UPI became the top choice for payments, growing by 52% this year, thanks to its speed, security, and ease of use. Flexible options like BNPL gave shoppers more freedom. The festive season broke records with a 12% jump in sales.

What Payment Trends Took Over in 2024, and How Did Consumers Adapt? Let’s explore how these shifts are shaping the future and how businesses can stay ahead.

UPI: The Everyday Hero

From neighborhood stores to online shopping, UPI has simplified everyday transactions, becoming the go-to option for millions due to its convenience and ease—making payments faster, more secure, and cashless.

Unstoppable Growth: UPI transactions grew by 52% year-on-year, with 16.58 billion transactions processed in October alone—a 45% increase from the previous year! (Source: Economic times)

Big Wins for Small Transactions: With an average ticket size of ₹1,478, UPI became the preferred choice for small-value payments for everyday essentials, especially in Tier 2 and Tier 3 cities. (Source: Businessstandard, RBI Digital Payments Report)

The Rise of Flexible Spending: Shop Now, Pay Later (BNPL)

While UPI dominated small-ticket transactions, larger purchases saw shoppers turning to flexible options like BNPL.

Why Shoppers Loved BNPL: 40% of metro city consumers chose BNPL for affordability and ease when upgrading to premium smartphones or booking vacations. (Source: StartupTalky)

UPI-Linked EMIs: These services allowed shoppers to split payments, sticking to their budgets while making bigger purchases seamlessly.

Festive Season Fever: Shopping Big and Bold

As flexible spending options gained traction, the 2024 festive season saw a 12% year-on-year growth. The rise of no-cost EMIs, cashback deals, and competitive pricing made the season irresistible to shoppers.

Record-Breaking Engagement: 80% of e-commerce visitors came from Tier 2 and Tier 3 cities, fueled by seamless UPI and BNPL payments making payments seamless! (Source: Amazon Festive Sales Report)

What Shoppers Loved: Electronics, fashion, and home goods topped the shopping lists. UPI-linked BNPL services made larger purchases easy.

Shoppers on a Clock: Peak shopping hours were between 7 PM and 11 PM, when consumers indulged in retail therapy after their day. (Source: Amazon Festive Sales Report)

