Imagine having a shield that protects you when life gets tough—whether it’s fixing your car, paying hospital bills, or supporting your family. Insurance is that safety net we all need for unexpected times.

In India, the insurance industry is growing fast. According to McKinsey & Company, it made over $130 billion in 2023 and has been growing at 11% every year since 2020. Evidently, more people are realizing the value of insurance. But even with this growth, there are still millions of people who don’t have access to it.

Why does something so important still feel out of reach for so many? Let’s find out.

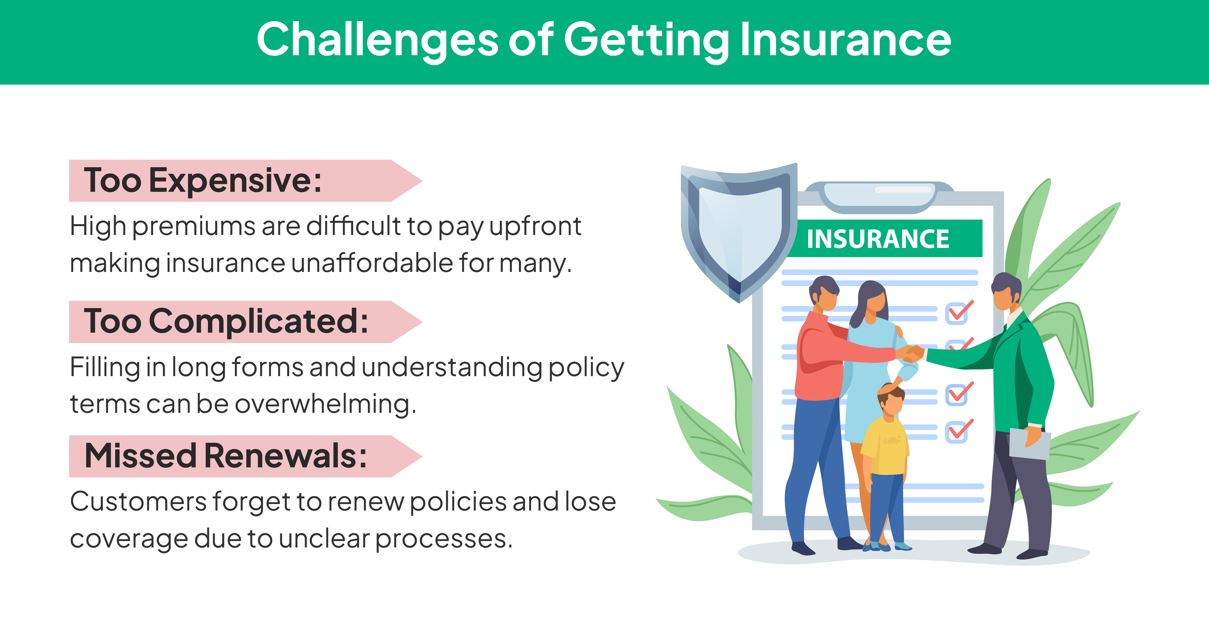

What Makes Insurance Hard to Access?

For many people, insurance feels too costly, hard to understand, or just not made with their needs in mind. Here are the main reasons why:

These challenges make it harder for people to get insured. But things are changing—thanks to digital payments, which are breaking down these barriers and making insurance accessible to everyone, no matter where they live or how much they earn.

