India’s digital payment revolution is synonymous with UPI. It’s fast, familiar, and trusted — whether you’re reserving an IPO allotment, paying rent, or subscribing to your favourite OTT platform.

The Enterprise Gap: When UPI Alone Isn’t Enough

But while UPI works brilliantly for everyday transactions, businesses with high-volume, customer-specific payment needs often require more than a standard flow. They need built-in identification, real-time reconciliation, and a seamless experience at scale — without compromising security or compliance.

That’s where the UPI ecosystem continues to evolve — with innovations like AutoPay, Block & Collect, Third-Party Validation, and Dynamic VPAs — to solve deeper operational problems across industries.

Where Repayments Break Down: A Real NBFC Use Case

As UPI became the preferred repayment mode for millions of borrowers, financial institutions faced a new kind of challenge: enabling scale without losing control. For NBFCs, accepting digital payments wasn’t the hard part — reconciling them was. Behind every successful scan lay a bigger operational question: Who paid? For which loan? And how do we close the loop instantly?

The core challenge: While UPI enabled borrowers to make payments digitally, but without identification built into the flow, NBFCs couldn’t track who paid, or match payments to loan accounts. This created friction for customers, operational overhead for staff, and risk of mismatched or delayed repayments.

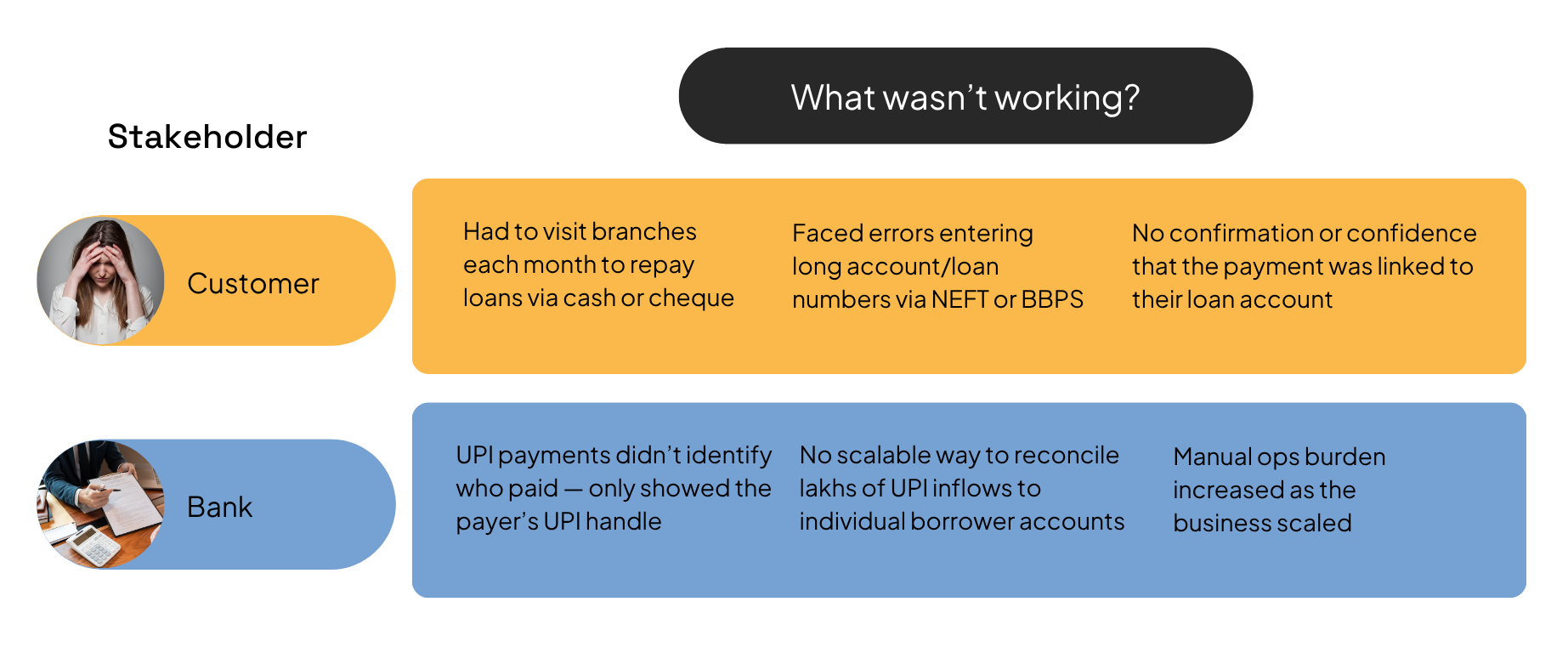

Breaking It Down: What Customers & NBFCs Were Facing

Let’s break it down:

