Did you know recovering a single bounced EMI costs ₹50–150? Most NBFCs spend thousands on agent fees and call center costs. These costs are eating into your profits.

According to CRISIL, operational costs grew by 3% YoY in FY24 due to rising bounce rates and recovery expenses. Manual recovery methods simply can’t keep up anymore.

Bounces disrupt your cash flow, delay disbursals, and increase operational load. The more bounces you face, the harder it gets to grow your business.

The solution? Smarter, automated collections that reduce your costs, stabilize your cash flow, and help you scale faster.

Let’s understand why manual methods aren’t working — and how PayU can help you fix them.

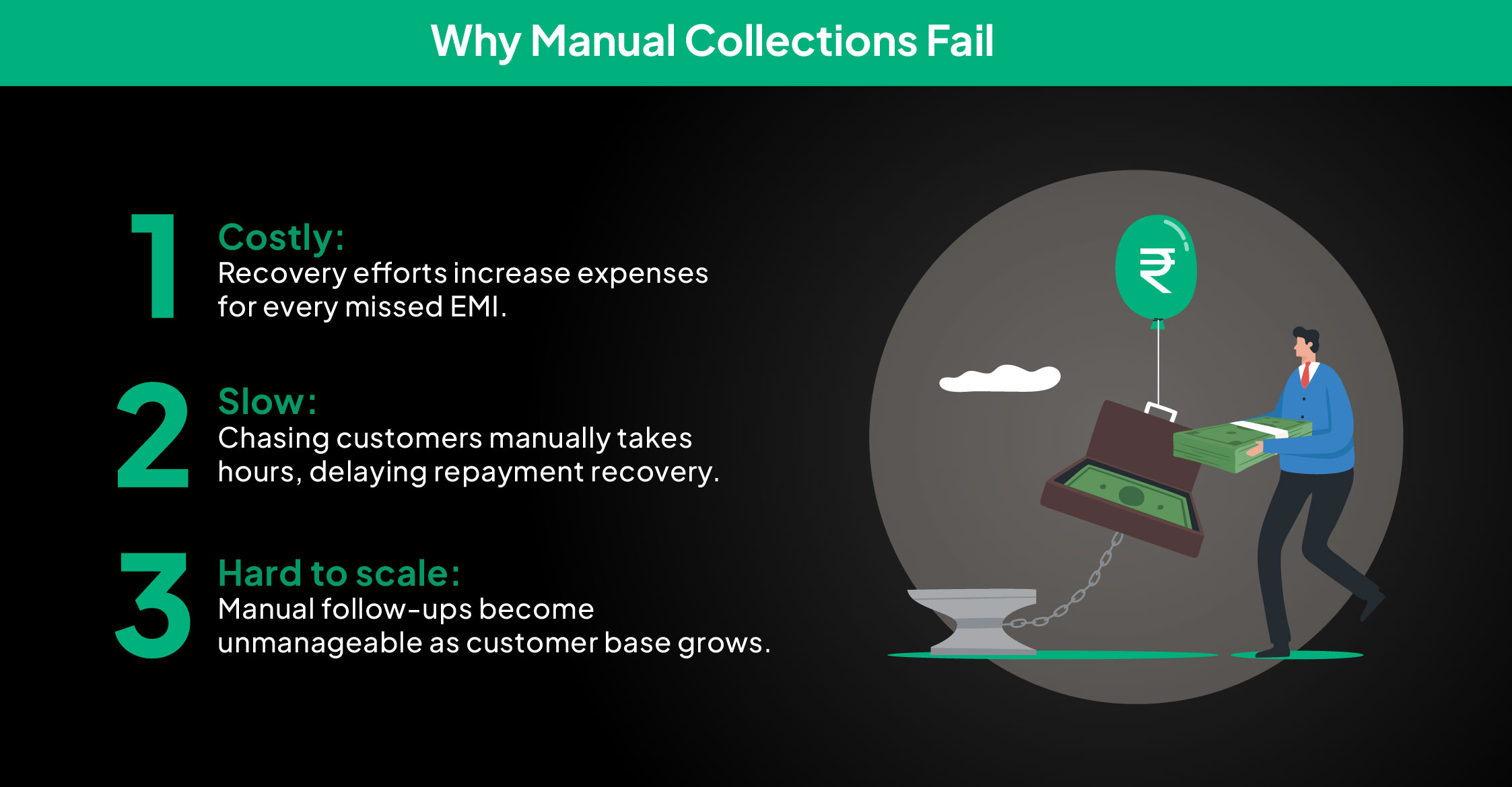

Why Traditional Recovery Doesn’t Work Anymore

Manual recovery methods like calling customers, sending agents, or using IVR systems are outdated. Here’s why they fail:

Imagine chasing 300 bounced EMIs a day with just 5 agents. Scaling with unpredictable cash flow and delayed credit disbursals isn’t sustainable. This is blocking your growth. It’s time to automate collections.

