In today’s digital world, where convenience and speed are paramount, the way people make payments has undergone a profound transformation. Traditional payment options, such as cash and cheques, have become obsolete, paving the way for digital or electronic payment systems.

Today, if you are a business owner in India, offering an efficient payment solution for your customers is no longer an option but a necessity. And, behind the scenes of payment systems is API, which is an acronym for Application Programming Interface. It plays a crucial role in enabling the seamless integration of digital payments for businesses of all sizes and types.

API is at the heart of modern payment ecosystems, as it allows businesses to meet their customers’ expectations for a reliable, fast, convenient, and secure payment system. If you are wondering what an is API and how it works, then this guide is just for you.

What is an API?

An Application Programming Interface (API) is essentially a set of rules and protocols that enable software systems to communicate effectively. In the context of payment solutions, APIs enable businesses to accept online payments on their websites without having to build this feature themselves. With payment gateway API integration on their website, businesses can accept online payments from their customers. The API in payments solutions facilitates the exchange of information between different entities, including banks, customers and businesses.

Importance of APIs in payment solutions integration

Payment gateway APIs are like the unsung heroes that work behind the scenes of the modern payment solutions and serve several critical functions, including:

- Retrieving data

APIs serve as intermediaries between different software systems, facilitating communication and data sharing among them. From a payment solution perspective, APIs play a crucial role in transmitting and retrieving transaction-related data in real-time.

Real-time access to payment data ensures that both business owners and consumers have accurate information about their financial transactions.

- Processing the payment

Another important role of UPI API integration is that it facilitates the actual processing of payments. The API acts as a conduit through which transaction data is transmitted between different parties involved, including payment gateways, banks, and merchants. The secure transmission of data also ensures that payments are processed efficiently, reducing the likelihood of errors or delays in the process.

- Currency conversion

API also plays an important role in international transactions, as it facilitates the real-time conversion of currencies. This means that when customers make a payment in a foreign currency, the API will automatically convert the amount into the merchant’s local currency.

- Accessibility

API provides businesses with the necessary infrastructure to offer multiple payment options to their customers, giving them the flexibility to choose their preferred method of payment. Whether it’s a credit/debit card, digital wallet, net banking, or bank transfers, with payment gateway API integration, you can let them make payments using their preferred method.

- Fraud detection

Speaking of the importance of API in modern payment processing, you can overlook its role in fraud detection and prevention. API can analyse the transaction patterns and identify unusual and suspicious activities. Thus, it helps prevent fraud.

Additionally, the API continuously monitors all transactions and can flag any potentially fraudulent transactions, allowing you to implement additional security measures and notify the relevant parties to take prompt action. Thus, it helps protect the interests of both the businesses and the customers.

