TL;DR

Did you know by 2030 India will become the second-largest shopping hub globally. With 500 million shoppers & e-commerce growing at 18% annually, the potential is limitless.

But the biggest challenge is entering this lucrative market. International businesses get stuck with complicated setups, missing local payment methods like UPI, low transaction success rates and fraud risks. This leads to frustrated customers and blocked business growth.

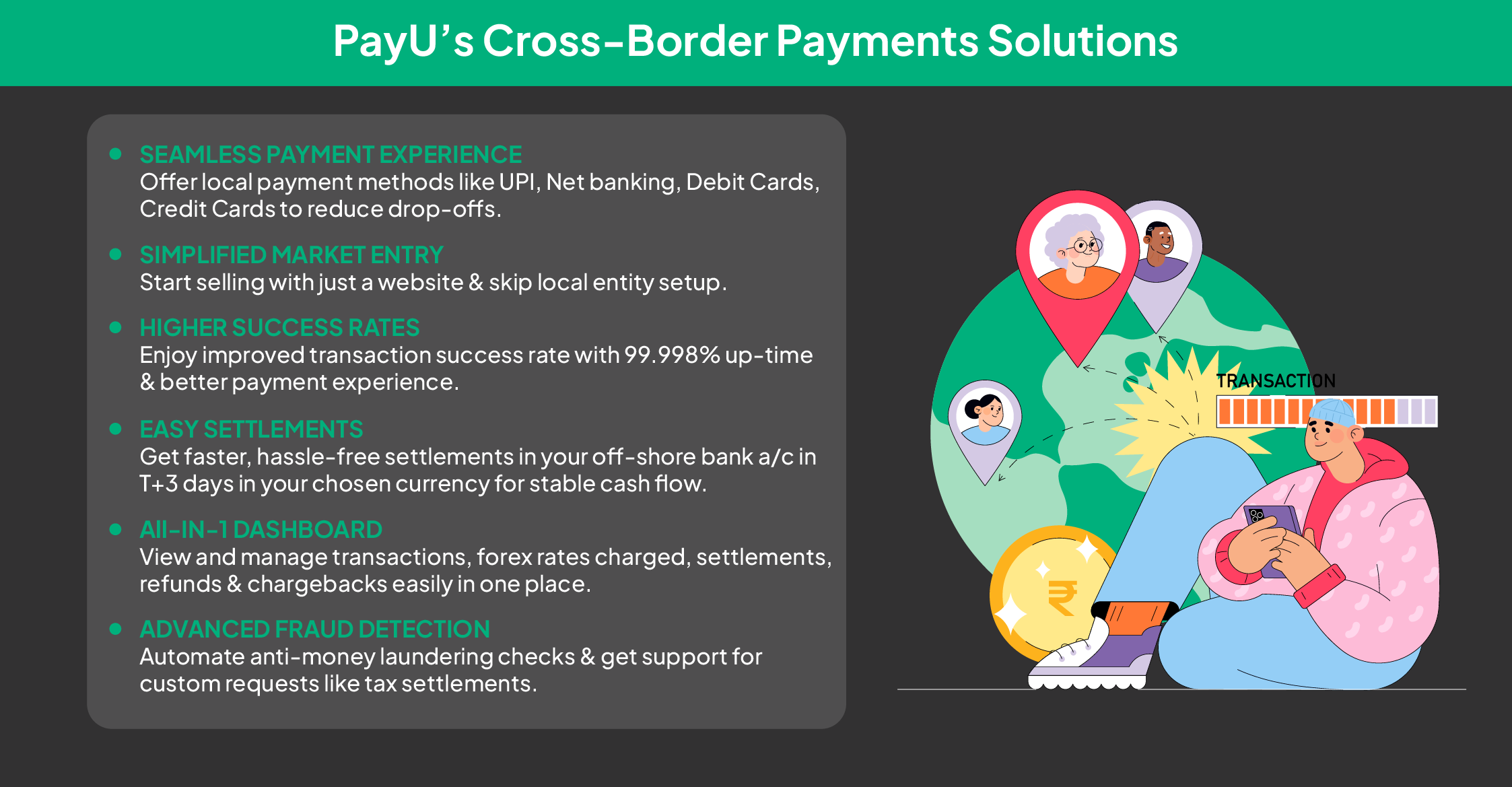

With PayU Cross-Border Payments, entering India has never been easier. Sell with just a website—no local entity required. Offer UPI, Net Banking, and cards to reduce drop-offs, enjoy faster T+3 day settlements in your currency, and manage everything on an all-in-one dashboard.

Make payments seamless, quick & secure to scale your global business effortlessly.

Get started with PayU Cross-Border Payments today!

Your Shortcut to Indian Markets: Simplify Cross-Border Payments with PayU

Every global business has its eyes set on India. With the e-commerce sector growing at 18% annually, India is one of the world’s most promising markets.

By 2025, India will have 1 billion internet users and 500-600 million shoppers by 2030, making it the second-largest shopping hub globally. Exciting, right?

But the biggest challenge is entering this lucrative market.

International businesses spend almost a year getting permits and licenses to set up a local entity, just to accept payments. They also lack local payment modes preferred by Indian customers causing drop offs.

Transactions often fail while using international gateways which frustrates customers. These businesses need payment solutions that are reliable and tailored to the diverse needs of Indian customers.

So, how do you solve these cross-border payment challenges and tap into this vast potential? Let’s dive in!

Cross-Border Payment Challenges in India

Imagine being ready to launch your fashion brand tailored for Indian customers, only to face challenges like:

These challenges leave Indian shoppers frustrated, often causing drop offs and losing trust in the business. While businesses struggle with cash flow, low conversion rates, rising expenses, blocking their growth.

Power Your Market Entry with PayU

What if entering Indian market didn’t have to be so complicated? With PayU, you can simplify cross-border payments and have an easy market entry effortlessly.

With these PayU solutions, international businesses can streamline their payments. PayU has a Payment Aggregator-Cross Border (PA-CB) license necessary to smoothly accept cross border payments online. Most international businesses trust PayU for their cross-border payment needs. Wondering why?

What Makes PayU the Preferred Partner for Global Businesses?

CURRENCY SUPPORT

Get fast settlements in in your preferred currency—USD, GBP, EURO, SGD. CAD, AU and more.

SEAMLESS INTERGATION

Get seamless integration with 100% API- driven, customizable solutions.

MINIMIZED COSTS

Enjoy competitive pricing to avoid bearing heavy transaction costs for international sales.

PayU’s Products that Power Your Business Growth

Did You Know? 40% of Indian payments are digital, with UPI leading the way. It’s used by 300 million+ individuals and 50 million merchants. Businesses entering India need solutions that make shopping easy. Here’s how PayU products enhance customers’ shopping experience:

PayU UPI: Enjoy seamless UPI payments with best success rates, and easy app integration with GooglePay and PhonePe.

Token Hub: Ensure secure transactions with tokenization for UPI, cards, and Net Banking.

Offer Engine: Boost sales with offers, discounts, cashbacks, and flexible EMI options for customers.

Recurring Payments: Simplify subscriptions with easy billing and upgrades with a single integration.

Unlock India’s Potential with PayU

Breaking into India doesn’t have to be hard. PayU provides local payment methods, fast settlements, and strong security to help you grow effortlessly. With PayU, unlock the full potential of India’s booming market today!

Ready to scale? Start today with PayU and power your business to go global.