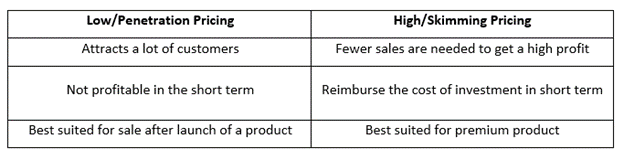

Product pricing is an essential factor that can determine the success of your products and services in the market. Pricing products correctly is so critical that it can skyrocket your sales and popularize your brand. Do you need to price your products but wonder if you are going too high or low? Understand the difference between the two to know which works when:

A well-planned strategic pricing and a strong pricing strategy directly impact brand value, sales, and overall profitability. When customers feel they are getting fair value, they trust your brand more and are more likely to buy. On the other hand, incorrect pricing can hurt sales, weaken brand perception, and shrink profit margins. That’s why businesses need a data-driven approach that includes pricing comparison, value based pricing, competitive pricing, dynamic pricing, psychological pricing, and cost based pricing to ensure long-term success.

For many Indian SMBs and eCommerce brands, pricing challenges are real, rising input costs, high competition, changing customer expectations, and marketplace fee structures often make product pricing difficult. Without the right insights and strategy, companies struggle to maintain profitability while staying affordable to customers. Strategic, research-backed pricing is no longer optional, it is essential to stand out, grow sales, and build a profitable business.

What is Product Pricing?

Product pricing is the process of deciding the right selling price for a product or service. It involves calculating all the costs involved, such as raw materials, labour, packaging, marketing, and logistics, and then adding a suitable margin to ensure profit. But pricing is not just about covering costs. It also requires understanding customer expectations, studying competitor prices, analyzing market demand, and identifying how much value people see in your product.

The goal of product pricing is to find a balance where customers feel the price is fair, the brand remains competitive, and the business earns enough profit to grow. A well-designed price can increase sales, improve brand trust, and strengthen market position, while the wrong price can lead to low demand, losses, or poor brand perception. This blog will discuss 7 easy tips to ensure your product pricing is just right.

What Are the Different Types of Online Payments?

Online payments allow customers to pay digitally without using cash. In India, several digital payment methods are widely used across eCommerce, retail stores, and service businesses. Here are the most common types:

UPI (Unified Payments Interface)

UPI enables instant bank-to-bank transfers using mobile apps. Users can pay via UPI ID, mobile number, or UPI QR code.

Debit & Credit Cards

Customers can pay using Visa, Mastercard, RuPay, and American Express cards. Widely used for online shopping, subscriptions, and bill payments.

Net Banking

Direct payment from a bank account using the bank’s secure payment gateway.

Wallets

Digital wallets for quick payments and rewards.

Buy Now, Pay Later (BNPL)

Services like Simpl, ZestMoney, Amazon Pay Later, and LazyPay allow customers to buy and pay later in instalments or after 30 days.

EMI Payments

Interest-free or low-cost EMIs through banks or cards enable customers to purchase high-value products easily.

Cash on Delivery (CoD) / Card-on-Delivery

Still popular in India, allowing customers to pay in cash or by card when the product arrives.

Subscription Auto-Pay

Used for OTT platforms, software tools, and memberships through cards, UPI AutoPay, and wallets.

Netbanking e-Mandates

Automated recurring payments for insurance premiums, SIPs, or loan instalments.

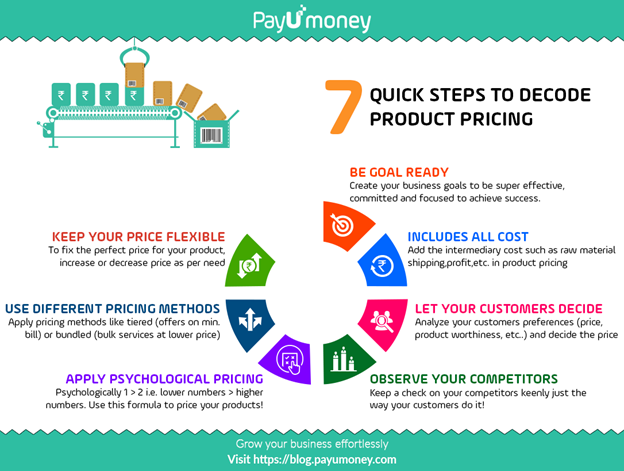

7 Pro tips for pricing your products correctly

Setting the right price is not guesswork, it requires understanding costs, customers, and competition. These simple yet powerful tips will help you build a strong pricing foundation and improve profitability.

