How to register your business under GST?-Types of GST, Advantages, Exemptions

Do you want to register your startup or small business under GST (Goods & Service Tax) but don’t know where to start? Don’t worry! Read on to know more about GST, its registration process, and tax exemptions for startups and small and medium businesses (SMBs).

Table of contents

What is goods and services tax (GST)?

It is a tax reform that came into existence on 29th March 2017 by an act of parliament and has replaced many indirect taxes such as VAT, excise, service tax, etc.

A comprehensive destination-based tax, GST is levied on the supply of goods and services at every point of sale. For example, you are a wholesale merchant and sell goods to Mr X, a retailer, who further sells it to Mr Y, the consumer. At first, the tax is levied on the purchase made by Mr X from you. Then, the tax is further levied on the purchase made by Mr Y from Mr X.

A unique number called GST registration number is allotted to every business registered under GST.

Types of GST

In India, there is a dual GST system in which the central and state governments levy taxes simultaneously with a common tax slab. However, GST is mainly categorized in three simpler terms:

State Goods and Services Tax (SGST) – taxes levied by the state government or union territory (UT) on goods and services manufactured or sold within state or UT boundaries.

Central Goods and Services Tax (CGST) – taxes levied by the central government on any intra-state transactions for goods or services.

Integrated Goods and Services Tax (IGST) – taxes levied by the central government when a transaction of goods or services takes place within two different states. The state and central government share the tax levied equally.

Advantages of GST registration for startups and small businesses

GST for small business and startup provides these advantages:

- If you file your return under GSTR-1 and GSTR-3B, no late fee will be charged as per the 31st GST council’s declaration to boost Startups and SMBs.

- Starting a business in India is now a lot easier. SMBs and startups can go ahead with only GST registration. Earlier, the process was a bit complex.

- Simplified indirect tax system to one uniform system. Ever since GST came into existence, a lot of indirect and direct taxes have been subsumed such as excise, VAT, etc. This has made the tedious process of filing and managing taxes much simpler.

- Easy compliance and requirements

- Paperwork efficiency and ease of logistics towards dense locations of client

Exemptions under GST for startups and small businesses

There are no complex criteria for eligibility for GST registration. In fact, businesses with a turnover of under Rs. 40 lakhs per year don’t need to register under GST. As a result of this exemption, many startups and small businesses that fall under the category of Rs. 5 lakh – Rs.40 lakh income can grow without having to worry about filing GST returns.

How to register a startup or small business under GST

Wondering how to register a small business in India? It’s quite simple to register your business under GST online. There are a few GST registration requirements. Just follow the steps given below:

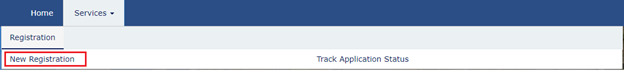

- Go to the GST portal at https://www.gst.gov.in/. Click on ‘Services’ and then select ‘New Registration’ under ‘Registration’.

