Electronic payments, also commonly referred to as digital payments, are a type of e-payment. It is a mode of online transaction between the payee and the payer. These payment methods enable you to make instant money transfers conveniently, from anywhere and at any time, as you prefer.

Different Types of Electronic Payment Systems

Previously, people made payments only with hard cash. However, the preferences of people changed with the introduction of online payment modes, such as debit and credit cards, and nowadays, most people make only electronic payments. This is because it is safe, quick and secure. However, apart from debit cards, credit cards, and net banking, people now have many other new electronic payment options to choose from.

In this guide, we examine the various types of electronic payment methods and their respective advantages and disadvantages.

Virtual Payment Cards

Although only 4% of the companies prefer virtual payment cards as a supplier’s electronic payment option, these cards offer a wide range of amazing benefits. First and foremost, virtual cards offer enhanced security by generating a unique card number for each transaction. Thus, it helps prevent the risk of fraud.

Additionally, if you are a business owner, these cards help streamline the payment process by eliminating the need for physical cards and reducing operational costs. Another significant advantage of virtual payment solutions is that they offer customisable cards with a specific spending amount.

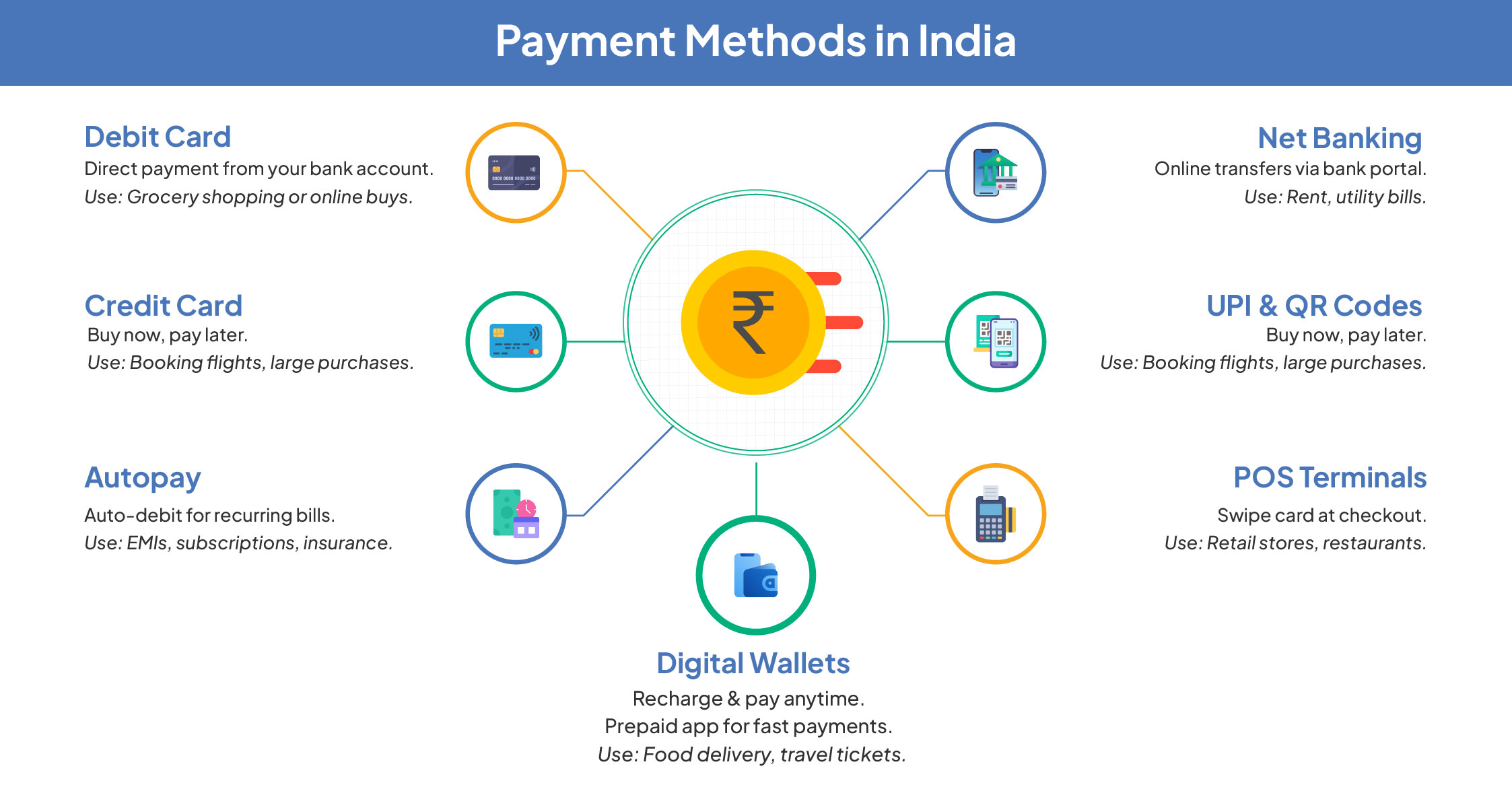

Digital Wallets

Among the various types of electronic payment systems available in India today, digital wallets are gaining popularity, with the number of users increasing daily. One of the primary reasons for the rising popularity of digital wallets is that they provide a secure payment gateway for users.

Also, as a user, when you use a digital wallet to make payments, you can be assured that all your payment information is secure. You can have peace of mind knowing that your funds are safe. Additionally, digital wallets offer other functions, such as peer-to-peer fund transfers, in-store and online payments, and loyalty card storage.

On the other hand, implementing POS (point of sale) systems with digital wallets can be challenging for business owners, especially those with online stores.

Bank Transfers

One of the traditional e-payment system types, bank transfers, has been around for a while now, dating back to the advent of internet banking. With a bank transfer, you can easily make payments from your bank account to the recipient’s bank account through the internet banking portal or the mobile banking application. For this transaction, you will need the recipient’s bank account details, including account number, account name, bank name, and IFSC (Indian Financial System Code), among other information.