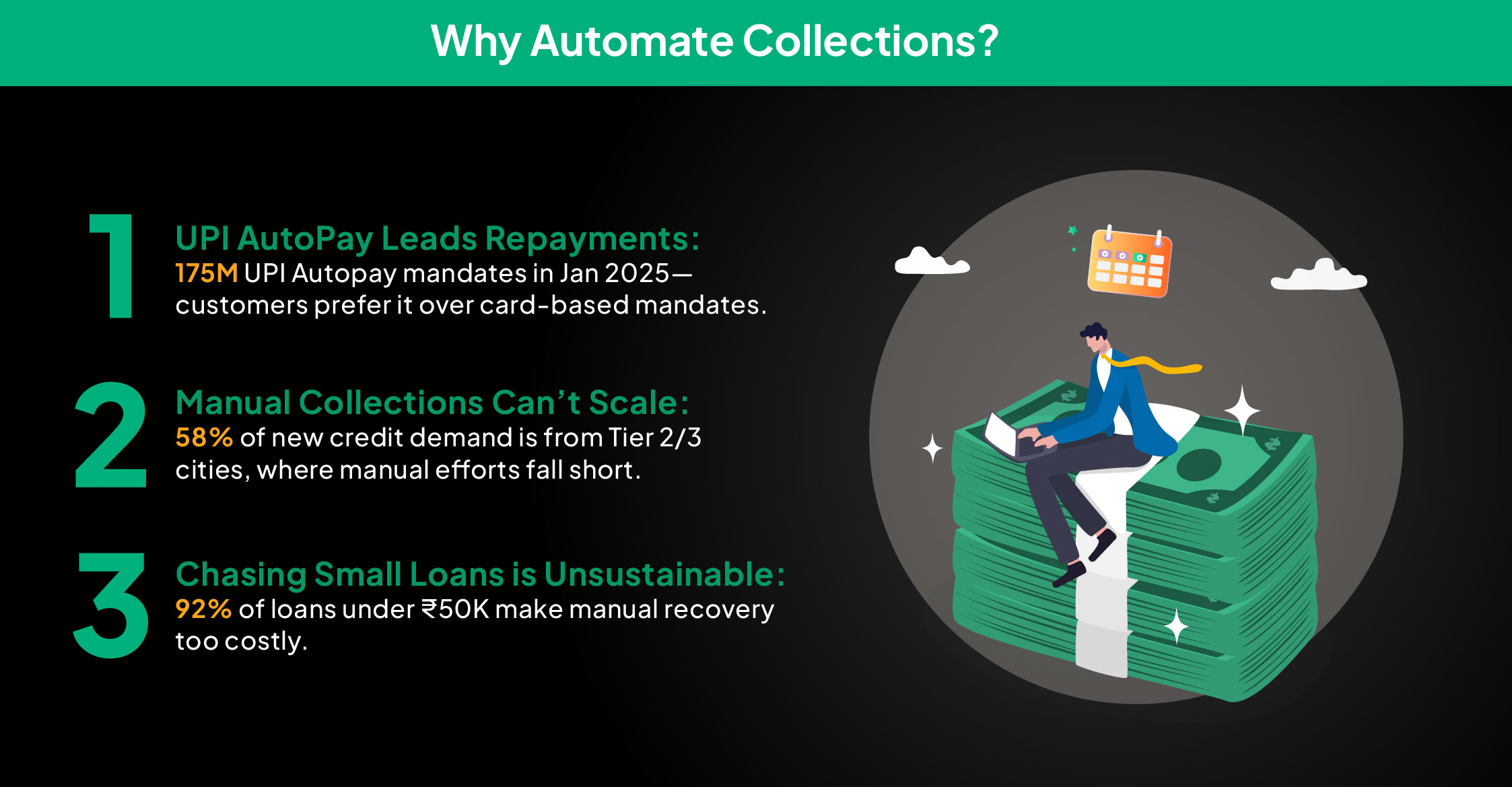

Customers Need Automation

Your customers aren’t skipping payments—they’re looking for faster, easier repayment options online. Their needs have shifted, and keeping up with them is critical.

Customers today expect fast, hassle-free repayment options. Manual processes are too slow, too costly, and just don’t work anymore. Automation is critical to cut costs, scale, and meet customer needs.

Fix the Bounce Problem with PayU

PayU’s bounce-proof collection stack eliminates delays, reduces costs, and simplifies collections for NBFCs.

1. Verify Accounts Before Disbursal

- Penny Drop & Penny-less Account Validation: Confirm customer account details instantly to avoid errors.

- TPV (Third Party Validation): Ensure real-time account accuracy to reduce fraud.

2. Automate Recurring Payments

- UPI AutoPay & eNACH: Enable recurring payments with high-success mandates.

3. Make Repayments Easy and Fast

- Pay by Link & WhatsApp Reminders: Send payment links directly to customers for instant action.

- Dynamic QR Codes: Offer pre-filled QR for quick, error-free payments.

- Native OTP: Show OTP in the payment screen. No app switching needed.

With PayU, your collections don’t just become automated—they get smarter, faster, and more reliable.

Smarter Collections That Drive Growth

Here’s how automated collections through PayU drive growth for your business:

- Cut Bounce Rates by 50%: Reliable recurring payments reduce missed EMIs.

- Improve Repayment Consistency by 40%: Automation ensures on-time repayments, boosting cash flow stability.

- Lower Operational Costs by 35%: Save time and money by eliminating expensive manual recovery processes.

With PayU, it’s easier to scale your collections as fast as you grow your lending.

Become Bounce-proof with PayU and Grow Effortlessly

Manual follow-ups cost time, money, and energy. Every missed EMI slows down your growth and frustrates your customers.

With PayU, you can ditch outdated methods for smarter, automated tools that simplify collections so you can focus on growth.

Don’t let another EMI bounce disrupt your growth. Start collecting effortlessly with PayU.

Explore PayU’s bounce-proof collection stack and grow faster.