Why Traditional UPI Flows Couldn’t Reconcile at Scale

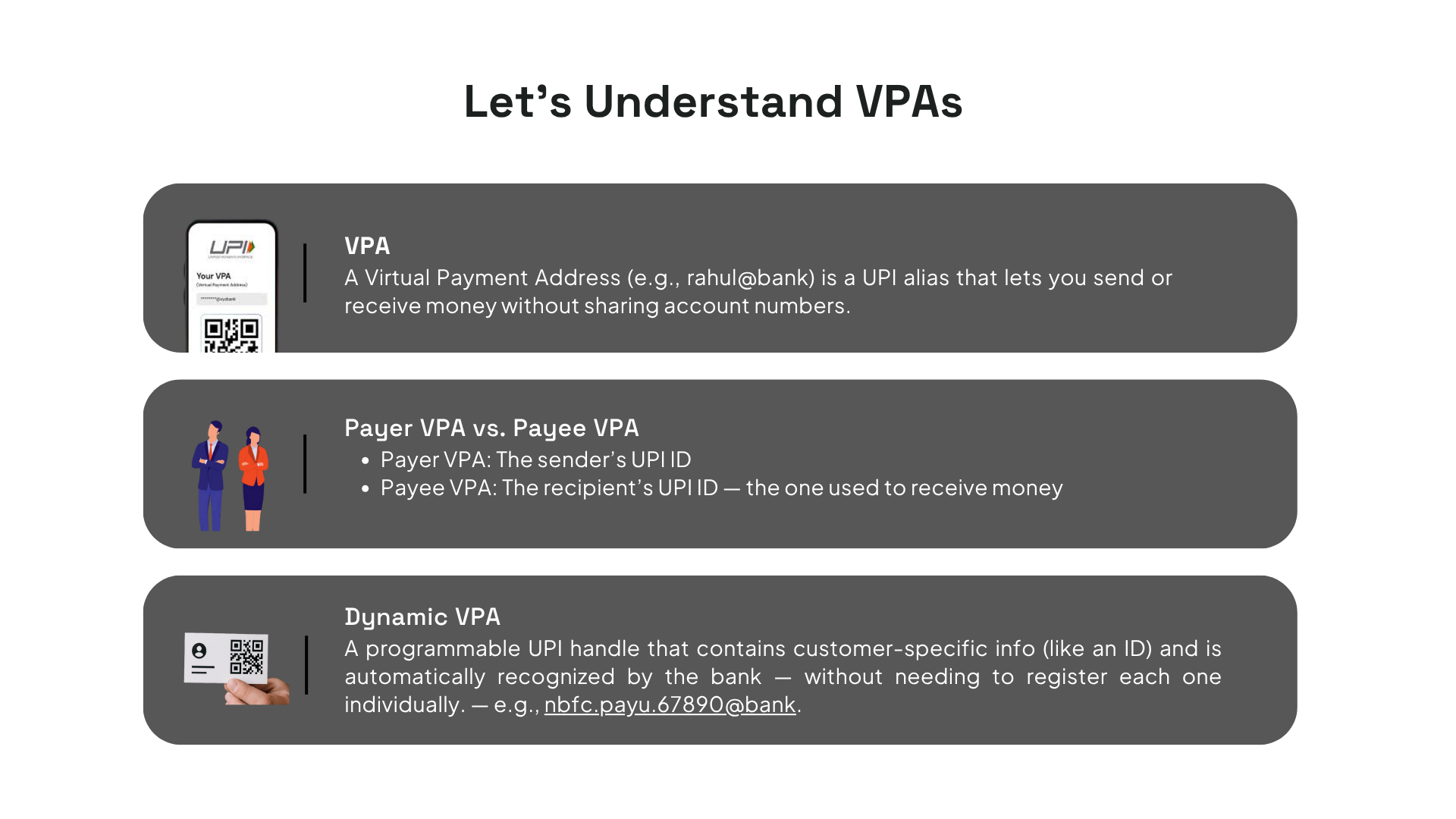

When a customer pays via UPI, the receiver sees the payer’s VPA (Virtual Payment Address) — like john123@upi. But customers may use multiple VPAs, and none of them link back to a specific loan account. Without clear customer identification, there’s no way to reconcile payments automatically.

Now, let’s say the NBFC wanted to assign each customer a unique UPI handle for repayment. That would mean onboarding lakhs of VPAs onto the bank’s UPI switch — a compliance and infrastructure nightmare.

