Financial operations are key to business success, whether in a small venture or a multinational corporation. They are integral for enterprise risk assessment, performance measurement, informed decision-making and ensuring long-term profitability across all business scales. Strategic finance, such as budgeting, accounting, forecasting, and long-term planning done right, yields great results to steer the future success of a business. But supplement it with fintech products, tools, and capabilities, and it can help boost cash flows in the short term as well as long term.

Predictions indicate that by 2026, embedded fintech led by cutting-edge technology such as the following will lead to significant contributions to digital as well as traditional businesses:

Artificial intelligence (AI)

AI and ML (Machine Learning) contribute approximately $1 trillion annually to the global banking industry by uncovering patterns and insights. Privacy measures like federated learning enhance data protection and also offer tailored products and robo-advisors.

Blockchain technology

Blockchains ensure data integrity and synchronization. Notable applications that are likely to spread across sectors including real-time settlement and decentralized finance (DeFi).

Cloud computing

Cloud tech is expected to generate over $1 trillion in EBITDA for the top 500 companies by 2030, as per a study by McKinsey in 2021. It will boost platform integrity, encourage DevSecOps (Development, Security, and Operations), and support AI-driven applications.

No code and low code development platforms

No-code and low-code platforms simplify application development, automating audit trails and compliance. They will thus empower financial institutions and fintech firms to respond to market shifts.

Fintech in boosting business cashflow

Fintechs provide specialized software and algorithms to streamline financial operations, benefiting companies and consumers alike. Fintech-driven entities are thus emerging as competitive alternatives to traditional financial players. Enhanced customer satisfaction, increased conversion, targeted marketing, and financial inclusion are among the many core benefits as well. But beyond operations, fintech also enhances cash flows through cost efficiency, pricing interventions, and predictive analysis.

Imagine foreseeing the product market’s five-year outlook. Planning the next move, deciding on the marketing plan, and category expansion or customer retention becomes easy, knowing the projections of future demand metrics. This knowledge comes in handy with integrated fintech and AI-powered customer and market data analysis. The application and strategies don’t stop at predictive analysis; it spans the following as well:

Business analysis

Understanding your current business operations is vital to address shortcomings and seize opportunities. Fintech facilitates a rapid assessment of your existing state, a crucial first step in uncovering areas of improvement.

Identifying signals of change

Leading companies vigilantly track fintech activities across the value chain, including competitors and tech giants like Google, Microsoft, Amazon, and Alibaba. By assessing the certainty, implications, and timing of these changes with fintech tools, companies can proactively respond to fintech innovations, avoiding reactive approaches.

Enhancing customer experience

Enhancing the customer experience is paramount in fintech strategies. Harvard Business Review in 2023 reported a 5% rise in retention can yield 25-95% higher profits. Walmart, a top omnichannel retailer, hiring Goldman Sachs executives for finance division leadership highlights the importance of fintech for revenue growth.

Harnessing digital sales channels for sales growth

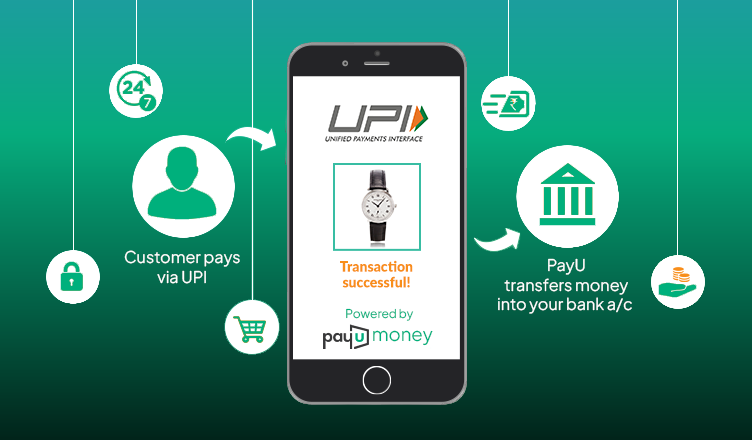

Fintech can harness digital sales channels for revenue growth. Customers preferably access trading, banking, and insurance services through apps, while messaging platforms like WhatsApp enable product purchases and account management. With over 2 billion global users, fintech recognizes the power of messaging apps like WhatsApp, where 175 million daily interactions occur, in helping businesses reach their customer base.

- Operational efficiency

Reviewing processes and financial flows can uncover savings by eliminating bank fees and payment delays. For instance, global firms can use embedded finance for quicker international salary payments, reducing friction.

In this dynamic landscape, where fintech and emerging technologies intertwine, niche financial sub-sectors have leveraged innovation. India’s fintech investment surge, with over $35 billion invested and the emergence of 18 unicorns, demonstrates the sector’s remarkable growth. With fintechs contributing $100 billion to enterprise value, embracing fintech is a strategic imperative. The convergence of fintech with financial and non-financial sectors promises sustained growth and innovation. As technology advances and consumer behavior evolves, the future holds exciting prospects for fintech, reshaping the financial landscape for years to come.