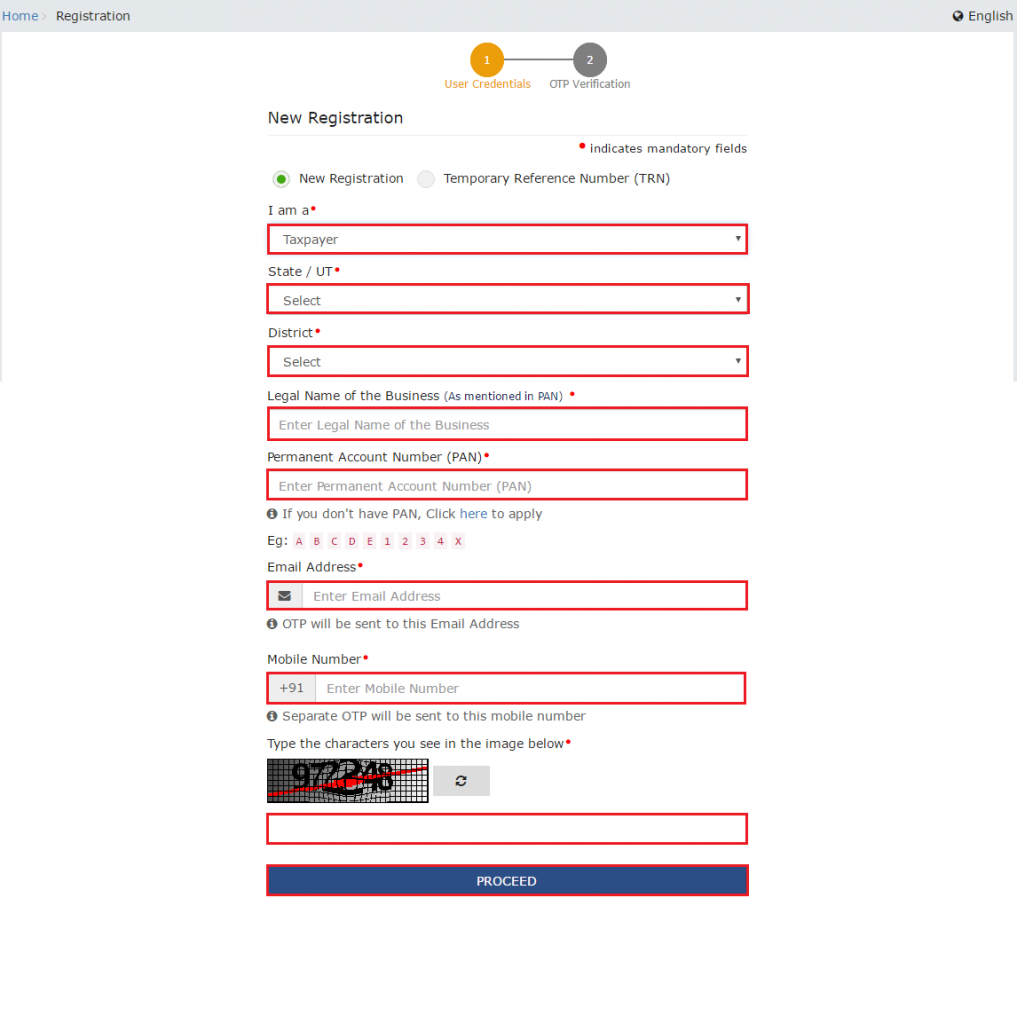

- Generate a temporary reference number (TRN) by filling in the details given below such as PAN, email ID, and mobile number, and click on Proceed.

- Enter the OTP received on the given mobile number or email ID and validate it.

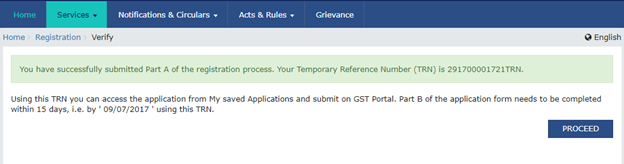

- Once you validate your number, a TRN will be allotted. Use it to log in again to complete the GST registration process and requirements.

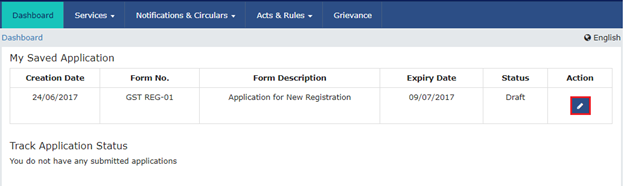

- Login to the portal using the TRN, enter the captcha and complete OTP verification. Click on the pencil icon below ‘Action’.