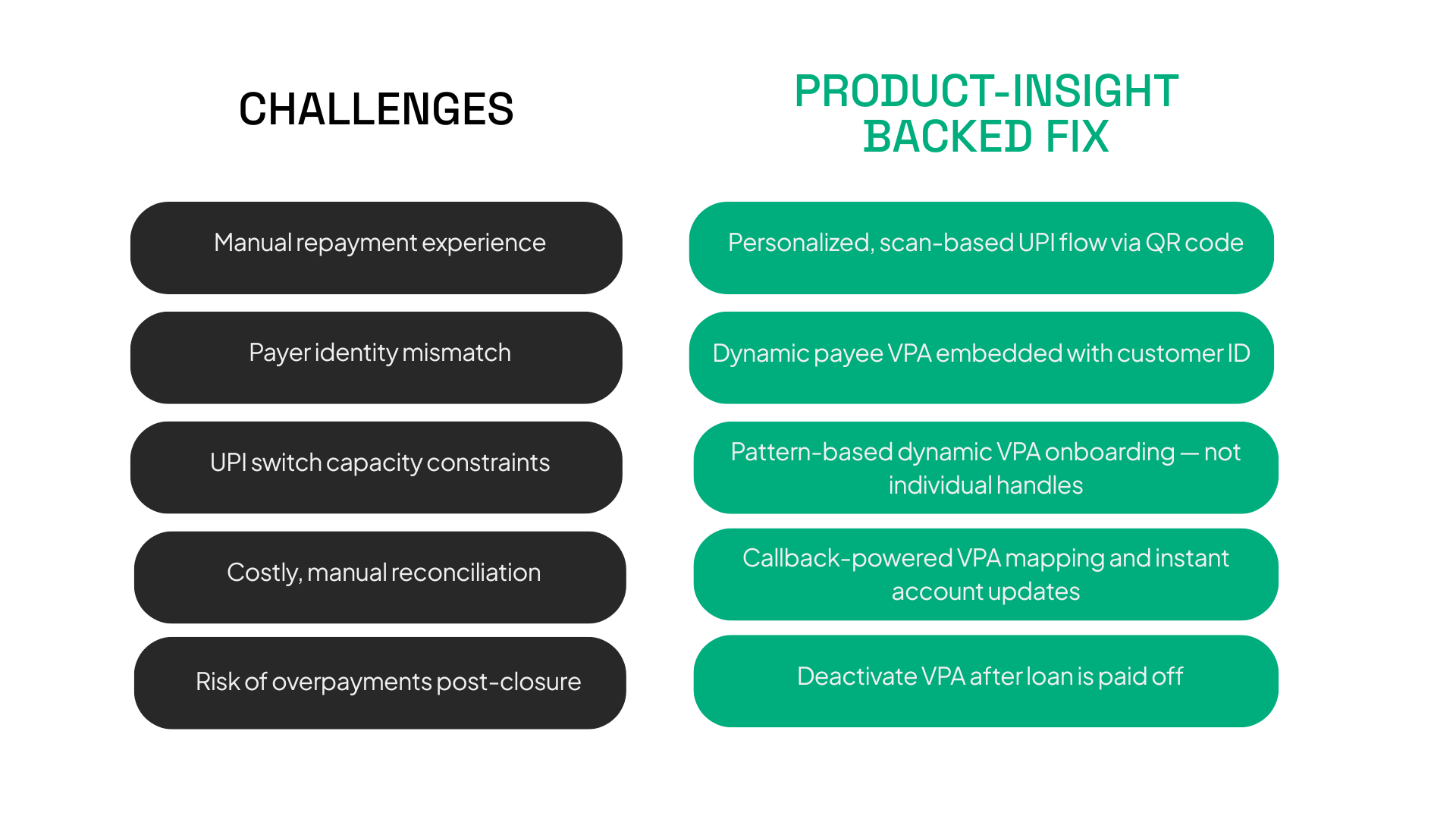

The solution wasn’t more tech. It was a design-first approach — rethinking how UPI could be used to embed intelligence at the point of payment.

Introducing Dynamic VPAs: Identity Built Into the Payment

Inside the Build: How PayU Made Dynamic VPA Work at Scale

- Flexible VPA Format: We worked with the bank to approve a general format —

nbfc.payu.[customerID]@bank. Instead of onboarding lakhs of individual VPAs, the bank only needed to validate that any VPA following this format was acceptable. - No Overload on Bank Infrastructure: Since the format was pre-approved, the bank’s UPI switch didn’t need to register or store every single customer’s VPA — it simply checked that incoming VPAs matched the approved format.

- QR Code for Each Customer: Every borrower received a personalized QR code, embedded with their unique VPA, printed on their passbook or loan card.

- Scan & Pay Flow: The borrower scans the QR using any UPI app, which reads the customer-specific VPA. The app confirms it with the bank, and the payment goes through seamlessly.

- Same Settlement Account: Even though every borrower had a unique VPA, all payments were routed to a single NBFC account — no change in settlement structure.

- Auto Reconciliation: PayU captured the payee VPA in the UPI callback and instantly mapped it to the borrower’s loan account — enabling real-time, error-free reconciliation for the NBFC.

- Dynamic Lifecycle: Once the borrower closed the loan, the NBFC could instruct PayU to deactivate that VPA — preventing any future payments from being made against it.

From Problem to Product: A Fix for Every Friction

Beyond Repayments: A Blueprint for Business-Grade UPI

