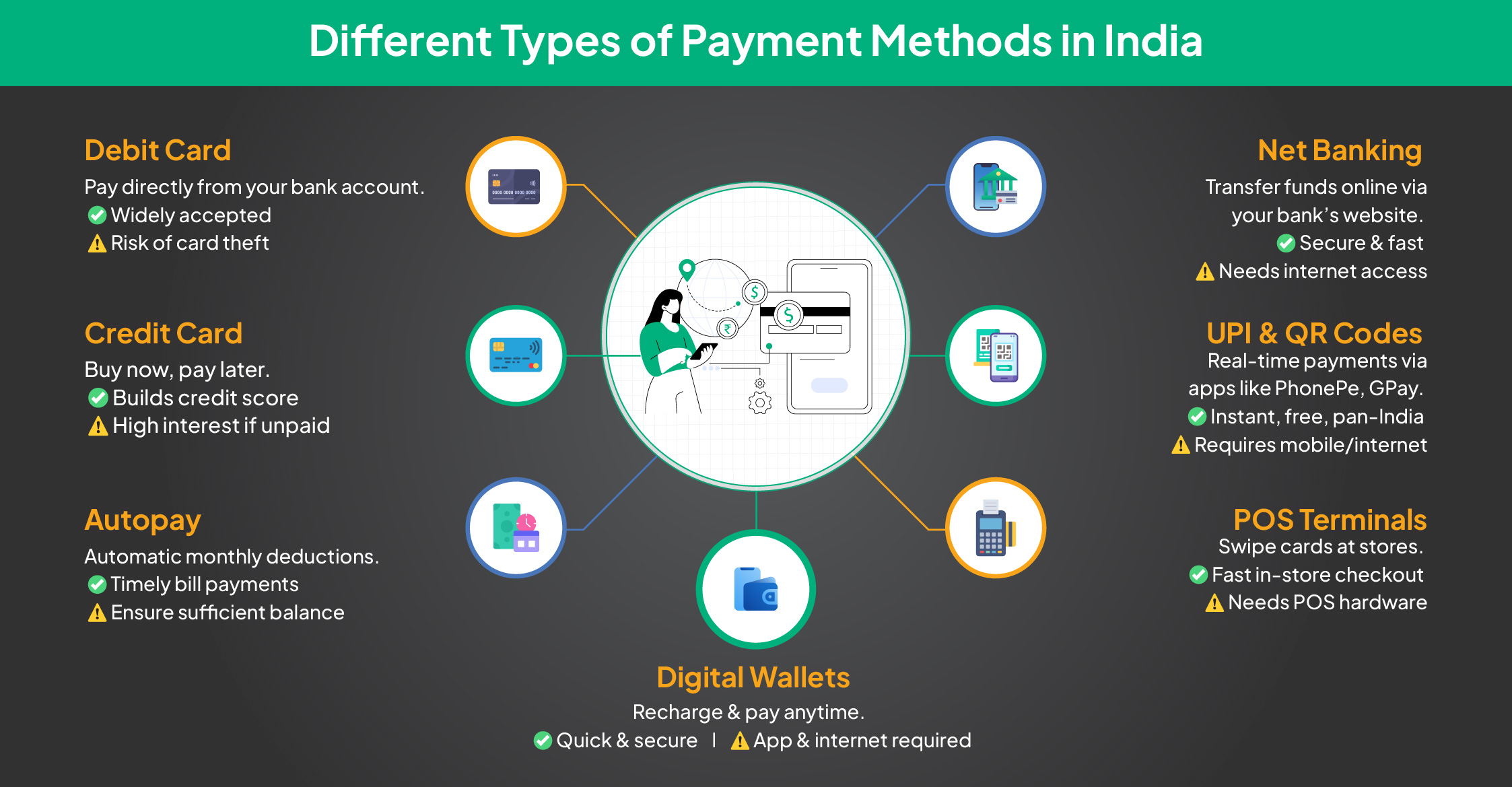

Various payment methods are available in India

Today, in the current digital age, both consumers and business enterprises have access to various payment methods that facilitate seamless transactions. Let us dive into each of these payment methods in detail.

- Debit card payment

A debit card is one of the most popularpayment methods in India. It allows you to make transactions by deducting the funds from your bank account. This is a convenient payment method, as you don’t need to carry cash, and you can also keep track of all your expenses. However, on the other hand, it also comes with potential risks, such as card theft.

- Credit card payment

Another popular mode of payment in India is the use of a credit card. It provides a revolving line of credit, allowing you to purchase things and pay for them at a later date. Using a credit card for making payments has many benefits, including the opportunity to establish a strong credit history. However, if you don’t prudently use the credit card and repay the amount promptly, the high interest charges may lead to debt accumulation.

To accept online payments via credit or debit card, the businesses must partner with a payment processor that facilitates the transaction. For in-store payment acceptance, businesses must have a payment gateway machine, such as a POS (Point of Sale) system.

- Autopay

This is a convenient and efficient online payment methodthat automatically deducts payments from your bank account or credit card. You can give your bank a standing instruction to deduct a specific amount on a specific day of the month toward bill payments, insurance premiums, online subscriptions, EMIs (equated monthly instalments) or other expenses, allowing you to make timely payments and avoid paying interest or penalty charges.

However, you must ensure that your account has a sufficient balance.

- Net banking

Since the advent of online banking, also known as net banking, it has become one of the most popular payment options in India. It allows you to easily transfer funds and make payments between your bank account and those of merchants, as well as friends and family’s bank accounts.

It is a convenient and quick payment method, and more importantly, it is secure. However, to make payments through net banking, you would need internet access, which can sometimes be a problem, especially when travelling.

- UPI and QR codes

UPI stands for Unified Payments Interface, and QR Code is Quick Response Code. Today, in the modern digital world, it is unarguably the most preferred online payment method among many Indians. And the best part is that it works and is accepted in all parts of the country.

It allows you to instantly transfer funds and make payments using UPI-enabled mobile applications. You can simply scan the QR code, use the recipient’s bank account details or phone number to complete the transaction. UPI payments are super convenient for all, and more importantly, they are secure and cost-effective.

- POS (Point of Sale) Terminal

A POS terminal is commonly found in retail stores throughout India. It allows you to make payments by swiping your debit or credit card and entering your PIN (Personal Identification Number). POS payments are efficient and fast, allowing businesses to offer an enhanced customer experience.

But, for POS terminal payments, you ned hardware, i.e., the POS machine and a reliable and stable internet connection for it to work efficiently.

- Digital wallets

When discussing the best online payment methods in India, digital wallets cannot be overlooked. A digital wallet is a convenient and quick way to make payments, with minimal risk of fraud or online scams associated with it.

All you need to do is recharge your wallet with any amount you prefer, and you can continue making payments anywhere and at any time. Additionally, modern digital wallets are designed to keep your payment information secure. However, to make digital wallet payments, you must download compatible apps on your smartphone and have internet access.

Read more – How To Choose The Right Payment Method For Startups?

Conclusion

Payment method means the way you pay for the product or service you purchase, whether it is from an online store or a physical retail outlet. It can also refer to how businesses choose to accept payments from their customers.

Understanding the various types of payment methods available, their working mechanisms, and their pros and cons can help you select the most suitable payment mode to meet your requirements.