Tip 1: Align Your Pricing Strategy with Business Goals

Your pricing should support your mission, vision, and revenue goals. Ask questions like: What profit margin do we aim for? Do we want to be a premium brand or an affordable choice? How should pricing reflect our brand positioning and customer value? When pricing aligns with business direction, decisions become clearer and growth becomes easier.

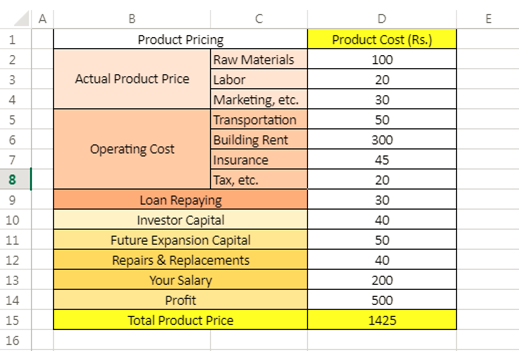

Tip 2: Calculate All Costs Before Setting Prices

When deciding pricing, include every cost involved in producing and selling your product. This includes direct, indirect, and hidden expenses such as raw materials, labour, packaging, logistics, storage, marketing, service, taxes, discounts, and customer support. Understanding the true cost ensures you never price below profitability and helps you set a realistic, sustainable selling price.

Ask yourself:

- Have I considered discounts or deals I can get from my suppliers?

- Did I include post-sales costs such as customer service in my pricing?

- Or any tax incentives and other benefits I can take advantage of?

- Is it just breaking even or adding to your profits as well?

Imagine this. Leena sells jewelry for Rs. 100, making it at a loss of Rs. 10. If Leena sells the jewelry for more than Rs. 110, she will make that much more profit.

Pro tip: Fill in all the costs in an Excel sheet, so you don’t miss out on anything and can easily see the gross revenue you need to generate.

Here is a hypothetical example of the product pricing of a t-shirt:

Tip 3: Know Your Customer’s Budget and Value Perception

Understand what customers are willing to pay and what value they expect from your product. Use market research, competitor analysis, surveys, and direct feedback to learn real expectations. Consider customer segmentation for B2B and B2C, and note local price variations across cities or regions. When pricing matches perceived value, customers feel confident and more likely to purchase.

Conduct market research to find out –

- who your target audience is

- how much they pay for similar products

- what the perceived value of your product is

The better you know your customers, the more value you can provide them. You can tweak the pricing according to your customers’ location, use cases, purchasing capacity, etc. It is good to ask customers for feedback to understand their needs and determine the right product pricing and development strategy.

Tip 4: Study your competitors pricing

Competitor analysis helps you understand market standards, respond wisely to discounts, and avoid a harmful price war or “race to the bottom.” Use competitive intelligence tools, surveys, and pricing comparison to study similar products and identify gaps or added value. Check supply-demand differences, special offers, promotions, and seasonal pricing trends. This helps you set competitive, attractive prices while maintaining profitability and strong positioning.

Tip 5: Apply Psychological Pricing Techniques

Use psychological pricing to influence buying decisions through perception. Techniques like charm pricing (₹999 instead of ₹1,000), price anchoring, decoy pricing, and bundle discounts make prices feel more affordable and valuable. These methods work because customers often react emotionally rather than mathematically when judging price. Smart psychological pricing can improve conversions and increase sales without lowering real value.

Tip 6: Explore Different Pricing Models and Methods

You can use many product pricing methods to sell your products and services effectively. Choosing the right model depends on your industry, customer segment, and business goals. Here are some commonly used methods with simple examples:

- Cost-Plus Pricing — Calculate the total cost of production and add a fixed profit margin. This ensures every sale remains profitable and works well for predictable manufacturing costs.

Example: Manufacturing products with fixed markup. - Value-Based Pricing — Set prices based on how much value customers believe your product provides. Higher perceived benefits allow higher pricing and stronger brand positioning.

Example: Premium skincare or handmade crafts. - Competitive Pricing — Price your product by analyzing competitor prices and market standards. Helps attract customers in competitive markets without sacrificing profitability.

Example: Online electronics and fashion stores. - Tiered Pricing — Offer multiple pricing levels with different features to serve diverse customer needs and budgets, increasing accessibility and upselling opportunities.