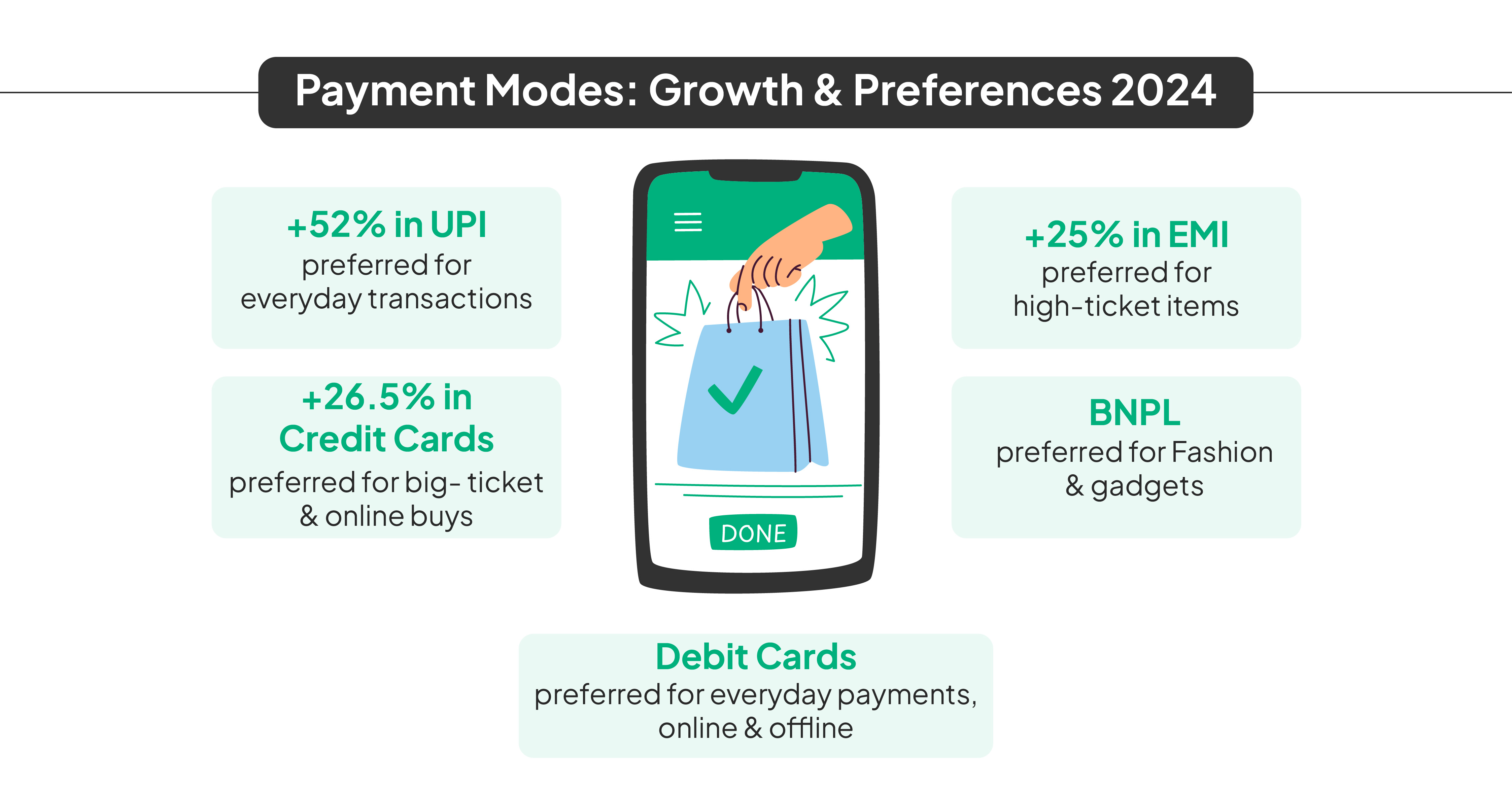

The Payment Landscape in 2024: UPI Dominates, Flexibility Takes Center Stage

The record-breaking festive sales were a testament to how digital payment preferences are shaping the broader landscape.

UPI: The dominant payment method surged by 52% year-over-year for everyday transactions.

Credit Cards: Favored for larger purchases and premium rewards. Spending grew by 26.5% in FY24, with a significant rise in online and big-ticket transactions. (Source: Economic Times)

Debit Cards: Debit cards remained a stable payment mode. Essential for everyday payments, both online and offline.

EMI Services: EMI saw a 25% year-on-year growth, driven by consumer demand for high-ticket purchases such as electronics, appliances, and furniture. (Source: Economictimes)

BNPL: BNPL remains a popular choice in 2024 in fashion, gadgets, and retail sectors, propelled by younger consumers seeking flexibility and lower upfront costs. (Source: MoneyMint).

Peak Shopping Times and Spending Trends Across Sectors in 2024

These payment preferences shaped consumer behavior during peak shopping periods, highlighting distinct trends across key sectors:

Travel: Spends surged 15% in July compared to last year, driven by increased credit card usage for cashback, loyalty points, and discounts on bookings.

Education: A 12% rise in education-related payments was observed in June and July, with 70% of transactions made via debit cards for secure and straightforward payments.

Insurance: UPI-based insurance premium payments grew by 18% year-over-year in January, showcasing its efficiency for quick and secure transactions.

E-commerce: Sales spiked 20% in November compared to 2023, as credit cards and e-wallets dominated payments due to benefits like cashback, no-cost EMIs, and seamless checkouts during festive sales.

F&B: Dining spends rose 25% in December, with credit cards and mobile wallets simplifying payments and offering exclusive restaurant discounts and loyalty points.

Why It All Matters

These trends reflect how consumer behavior is shaping the future of digital payments. Behind the scenes, businesses are working harder than ever to meet these evolving preferences.

This is where PayU comes in:

Seamless Shopping: PayU’s payment solutions, such as UPI, BNPL, and card EMIs, help businesses offer customers the flexibility they need.

Trust and Security: With advanced fraud detection, PayU ensures that transactions are safe and stress-free.

Growth Made Simple: Whether it’s a small local store or a large e-commerce platform, PayU empowers businesses to scale effectively.

Conclusion: 2025, Here We Come

2024 saw India shop smarter, spend more flexibly, and embrace digital payments like never before. From festive shopping sprees to everyday transactions, we’ve set the stage for an even bigger 2025.

Ready to scale your business with smarter payments? Discover PayU’s seamless solutions today.