UPI has already transformed how India pays — powering everything from daily peer-to-peer transfers to high-value investments and subscriptions. But its potential doesn’t stop at payments.

With the right design lens, the same infrastructure can be applied to solve deeper, operational problems for high-scale businesses — from identification to reconciliation and lifecycle control.

Dynamic VPAs are a powerful example of this thinking. By embedding customer-specific context into every UPI transaction, they enable:

- Zero ops complexity – no spreadsheets, no manual matching

- Faster cash flow visibility – real-time reconciliation at scale

- Full compliance – works within NPCI and bank switch constraints

- Better control – each payment is traceable, auditable, and customer-specific

And this design isn’t limited to loan repayments. Wherever businesses need to map money to people (or policies, or properties), this model fits.

- Education: Fee collection tied to each student’s roll number

- Housing Societies: Maintenance payments by flat number (e.g., apt302@buildingpay)

- Subscription Billing: One QR per customer for monthly utilities

- Insurance: Policy-specific VPAs for seamless premium tracking

Final Thought: Building on UPI, for India’s Next Fintech Leap

At PayU, we believe the next leap in Indian fintech won’t come from front-end innovation alone — but from smarter, infrastructure-level thinking. Dynamic VPAs reflect just that: a thoughtful use of UPI’s native capabilities to solve complex, high-scale business problems. This is product-led innovation working hand-in-hand with UPI — to bring identification, automation, and efficiency to every transaction. We’re committed to building for the ecosystem — and ensuring UPI’s full potential is accessible to every business that needs it.