Example: SaaS tools offering Basic / Pro / Enterprise tiers. - Freemium Pricing — Provide a free basic version to attract users and charge for advanced features, upgrades, or premium services to generate revenue.

Example: Apps like Canva or Spotify. - Bundle Pricing — Group complementary items and sell them at a combined lower price to increase overall value perception and boost total sales volume.

Example: Restaurant meal combos or festive product packs.

Tip 7: Monitor Results and Adjust Pricing Regularly

Track your pricing performance continuously and make adjustments based on real data. Review sales trends, customer feedback, and profit margins, and run A/B tests to compare different price points. Use pricing tools or dynamic pricing technology to respond quickly to market shifts, seasonal demand, or competitor discounts. Flexibility is essential in volatile markets, changing prices at the right time helps you stay competitive, protect margins, and maximize revenue. Measuring results ensures you understand what truly works for your business.

Mistakes to Avoid When Pricing Products

- Not Calculating the True Cost

Many businesses ignore hidden expenses like logistics, taxes, and support. This can lead to pricing below cost and hurting profitability. - Ignoring Customer Feedback

Not listening to customer expectations or willingness to pay can lead to price mismatch, lost sales, and weak value perception. - Underpricing to Gain Quick Sales

Pricing too low can erode trust, make your product look cheap, and reduce long-term profit potential. - Overpricing Without Clear Value

High prices without strong value justification discourage customers and push them toward competitors. - Overcomplicating Pricing Tiers

Too many options confuse buyers and slow decisions. Keep pricing simple, clear, and easy to compare. - Copying Competitor Pricing Blindly

What works for others may not work for you—your costs, audience, and value could be different. Use competitor pricing as guidance, not a rule.

How Payment Solutions Support Profitable Pricing?

Integrating advanced payment gateways such as PayU helps businesses build profitable and flexible pricing strategies. Modern payment solutions offer smart analytics and real-time payment feedback, allowing merchants to understand customer behaviour, preferred payment methods, and conversion patterns. These insights help optimize pricing decisions and prevent revenue losses.

Payment gateways also support multi-currency pricing, split payments, instant refunds, and automated discounts, enabling businesses to customize prices for different markets and customer groups. For global eCommerce brands, adapting prices across currencies creates a strong competitive edge.

By improving transparency, reducing checkout friction, and enabling data-driven price adjustments, payment solutions empower businesses to scale confidently and maintain profitability in dynamic market conditions.

Set The Right Prices for your Offerings and Earn More

Remember, the product pricing process may look different for all. Focus on finding the right balance between earning profits and providing value for money. More importantly, pricing is a continual process. You may need to revise your prices with changing times.

If the pricing strategy works well and buyers start flocking to your stores, you may need some help to streamline all your payments and settlements. That’s where PayU can come in. With 150+ payment modes and plenty of useful payment solutions, PayU can help you provide the best checkout experience.

Click here to learn more about how PayU can help you grow your business.

FAQs

What is product pricing?

Product pricing is the process of determining the selling price of a product or service based on costs, value, and market demand.

Why is setting the right price important?

The right price ensures profitability, attracts customers, and strengthens brand value while avoiding losses or low sales.

What are the common pricing strategies?

Common strategies include cost-based, value-based, competitive, dynamic, psychological, tiered, and bundle pricing.

What is the difference between cost-based and value-based pricing?

Cost-based pricing is set using production costs plus profit, while value-based pricing reflects what customers perceive as the product’s worth.

What is the best pricing method for small businesses?

Small businesses often benefit from cost-based or value-based pricing to ensure profitability while staying competitive.

How can I set the right price for a new product?

Research customer expectations, study competitors, calculate costs, and test different price points.

How do I increase my product prices without losing customers?

Communicate added value, introduce gradual increases, and highlight quality or unique features.

How often should businesses update their pricing?

Regularly review pricing—at least quarterly or whenever costs, demand, or market conditions change.

How do I know if my current pricing is too low or too high?

Track sales, profit margins, and customer feedback; compare with competitors and market expectations.

What is psychological pricing?

Psychological pricing uses strategies like ₹999 instead of ₹1,000 to make prices appear more attractive and influence buying decisions.

Is discounting a good pricing strategy?

Discounting can boost sales short-term but should be used strategically to avoid eroding brand value or profit margins.