*Subject to applicable laws, we only charge a service fee and GST on every transaction for various modes of payments.

(Visa, Mastercard, Amex, Rupay, Diner)

Choose a payment option

Choose a payment option

Choose a payment option

Choose a payment option

Choose a payment option

Choose a payment option

(Visa, Mastercard, Amex, Rupay, Diner)

180+ Banks

100+ Options

15 Wallets

Cards & Cardless

Buy now pay Later

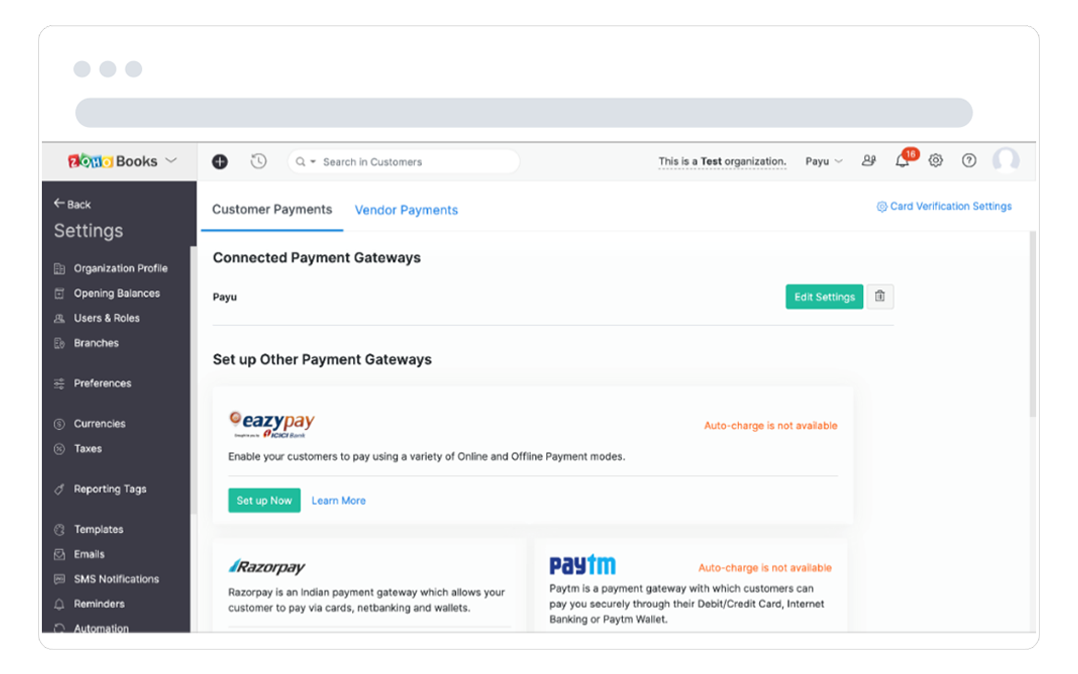

Click ‘Setting’ button on the bottom left corner of the dashboard and go to Accept Payments > Credit/Debit Cards > Setup Account.

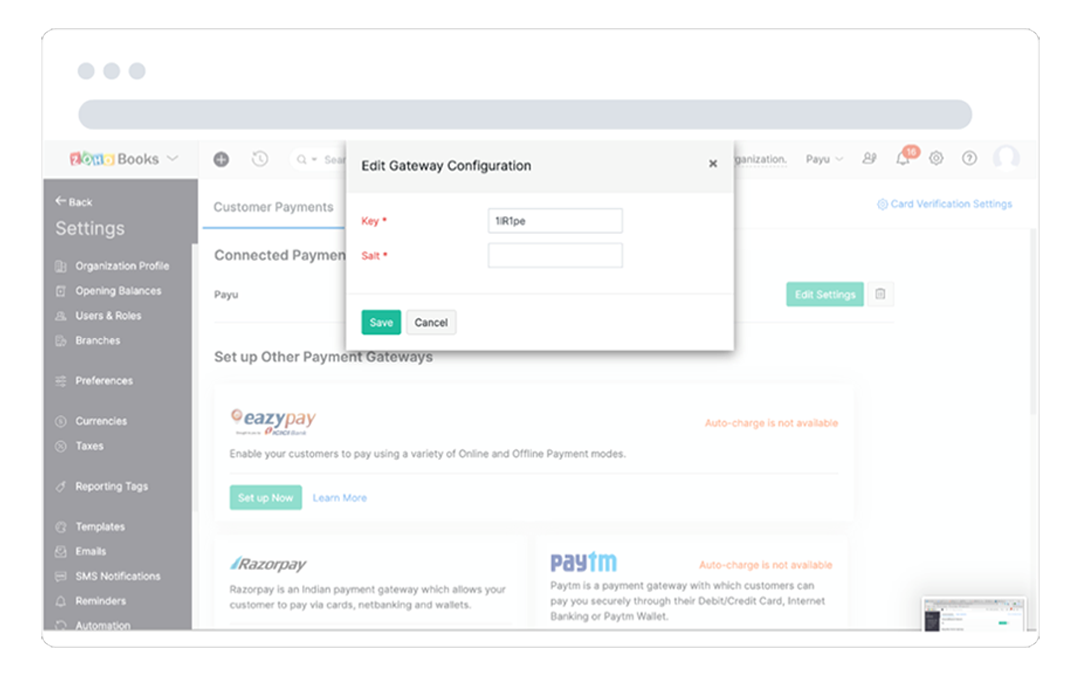

Enter the Business’ Key and Salt. Click on 'Save'