PayU Breaking Barriers with Smart Payment Solutions

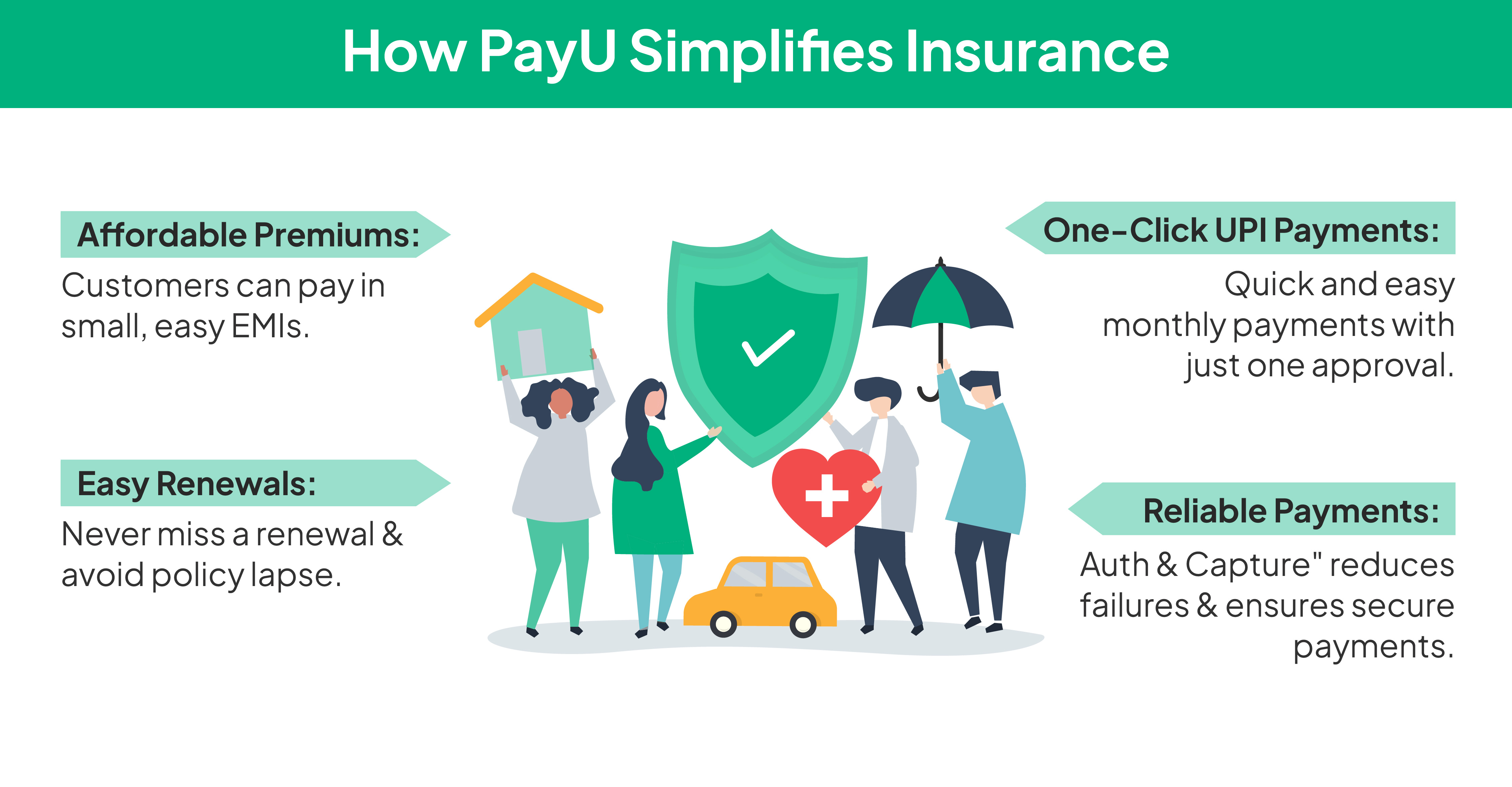

PayU simplifies the process. We help insurance businesses simplify payments and make them more affordable, so more people can get insured. With our solutions, you can reach more customers, help them protect what matters most, and grow your business.

How PayU Makes Insurance Easy

1. Affordable Premiums with PayU Affordability suite

PayU Affordability Suite helps insurers offer premium payments in easy EMIs. Customers no longer have to pay large upfront amounts.

2. No More Missed Payments with PayU Recurring Payments

With PayU’s recurring payments, customers never have to worry about forgetting to pay. Renewals happen automatically. So, insurers enjoy fewer lapses and steady revenue.

3. Fast and Easy Transactions with PayU’s One-Click UPI Mandates

PayU’s UPI One-Time Mandate (OTM) makes recurring payments easy. With a single approval, monthly payments are set up and done—no need for repeated approvals.

4. Reliable Payment Processes with PayU’s “Auth & Capture”

PayU’s “Auth & Capture” feature makes sure payments are approved during policy purchase and only completed when it’s activated. This reduces payment failures and builds trust with the customers.

Making Insurance Work for Everyone

Everyone deserves to feel secure, no matter their income. PayU is making that possible by making insurance easy and affordable for all.

With PayU, insurers can connect with more customers, offer simple payment options, and grow their business.

Ready to make insurance easier and more affordable?

Let PayU simplify the payment process and help you grow your business.