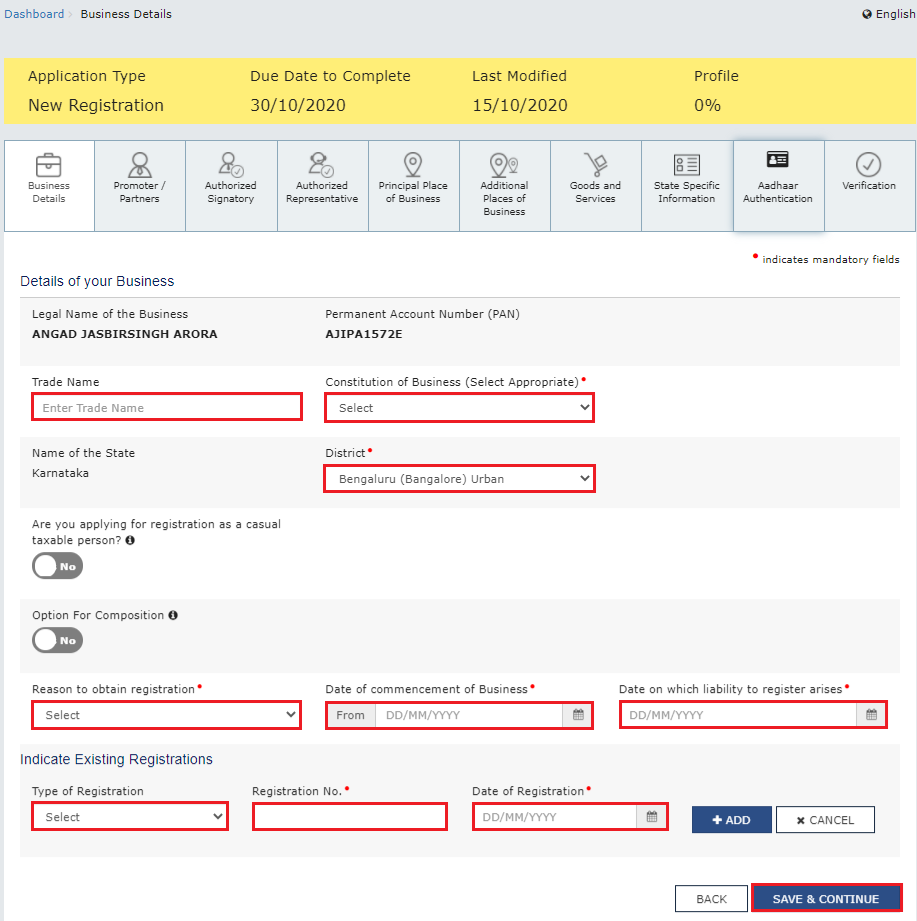

- Enter all the information about your business such as trade name and composition scheme. Click on ‘Save & Continue’.

- On the next screen, provide information about all the promoters and directors of your business. Or you may enter the details of the proprietor in case of proprietorship. You can enter the details of up to 10 promoters or partners on the portal. Then, click on ‘Save & Continue’.

- Enter the details of the authorized signatory nominated by the promoters to file GST returns of the business.

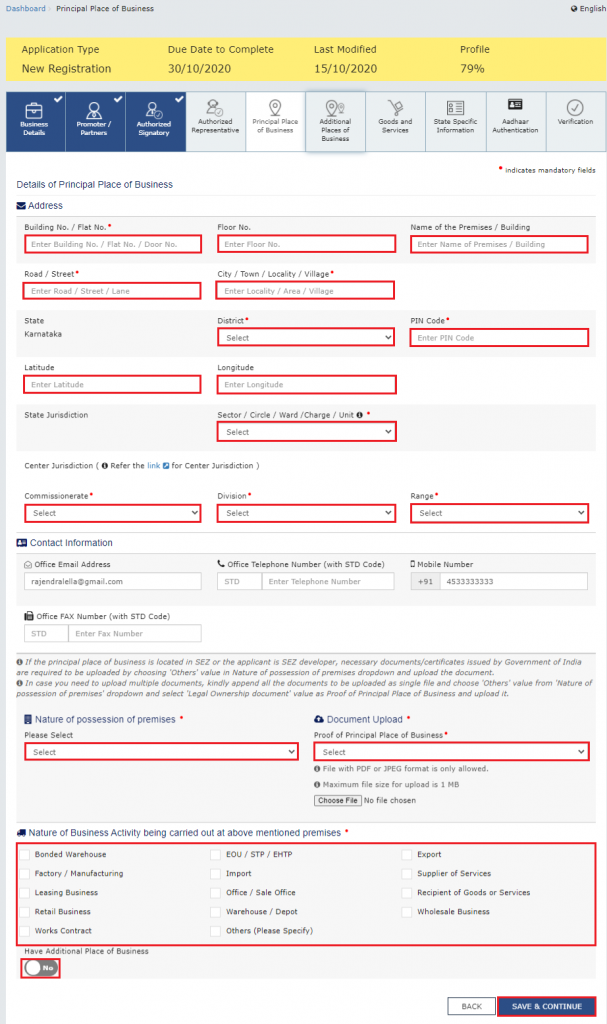

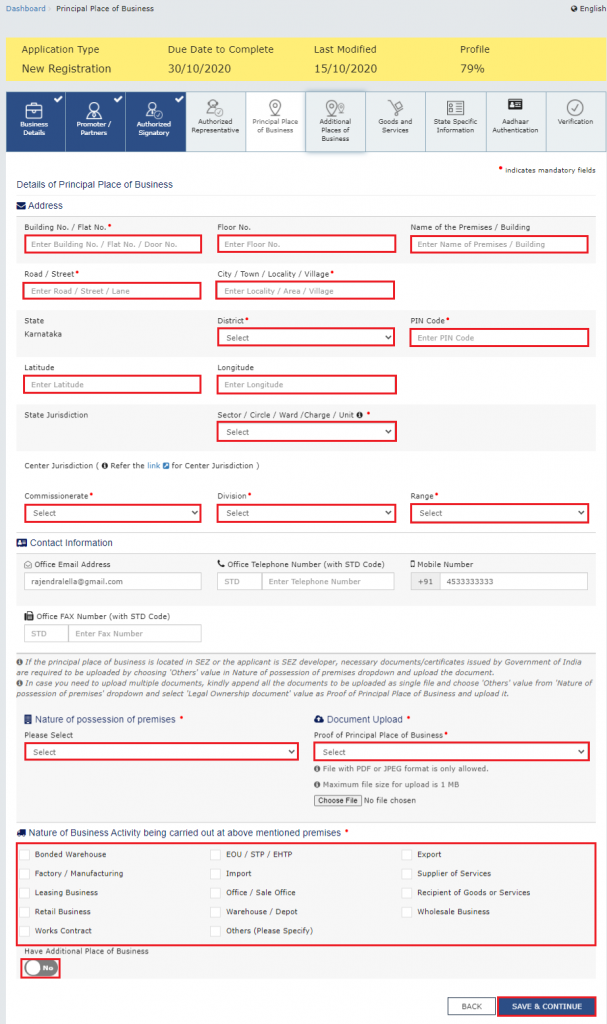

- Submit the details of the principal place of your business such as an address, official contact details (email, phone no., etc.), nature of possession and others. Upload relevant proofs of the same and click on Save & Continue.