Voila! Your Zoho Books account is now integrated with PayU. Let’s start payment collection

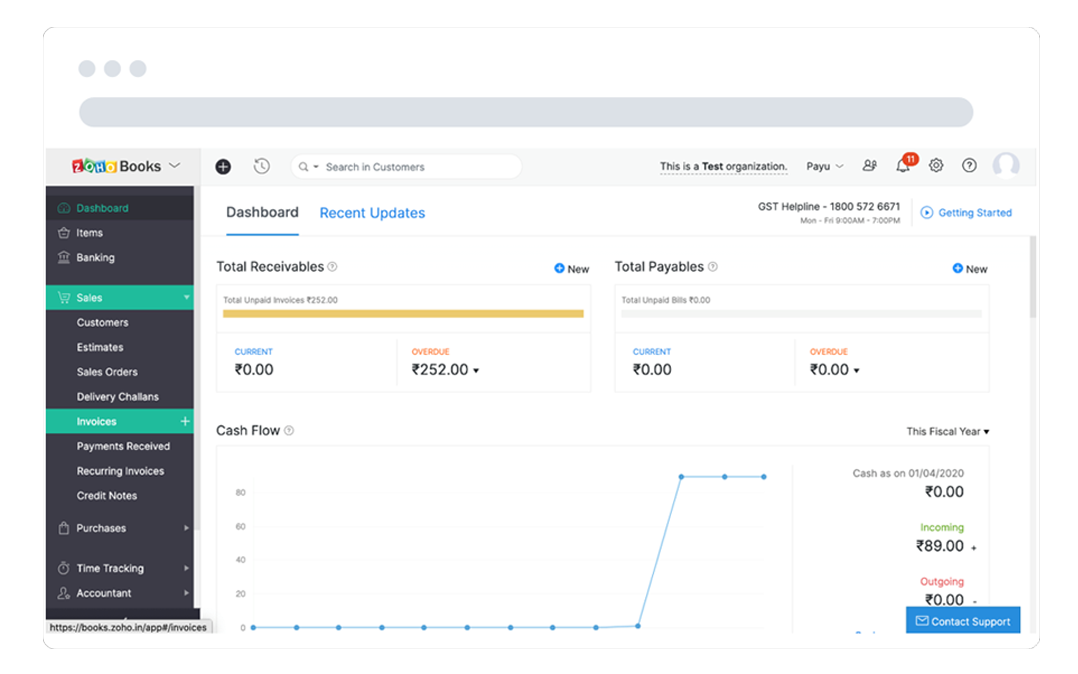

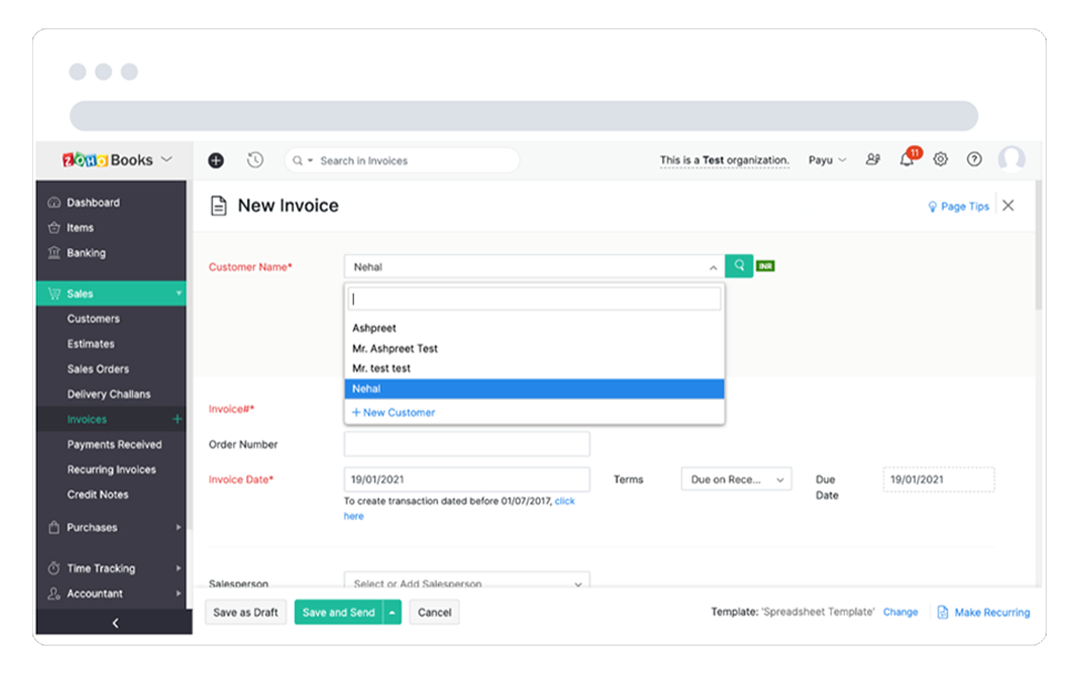

Go to ‘Invoices’ under Sales section. Click on ‘New’ to generate a new invoice.