When you make a payment through bank transfer, you get a transaction reference number, which you can use to check the status of the transaction in the future. It also guarantees the safety of your transaction.

One potential drawback of bank transfers is the lengthy processing time.

Credit and Debit Cards

Credit and debit cards are undoubtedly the most commonly used and popular electronic payment gateways. If you hold a bank account in India, you can easily get a debit or credit card from the bank and use it to make payments. However, the working of debit and credit cards is quite different.

When you make payments with a debit card, the account balance in your account is instantly reduced. Therefore, ensure that your account has sufficient balance before making the payment. In contrast, when you make a payment through a credit card, your credit balance is reduced proportionately. However, you can make the actual payment at a later date, which typically ranges from 45 to 90 days.

Both debit and credit card payments are processed instantly and are quite secure, providing a win-win situation for both customers and business owners.

Mobile Pay

Mobile pay is very similar to a digital wallet, as it securely stores your credit card and banking information, allowing you to make transactions and payments seamlessly. One of the significant advantages of mobile payments is that they facilitate contactless transactions. Thus, it offers enhanced convenience and security for both businesses and their customers.

And, although mobile pay offers great convenience, it has certain limitations. There may be compatibility issues with the POS system used by the business owner, and not all vendors accept mobile payments yet.

Conclusion

The growing popularity of online shopping and technological advancements have been key factors responsible for the exponential growth of e-commerce businesses in India. Electronic payments have been a catalyst for this transformation, as they enable consumers to make payments easily and quickly.

Today, almost every business in India offers some form of electronic payment facility to cater to consumer preferences, resulting in a better customer experience and seamless transactions.

Looking to integrate multiple payment options for your business?

Accept all payment methods with PayU’s all-in-one payment gateway & grow your business.