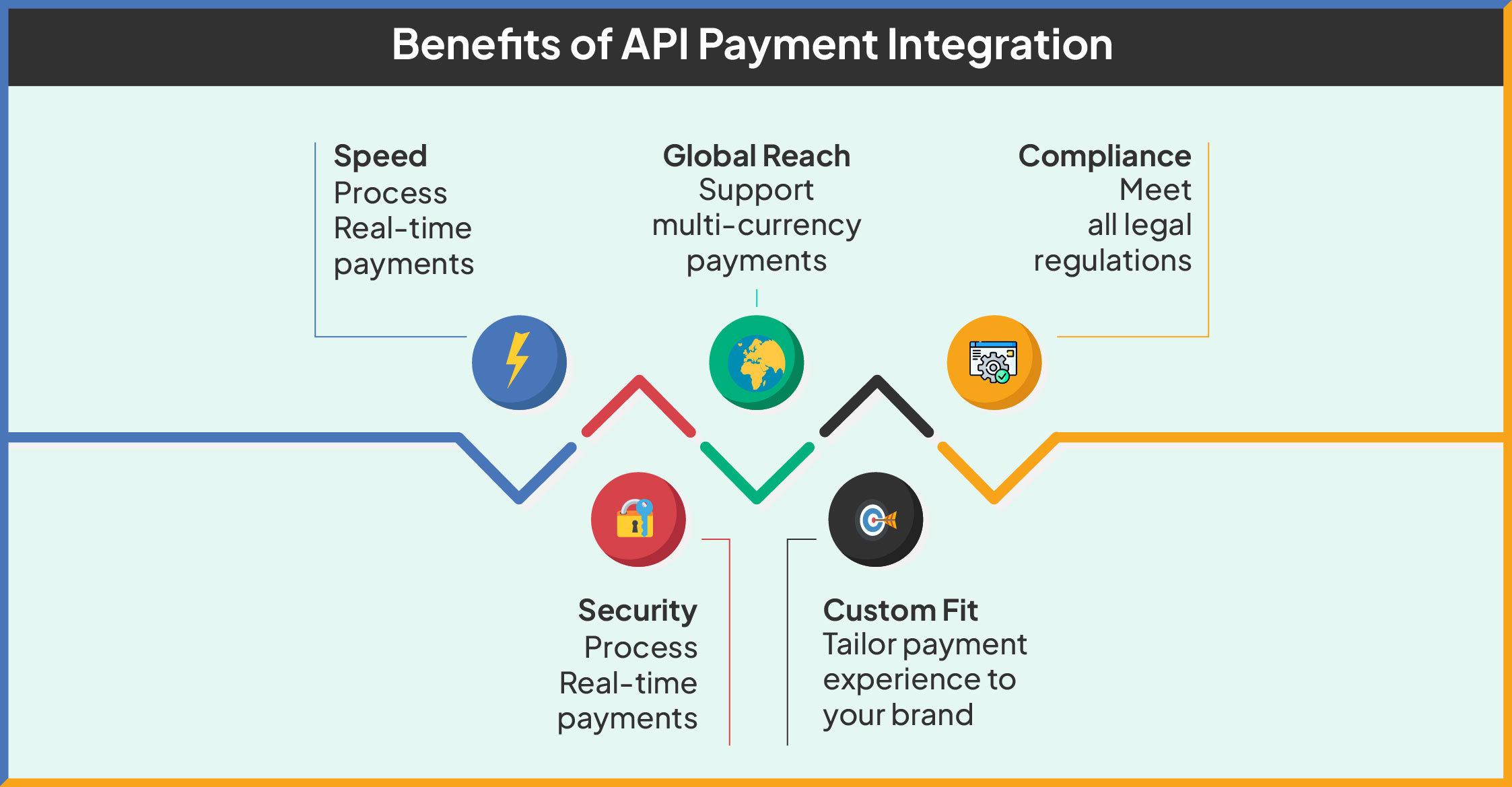

Benefits of API Payment Integration

Now that you understand the crucial role APIs play in payment processing, let’s examine the various benefits they offer for modern payment integration.

- Quick and efficient

API plays an important role in helping businesses streamline their payment processes. They enable businesses to accept payments in real-time and process the transactions quickly, providing a better customer experience.

- Security

API is meticulously designed to be secure; it has several robust security measures that protect sensitive payments-related data from being stolen by scammers online. APIs typically employ an advanced level of encryption protocols and verification methods to safeguard the integrity and confidentiality of the transactions.

The advanced secured measures provided by API are also a critical factor in helping businesses win the trust and loyalty of their customers.

- Global reach

Many businesses in India that carry out international transactions or cater to overseas customers use API-powered payment processing systems. This enables them to easily process and accept international payments as well as do currency conversions.

With API integration, businesses can process transactions in foreign currency without any hassle, and thus, they can expand their market reach and cater to customers from different locations.

- Customisation

API offers a high degree of customisation in the payment process. Businesses can integrate an API into their payment system and customise it to suit their specific needs and preferences. For example, they can incorporate specific features and provide a unique payment experience to their customers. Also, customisation allows businesses to provide payment solutions that align with their brand identity.

- Be compliant with all the regulations

The API is designed to be compliant with industry standards and adhere to local regulations. Thus, it ensures that the businesses meet the regulatory obligations and are on the right side of the law. Also, by using API-powered payment solutions, businesses can easily navigate through the complex legal frameworks, reducing the risk of potential penalties.

Conclusion

In the ever-evolving world of payment methods and technology, API acts as the driving force that facilitates seamless, secure and efficient payment integration. API will surely remain at the forefront of payment innovations in the future and shape the way people make payments for the goods and services they purchase.