Add the customer’s name and order details. Click on ‘Save and Send’ to send the payment link to your customers

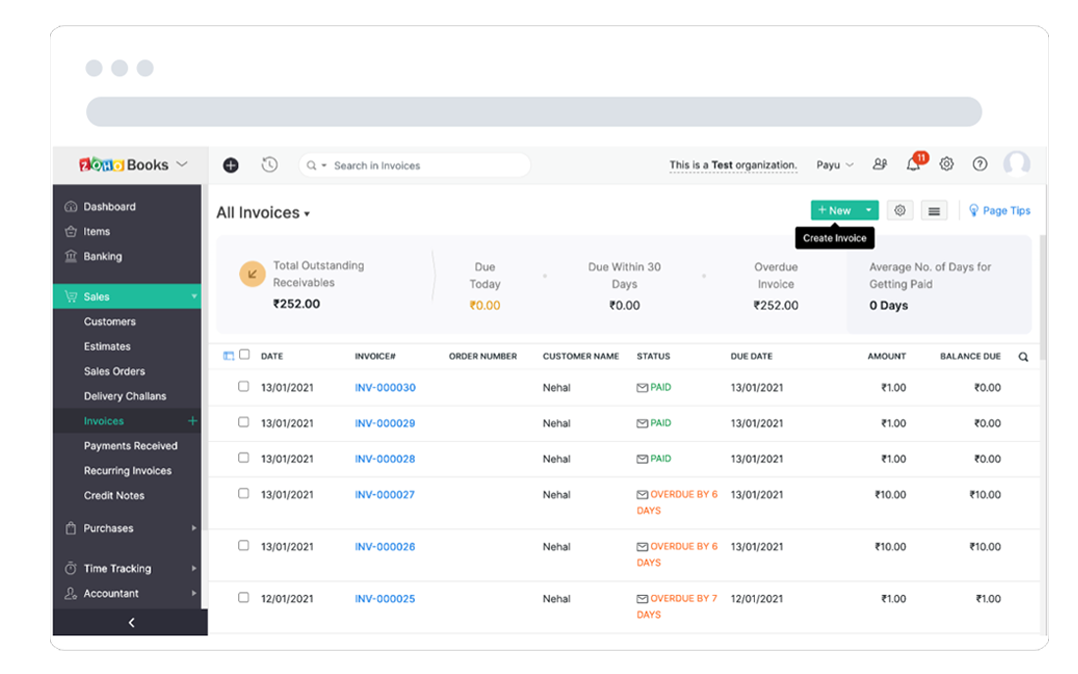

View real time payment status of all invoices

To find your Key & Salt details:

If you don’t have an account with PayU, Register Here to get started. You can create your account in a few minutes by following the steps mentioned on the PayU dashboard . You just have to enter your mobile and email, basic business information and then verify your bank account.

Please note that this is the bank account into which customer payments will be settled.

The meaning for the various statuses is explained below:

Account Created: A PayU money account has been created with email, mobile & your business name. No other business profile details have been submitted yet.

Profile completed: The business profile details like Address, Business Registration information, Bank details etc. have been submitted by or on behalf of the business. But the bank account details are not verified yet.

Bank verified: Bank account of the business has been verified either by using penny verification or other means, but the business is yet to start with the upload of the documents required by PayU.

Documents Upload in Progress: The business has started with the documents upload process but is yet to complete the same.

Documents Verification in Progress: This status implies that the business has successfully completed the upload of all documents required by PayU, but the verification by PayU is in progress.

Documents Rejected: Documents submitted by the business were incorrect and hence PayU has rejected the same. The business may re-upload the right documents on the PayU dashboard.

Website Verified: Business’ website details have been successfully verified by PayU.

Settlements enabled to verified bank account: This means the business is successfully on-boarded to PayU and can receive settlements in his bank account.

By enabling PayU Payment Gateway, your customers can choose to pay via 100+ payment modes that include - Credit card, Debit card, Net Banking, UPI, Wallets and much more.

Settlement of the transactions generally happens on T+2 basis. You can also opt for Same Day Settlements at a nominal charge.

For any kind of assistance, please do contact the PayU Support team @ https://help.payu.in.

PayU is a solid partner to rely on. Improves our success rate on UPI transactions.

Integration was fast and simple allowing us to focus on our daily operation without worrying about payments. PayU really helps us to improve success rate on UPI transactions. Amazing helpful team and service.