- Enter additional place of business details. For example, if you have an eCommerce business and use Amazon’s warehouse then the details of the warehouse must be given in this section.

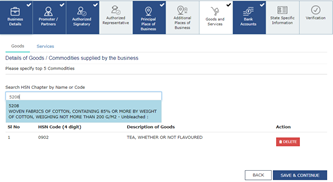

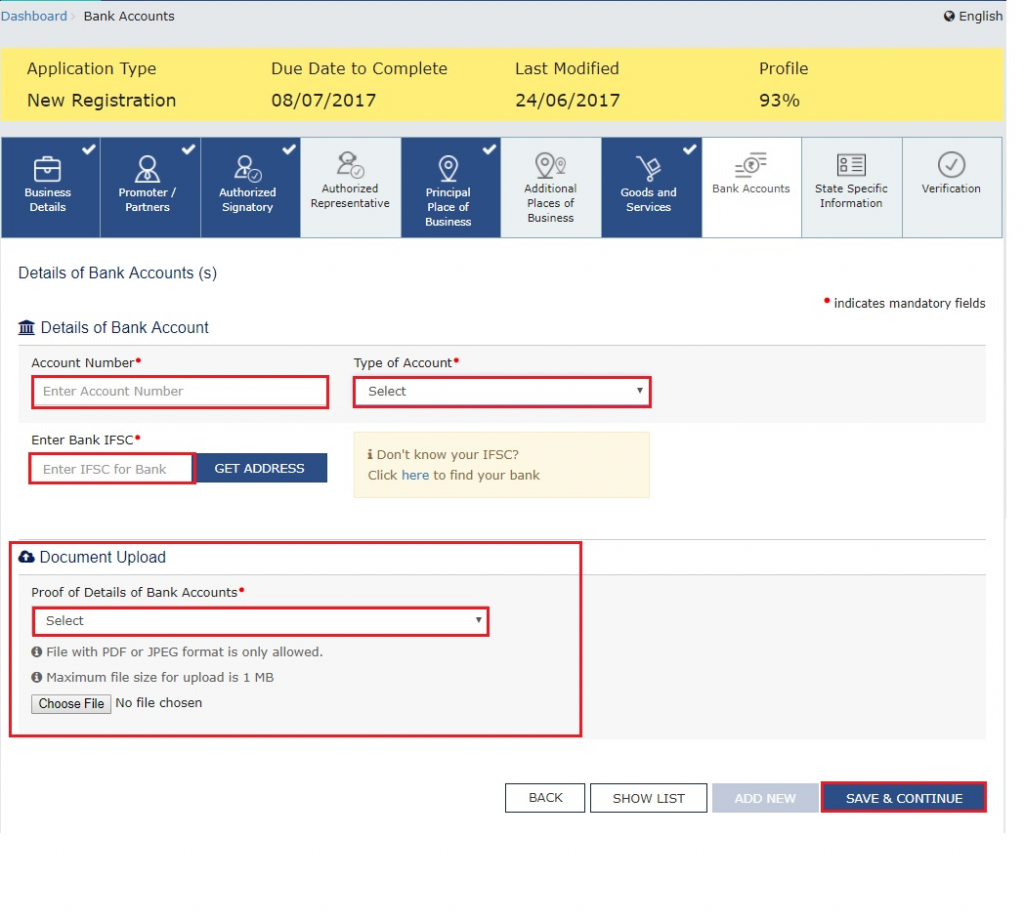

- Provide the details of the top five goods and services you supply. Fill in the HSN code for goods and SAC code for services.

- Verify the details submitted. Once it’s completed, select the verification check box and e-verify the name of the authorized signatory.

- After the signature verification, a success message will appear on the screen, and an Application Reference Number (ARN) will be generated. Use it to track the status of your application. Once the process is complete, you will be informed about the allotment of a GST number.

Conclusion

GST registration process for startups and small businesses is much simpler now. Just as a startup becomes successful when the idea behind it is properly executed likewise if GST is implemented properly, it helps a lot in achieving the financial goals easily.

Useful Details